In last week's article, I wrote about the long straddle in options trading, and how some traders incorporate the strategy into their trade plan. I will now cover the long strangle, another option strategy that features the use of options in unison with each other.

What is a Strangle?

Conceptually, the long strangle is identical to the straddle. However, as I covered in last week's article, the straddle has a single strike as its center. The strangle has the two different strikes, which produce wider breakeven points. The strangle also less costly to enter than a straddle. Construction of a straddle include:

- Out-of-the-money call, and out-of-the-money put

- Same underlying

- Same expiration date

- One-to-one ratio of number of options purchased (calls:puts)

Why use a Strangle over a Straddle?

The benefit of a long strangle is that it will cost less than a straddle, hence less risk. But, like all risk/reward scenarios, less risk equates to less reward. The buyer of the long strangle has a tradeoff for the lower cost and less risk; the underlying must move significantly more than the straddle in order to reach its maximum profit.

What scenarios might warrant the use of a strangle?

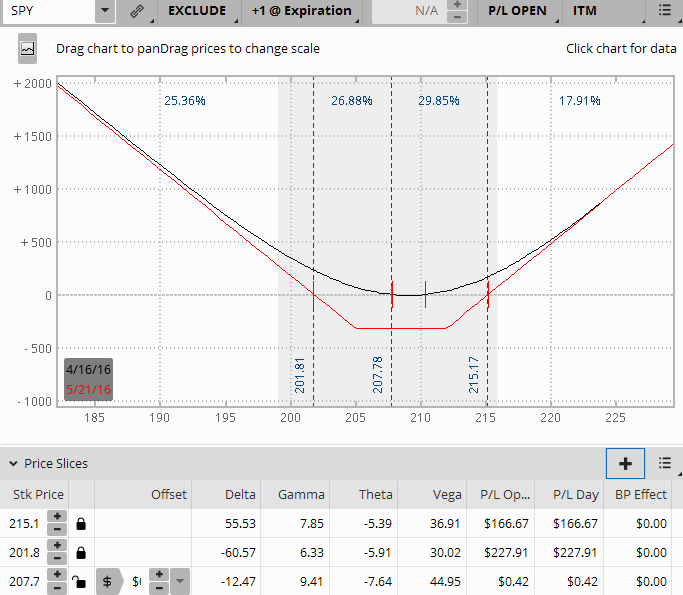

Strangles can be used in similar situations as the straddle; the purchaser of a long strangle is expecting a large movement in the price of the underlying, or an increase in volatility. The illustration below illustrates a long strangle position on SPY for the May 2016 expiration. With SPY trading at approximately 208, I have set up the straddle with the long call strike at 212, and the long put strike at 205. The cost at the time the example was set up is $3.00.

The expiration breakeven for the strangle is calculated by adding the cost of the straddle to the long call strike (upper breakeven), or subtracting the cost of the strangle to the long put strike price (lower breakeven. In the case of the illustration below, the expiration breakeven on the upside is 215.17, and 208.81 on the downside.

SPY Long Strangle for May Expiration.

As you can see from the above illustration, the value of the strangle increases as SPY moves away from the upper call strike or the lower put strike. The closer SPY is to the area between the two strikes, the lower the value of the strangle at May's expiration.

Summary of what affects the profitability of a straddle and strangle

- The first factor affecting the profitability of a straddle or strangle is, of course, the price of the underlying. The further away the underlying moves from the long strikes, the more the straddle and strangle values increase.

- A second factor that affects the pricing on a straddle and strangle is implied volatility. As implied volatility increases, the profitability of both increase. Straddles and strangles feel an increased effect with an increase in volatility because the strategies employ two options working together, and not against each other. When a strategy uses two options working against each other, the effect of implied volatility is the difference of its effect on each option. This is NOT the case with a straddle and strangle. Because these two strategies have options that are working together, so the effect of implied volatility on each option is added together.

- Lastly, time decay is another major factor affecting the profitability of straddles and strangles. As most know from other strategies, time decay takes its toll on all options. Its effect is even more pronounced on the straddle and strangle, because the strategies are combining two options in the same time period.

As with any options strategy, it is important for a trader to be aware of all the risks and rewards involved when considering the use of a straddle or strangle. They both can be used as an alternate to a purchasing a directional long call or long put when a large move is expected in the underlying.

I hope these two articles have been informative in how you may want to incorporate a straddle and/or strangle into your trade plan.

Feel free to comment below.