American and European Options: An Overview

There are two types or styles of equity options. One is an American style option and the other is a European style option. What are some of the similarities and differences in the two styles of options? If you buy a European or an American style option, what rights do you have to exercise them?

It is important to know which style the option you are about to buy or sell is before you enter a trade. For the purpose of this article, we will be using the underlyings SPX and SPY.

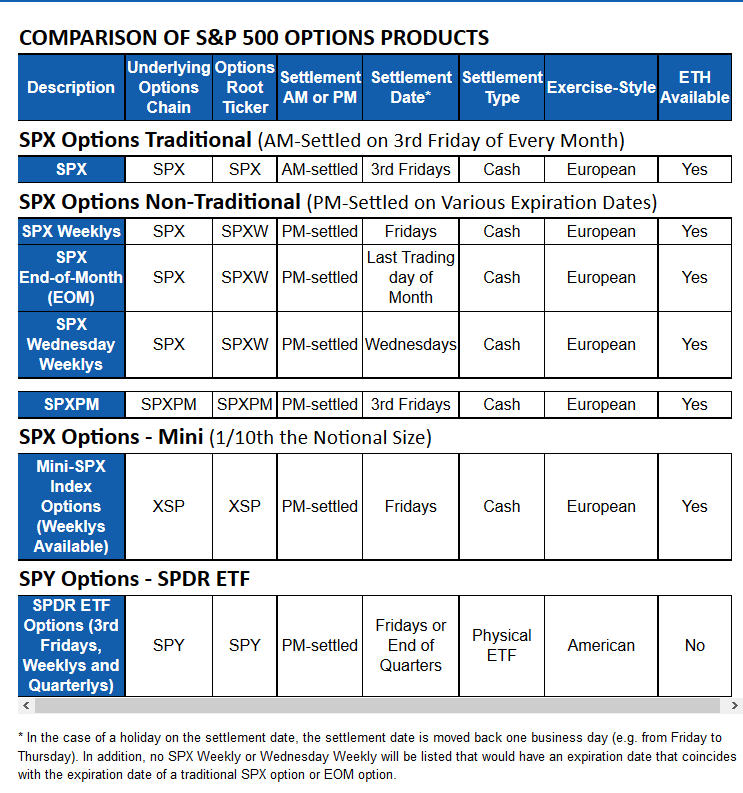

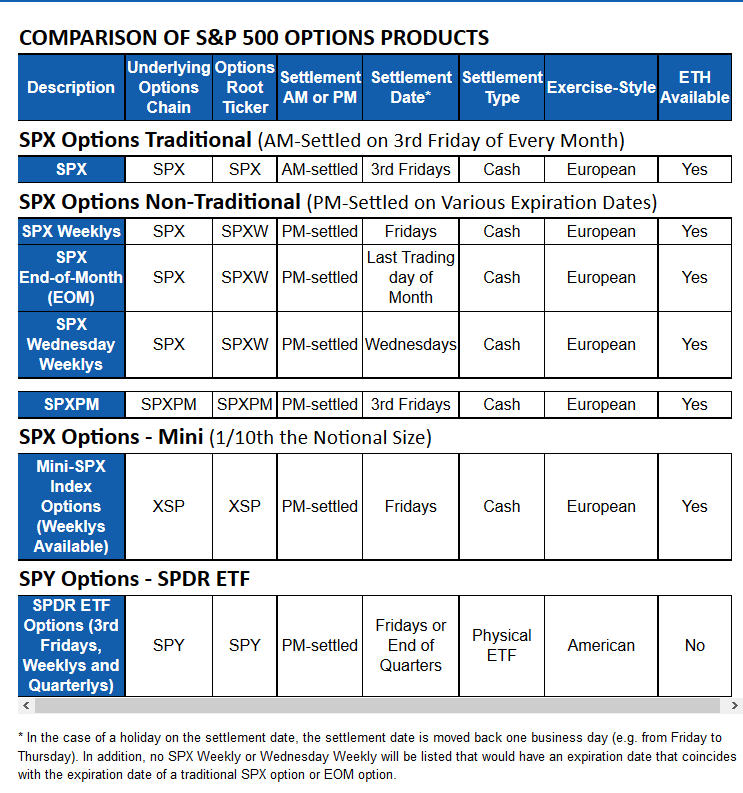

Comparison of S&P 500 Options Products as published at www.CBOE.com

What Does Exercising an Option Mean?

“Exercise means to put into effect the right specified in a contract. In options trading, the option holder has the right, but not the obligation, to buy or sell the underlying instrument at a specified price on or before a specified date in the future. If the holder decides to buy or sell the underlying instrument (rather than allowing the contract to expire worthless or closing out the position), he or she will exercise the option, and make use of the right available in the contract.” as stated by www.Investopedia.com

What are American Style Options?

As stated by the CBOE website

“An American-style option contract is one that may be exercised at any time prior to its expiration date. Currently, all equity options traded on U.S. option exchanges, including LEAPS, are American-style, as are certain index options.”

SPY is an American Style Option…

Let's use SPY as an example of an American style option; you have purchased a SPY monthly Call option. This SPY monthly Call option has 20 days before it expires. You as the holder of the long SPY monthly Call option have the right, but not the obligation, to exercise that Call option at any time prior to its expiration date.

Take a look at the Comparison Chart above and you will notice SPY is an American style option and is settled as physical ETF. The settlement date is a Friday and it is PM settled. If there is a holiday on the settlement date, the settlement date is then moved back one business day, as stated on the Comparison Chart. Since SPY is an ETF, if you choose to exercise the option you will be receiving 100 shares of physical SPY. If you are exercising the SPY option, you no longer own the option. You now have 100 shares of the physical ETF, which acts the same as stock. If you exercised the option you no longer have the properties an option contains such as time decay, implied volatility, strike price, etc..

Unlike the ETF SPY, if you were to exercise a stock option which is an American style option, you would receive 100 shares of the stock at the strike price you purchased the option.

What are European Style Options?

“A European-style option can be exercised only during a specified period of time just prior to its expiration. Many index options are European-style.”

SPX is a European Style Option…

Let's use SPX as an example; you have purchased a SPX monthly Call option. This SPX monthly Call option has 20 days before it expires. You as the holder of the long SPX monthly Call option have the right, but not the obligation to exercise that Call option at any time prior to its expiration date.

Take a look at the Comparison Chart and you will notice SPX is a European style option and is settled as cash. The settlement date is a Friday and is AM settled for the monthly option. If there is a holiday on the settlement date, the settlement date is then moved back one business day, as stated on the Comparison Chart. Since SPX is an index fund and is cash settled, if you choose to exercise the option, you will be receiving cash. If you are long an SPX monthly option; the strike price at which you purchased the long option at, must be in-the-money at the AM settlement. If it settles in the money at the AM settlement, it will create a potential profit. Your profit will depend on the cost of your commissions. If the strike you purchased your long call is not in-the-money at the AM settlement, your option will expire worthless.

Flexibility of an American Style Option…

Since an American style option can be exercised at any time up before or on the date of expiration, they have a little more flexibility than a European style option. All things being similar; this can make the American style option a little more expensive than a similar European style option.

In summary, an American style option is an option which can be exercised anytime before or on the expiration date. It would be exercised at the strike price at which it was purchased. European style options can only be exercised at the time of expiration.

If you choose, please leave a comment below to add to the conversation.

Good Trading!