Most traders follow a certain routine in preparation for the trading day. For example, one of the first things I do after turning on my computer and logging into my trading platform is to check to see what futures are doing for the various indices. This gives me an idea of what I might expect at the open.

There is a further barometer that traders can use to even better forecast the direction of the market, and that is fair value.

What is fair value and how can it help gauge where the market will open?

Fair value is a tool often used by investors to get a better understanding of the relationship between the value of futures contracts and the current price of an underlying instrument. This tool is used before the market opens to help investors gauge the direction of the market once the opening bell rings. Said another way, fair value can often be a trader's weather report on the trading day.

Within every index is a bucket of stocks, all with a cost as well as an associated benefit. The cost, in a nutshell, is the fee to purchase and hold those stocks, and the benefit is all of the dividends you could receive from holding that collection of stocks. The weighted effect of these costs and benefits isn't immediately reflected in the price of the stock index itself. Because of this, the actual price of the index is often different than it would have been if the interest and dividend effects had been accounted for – hence the “fair value” of the index.

As an example let’s use the S&P 500 index and the corresponding future which is /ES. The Chicago Mercantile Exchange (CME) is where the S&P futures contracts are traded. A futures trade consists of an agreement to buy or sell based on how the S&P 500 index of stocks will react in price over a period of time. The futures contracts on the S&P 500 expire in March, June, September, and December.

The S&P 500 index is comprised of 500 large company stocks such as Aetna (AET), Aflac (AFL), Adobe (ADBE), Amazon (AMZN), and American Airlines (AAL), to name a few. The cost of owning all the 500 stocks which make up the S&P 500 index is different than the cost of owning a S&P futures contract. To own all of the 500 stocks which make up the S&P 500 would be a large sum of money. At the time of writing this article, the 5 stocks previously mentioned are trading at the following prices: AET $108.66, AFL $70.73, ADBE $107.50, AMZN $813.02, and AAL $38.57.

The total cost to purchase these 5 stocks would be $1138.48.You would still need to purchase the other 495 stocks which comprise the S&P 500 index which would cost much more. You would have to pay a large sum of money. You most probably would have to borrow money to pay for those stocks and would have to pay interest on the loan. You or your broker would have to borrow the money at the current interest rate. When fair market value is calculated, the interest rate is taken into account. The rate to borrow money changes often.

Stocks within the S&P 500 index which pay dividends are also calculated in the fair value price. In comparison, the futures of the S&P 500 do not pay dividends. Futures do not have shareholders.

What is the formula used to calculate fair value?

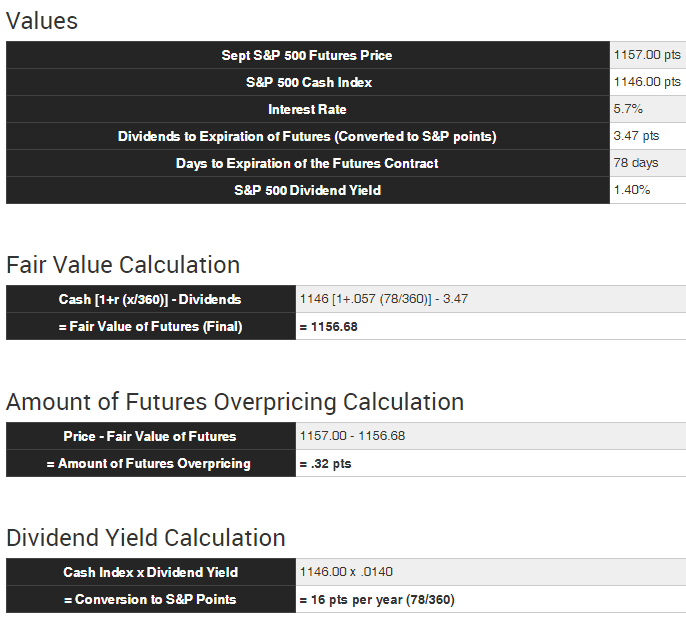

The following explanation of calculating fair value is derived from the http://www.cmegroup.com/.

Calculating Fair Value

”Fair value is the theoretical assumption of where a futures contract should be priced given such things as the current index level, index dividends, days to expiration and interest rates. The actual futures price will not necessarily trade at the theoretical price, as short-term supply and demand will cause price to fluctuate around fair value. Price discrepancies above or below fair value should cause arbitrageurs to return the market closer to its fair value.

The following formula is used to calculate fair value for stock index futures:

= Cash [1+r (x/360)] – Dividends

This example shows how to calculate fair value for S&P 500 futures:

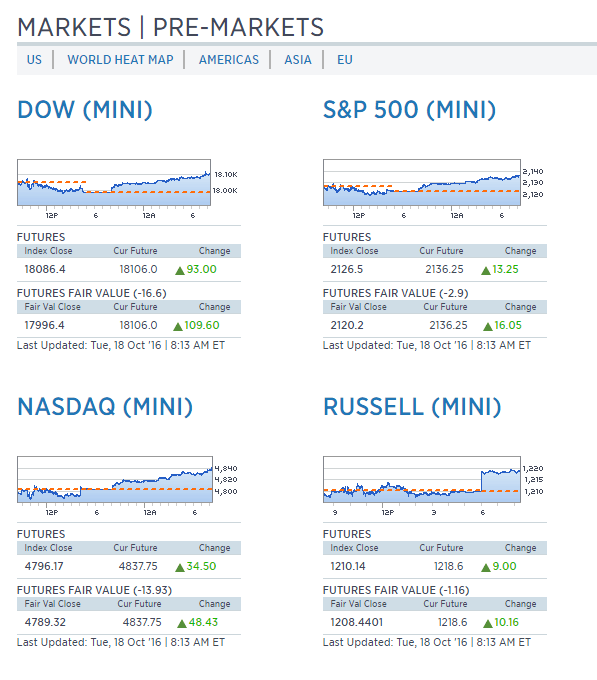

Fortunately, you as a trader do not have to calculate fair market value; just go to http://www.cnbc.com/pre-markets/.The screenshot below, courtesy of www.cnbc.com, shows the fair market value of the major indices in their pre-market section.

In summary, looking at futures pre-market gives you a general idea of which direction the market is headed, fair value will give you a clearer picture of what to expect when the opening bell rings.

Looking for a trading group, educational alert service, or perhaps a mentoring program? Look no more, go to www.capitaldiscussions.com where you will find a comprehensive list of programs that can be used in any type of options trading.

Feel free to comment below.