I am pleased to be presenting this new series for Capital Discussions. The title we have selected: ” Trading Options: Core Concepts” is intended to help both beginner and veteran traders re-visit and reinforce some of the basic concepts of options trading. By way of introduction, I have been trading options full time for income for almost 8 years, and reside in the US. I trade non-directional, positive theta trades such as Iron Condors and Butterflies, and my trade plan consists of a combination of monthly and weekly trades.

I am pleased to be presenting this new series for Capital Discussions. The title we have selected: ” Trading Options: Core Concepts” is intended to help both beginner and veteran traders re-visit and reinforce some of the basic concepts of options trading. By way of introduction, I have been trading options full time for income for almost 8 years, and reside in the US. I trade non-directional, positive theta trades such as Iron Condors and Butterflies, and my trade plan consists of a combination of monthly and weekly trades.

This series of articles will cover a variety of subjects related to options trading, including psychological aspects as well as some of the logistics of trading options as a business. My goal is to provide subject matter helpful to those new to options trading, as well as experienced traders.

This initial article titled “Preparing for the Trading Day” will let you watch over my shoulder as I outline how I prepare for the trading day.

What do you as a trader need to do to be ready for your trading day?

I'll outline the steps I take to prepare for my trading day. Some of what I do may spark ideas for you. Maybe you'll think my preparations are inadequate, or may be too much. Either way, this article is intended to prompt you to think about your own preparations as a trader to get ready for the trading day ahead of you.

My day begins early; I am usually at my computer by 5:30 am EST, 4 hours before the market opens. This may seem to be overkill, but for me it's all about preparation. An athlete doesn't appear at the starting line only minutes before the race begins, he takes time to prepare emotionally and physically for the competition.

I feel that you as a trader should take enough time to do adequate research, have breakfast, get some type of physical exercise, and take a break before the trading day begins. Time must also be allowed for any technical problems, i.e. updates, login issues, etc.

After booting my computer and logging into my trading platform, I begin by looking at futures on the major equity indices (/ES, /YM, /NQ, and /TF.) The US futures market is traded almost without interruption, just a small break at the market close Futures trading hours are 6:00 pm – 5:15 pm Sunday through Friday US eastern time, with a 45 minute break each day beginning at 5:15 pm US eastern time. Any overnight move is often a good barometer of what to expect for the open.

I next look at what happened overnight in Asia and Europe, and how that may affect my trading day. I personally use www.marketwatch.com for overseas market information, but there are other sites that offer the same information such as Bloomberg, Seeking Alpha, etc. I look for any overnight economic news in those markets that may have caused a significant move.

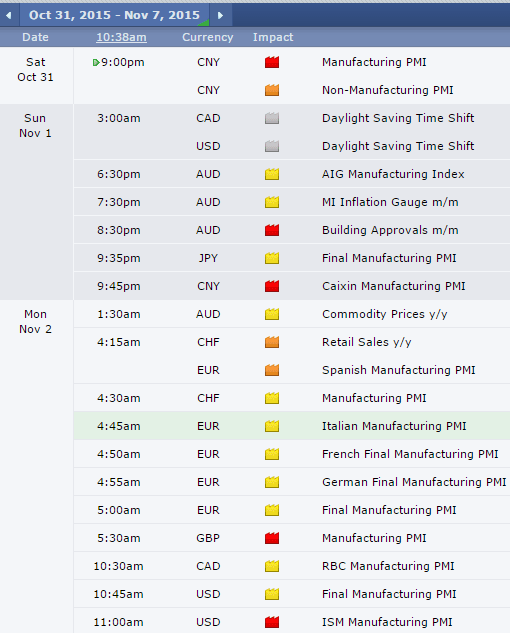

My next course of action is to review what economic reports are due out here in the US. I typically use www.forexfactory.com for the daily economic news releases, as it covers both domestic and the Asian/European news. A sample screenshot of Forexfactory is below:

For those trading in the Asian/European market, economic news releases will be important to your trading day preparations. I also review the earnings release schedule and who reported after the previous day's close. While I personally do not trade individual stocks, a big earnings event can sometimes affect the broad market. Some of the larger companies such as AAPL, GOOG, and others can be important.

