Many traders use straddles and strangles in their options trading plan. This week's article is intended to be a synopsis of the straddle strategy, and potential uses a trader may consider. The strangle strategy will be covered next week.

What is a Straddle?

A straddle is an options strategy composed of a long (or short) call, and a long (or short) put, where both options have the same strike price and expiration. The components of a straddle include:

- Call and the corresponding put

- Same underlying

- Same strike price

- Same expiration date

- One-to-one ratio

When you purchase a long call and a long put, you have a long straddle. When you sell a short call and a short put, you have a short straddle. The margin requirements for the short straddle can be quite significant, so the focus of this article will be the long straddle.

What scenarios might warrant the use of a straddle?

The straddle is a strategy that a trader can use when a large move is expected in the underlying in either direction. The purchaser of a straddle is looking for the underlying to make a significant move, resulting in an increase in volatility.

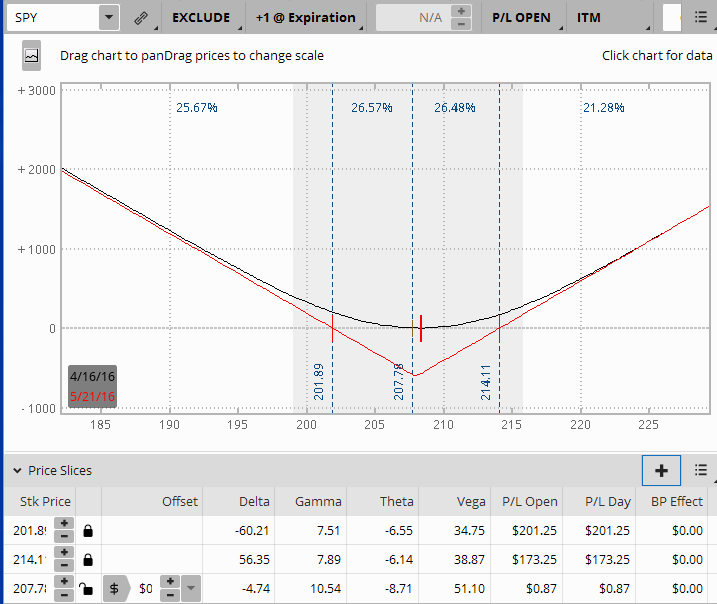

The photo below illustrates a long straddle position on SPY for the May 2016 expiration. With SPY trading at approximately 208, the straddle consists of one long call and one long put both at the 208 strike, at an approximate cost of 6.10. This straddle will reach its maximum profit if SPY moves outside the expiration breakeven prices by the end of the May cycle. The maximum loss for the position is at the at-the-money strike of 208; as SPY moves further away from the center strike, the profit increases.

The expiration breakeven for the straddle is calculated by adding the cost of the straddle to the strike price (upper breakeven), or subtracting the cost of the straddle to the strike price (lower breakeven). The expiration breakevens for the example shown below are approximately 201.89 and 214.11.

SPY Long Straddle for May Expiration

Because the straddle is often used when a trader is expecting a large movement in the underlying, it is often used around an earnings event. While the example shown is for the May cycle with 30+ days until expiration as of this writing, it is a trader's choice when to exit the position. If the straddle is purchased ahead of an expected news/earnings event, buyers may want to be ready to take profit or limit losses shortly after the news is released.

Another time to purchase a straddle is when you feel volatility will increase. A straddle has two options which work together, so the effect of volatility will double with an increase in volatility.

Because the straddle is a negative-theta position, time decay begins to erode its value quickly. Like volatility, the effect of decay also doubles because the straddle has two options working together. A delay in taking profits, or limiting losses may affect the position as time goes on.

Why purchase a straddle rather than a long call or put?

In order for a long call or long put to be profitable, you need to feel confident that you have picked the right direction for the move. With a straddle, you do not have to have a directional bias, you need price movement and/or volatility.

The straddle has the same risk/reward as a long call or put; both have an unlimited reward and limited risk. However, the price of the straddle can almost be double the cost of a long call or put which is certainly something a trader should consider.

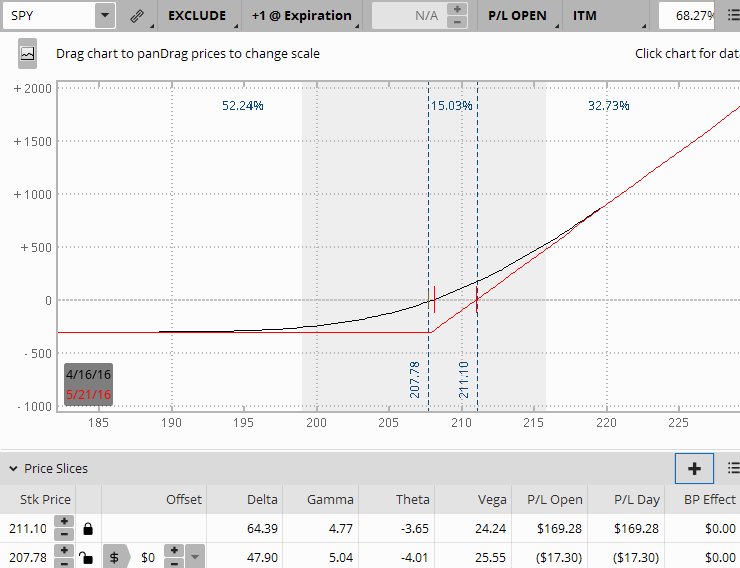

Using another example on SPY, a long call purchased at the same strike as the straddle is shown below:

SPY Long Call for May Expiration

The long call will reach its maximum profit if SPY moves above the expiration BE of 211.10, versus 214.11 for the straddle shown in the example above. While the maximum profit is reached a bit sooner with the long call over the straddle, you must be right on the direction of the move, as mentioned earlier.

In summary, a straddle is a viable alternate strategy when a large move is expected in the underlying and/or an increase in volatility. As with any strategy, however, the trader must be vigilant on how the position is affected by time decay, and be nimble to exit in order to lock in profits and eliminate further risk of substantial time decay.

Next week's article will cover the strangle, an alternate strategy to the straddle as a means for a trader to benefit from an expected large move on an underlying.

Feel free to share how you have used straddles in your options trading.