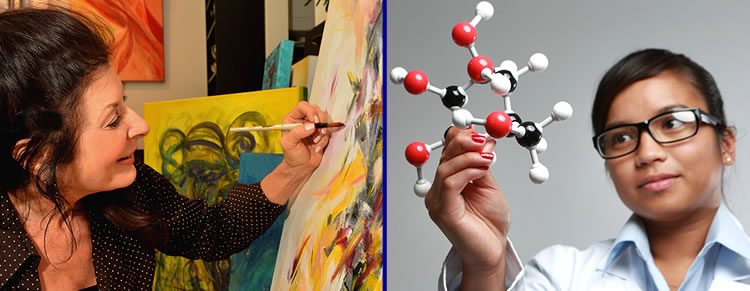

Several years ago I recall a question that someone wrote to the CBOE's “CBOE – Ask the Institute“, asking if there was a scientific way to manage iron condors, or any type of credit spread. They noted that from their observation, some used the Greeks (primarily delta), others used a percentage move away from entry point, etc. Their underlying question was if the “art” of trading could be reduced to a “science”.

The Institute's answer was an emphatic “NO!” There is no scientific method. All forms of trading are an art in some shape or form. There is not a “best way” nor a scientific way of managing all trades all of the time. For the purposes of this article, “art” refers to combining intuition with technical analysis in your trading.

How can you as a trader conquer the balance between the art and science of trading?

It is important to consider your own trading style before you decide to stick to the rules outlined in your trading plan, or incorporate some intuitive measures into your trade management.

- Are you a die-hard, live-by-the-rules kind of person, and know that using a little intuition from time to time won't threaten your overall trade management goals?

- Have you recently fallen into a habit that you are trying to break, basically ignoring your trading plan and trading solely on your instincts? If you have fallen prey to this trading style, you may be the victim of letting your losses get too large. This is the time it is more important to prove to yourself that you CAN follow your rules or guidelines. Trusting yourself to follow your plan must be reestablished.

Once you have identified what type of trader you are, it could be easier for you to determine how much to interject the “art” into the “science” of your trading plan.

There's no right or wrong to any of this in most situations that we as traders encounter. There's no “best”, no exact science, that is going to clear the crystal ball. It is just you and your decisions, and your decisions' effect on your ability to trust in yourself as a trader.

What is important is that you follow your trade plan and guidelines “most” of the time. It is not wise to be the type of trader whose trade plan includes adjusting and iron condor when the value of the delta on a sold call or put reaches 20 – 22, and then, when that point is reached, suddenly decide that you're going to change your plan mid-stream and adjust when those deltas reach 30. That is not incorporating a bit of art; it is totally abandoning your plan. Whatever art you introduce into your trading plan, it's important to never let a loss become unmanageable from either a financial or a confidence standpoint.

No matter how many guidelines you build into your trade plan, there are going to be times when a little art must be applied. What is of the utmost importance is to never let losses mount above that which you have built into your plan as acceptable levels while you're doing a little artwork. Accept that you will have to practice a bit of art with science from time to time. Only you as a trader can determine how much art to incorporate into your trade management.

If you are new to trading and looking for strategies and feedback from veteran traders, consider joining the community of options traders at Capital Discussions.

Here is the link to get started: www.capitaldiscussions.com/join.

If you have any comments on how you handle the balance between the “art” and “science” of trading, feel free to share below.