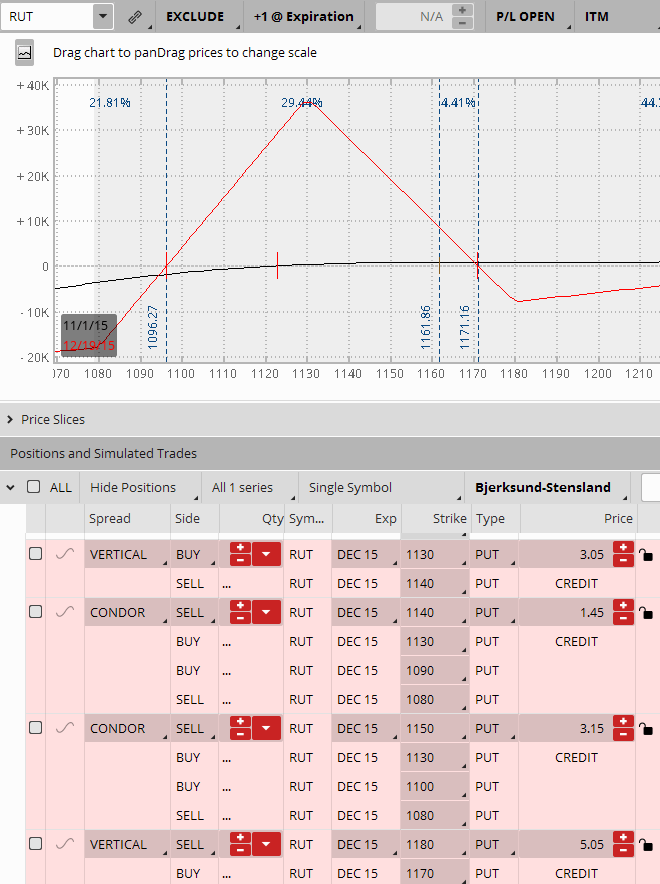

Now it's time to review my open positions, and how any overnight price move or news may affect my trade activity for the day. When I enter a new position, I immediately plan for any necessary adjustments as per the trade guidelines, closing orders, etc. and have them already set up as a simulated trade in my trading platform. This facilitates my morning review to see if any modifications are needed to the plan, depending on how the day progresses. Some of the questions I ask myself:

- Is my adjustment plan still valid?

- Do my closing orders need to be modified?

The screenshot below illustrates a December open position, showing some potential adjustments that I have set up as simulated trades as soon as the position was initiated:

Potential Upside Adjustments

The potential adjustments have also been set up for the downside; this is all part of planning ahead for the trading day.

Depending on futures price action, I then perform a chart analysis identifying support and resistance levels that could be potentially violated with a big move at the open.

Next, it's onto alerts and conditional orders. I always double check any alerts I have set up to see if they are still valid or may need tweaking, as well as any conditional orders that may need updating. There are times in every traders' schedule where appointments or commitments take us away from the markets for some of the trading day, so this daily review is just one more step in the preparation process.

Now, it's time for the break that I feel is so important to stay emotionally “charged” for the trading day. After my morning preparations for trading are done, I take a long walk, which puts me in the right frame of mind to handle the trading day psychologically and physically. I am back at my computer one hour before the open. Many times major economic news is released at that time, so this gives me a second opportunity to plan the action items for the day.

Here is a brief summary of my daily preparations for you:

- Check futures overnight price action

- Check overseas markets

- Check economic reports

- Check earnings releases

- Check open position status

- Review trade management plan, i.e. adjustments, closing, alerts, conditional orders

In Conclusion

This is how I prepare for the trading day. I hope this outline gives you a chance to tweak your own preparations. Don’t put yourself in the position of “Wow, I don't know what to do” when the market opens. If this unsettling thought is a reality, you probably have not prepared well enough for the trading day that awaits you. The market gives you enough uncertainty; you must be ready to tackle each and every trading day to the best of your ability. Being prepared gives you the confidence and ammunition to do so. If you are like me, you will take comfort in the feeling that you are “ready” when the opening bell rings.

This quote says it all about being prepared:

“If you can learn to create a state of mind that is not affected by the market's behavior, the struggle will cease to exist.” Mark Douglas.

Feel free to add comments and suggestions for future articles.