It happens to every trader at some point. You have a live position on, and something takes you away from your office computer during market hours. You as a trader should have a back-up plan for those days. Here are the steps I take:

- I use contingent orders when I know in advance that I'll be away for a portion or the entire day.

- I will then set alerts before my contingent orders are scheduled to trigger. For instance, let's say I have a contingent order in place to trigger at an upper adjustment point if the underlying reaches 1182. I will then set my alert for 1180 to give me forewarning. This way, I can go into my trading platform and work the trade manually if I have access. If I do not have access to my trading platform, I let the contingent orders execute.

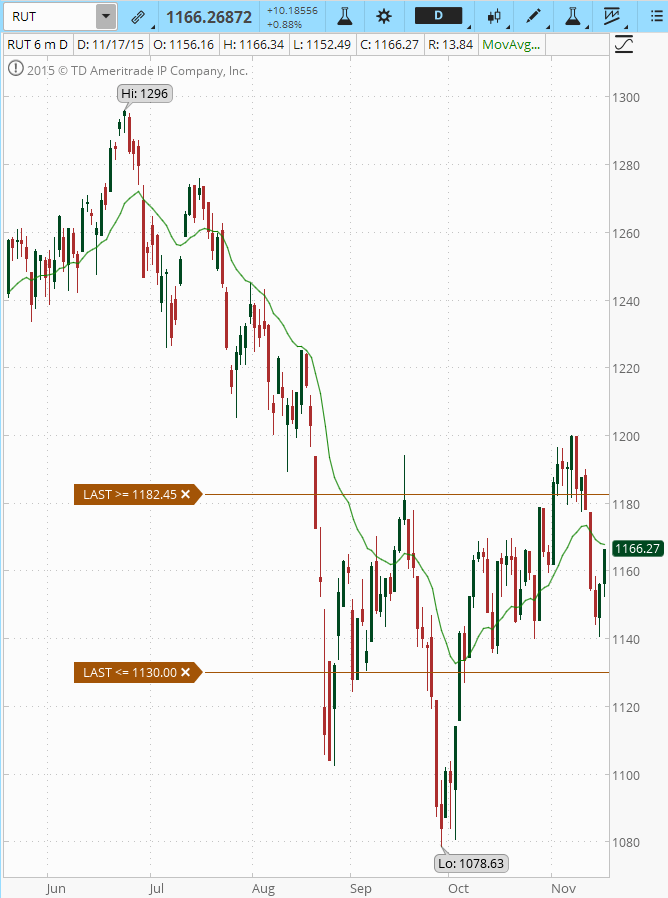

The following are alerts I recently set before a planned trip away from my office.

RUT Chart Showing Alerts Set For Upper and Lower Adjustment Trigger Points (Figure A)

What do these alerts mean? The following screenshot will explain my thought process behind the alerts.

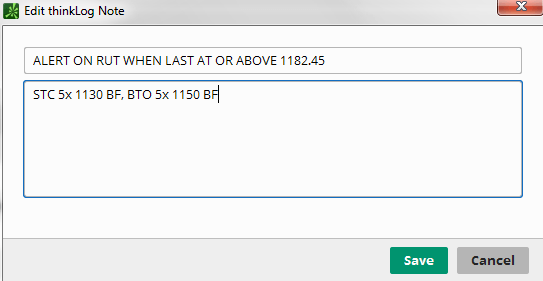

Here's a note I attached to one of those alerts:

(Figure B)

I have the telephone number for my platform's trading desk readily available. I store the number in my contacts list on my cell phone. I don't want to be scrambling for the number when I am on the road. Reception may be spotty on my mobile platform, and I may need to make a trade quickly. That's the reason my alert notes tell me the detailed order that I have planned when the alert triggers (Figure B).

If I am not receiving text messages telling me my contingent orders are being filled as the underlying goes through those trigger points, I know I've got a fast-moving market on my hands. I may need to call the trade desk to work those orders. Hence, the notes telling me what I intend to do at each level will make it easier. (Figure B) I don't trust myself to remember. I am prepared.

Below is a screenshot of a live position that correlates with the alerts shown on the RUT chart (Figure A). My alerts are set for my upper and lower adjustment points, 1182.45 and 1130.00.

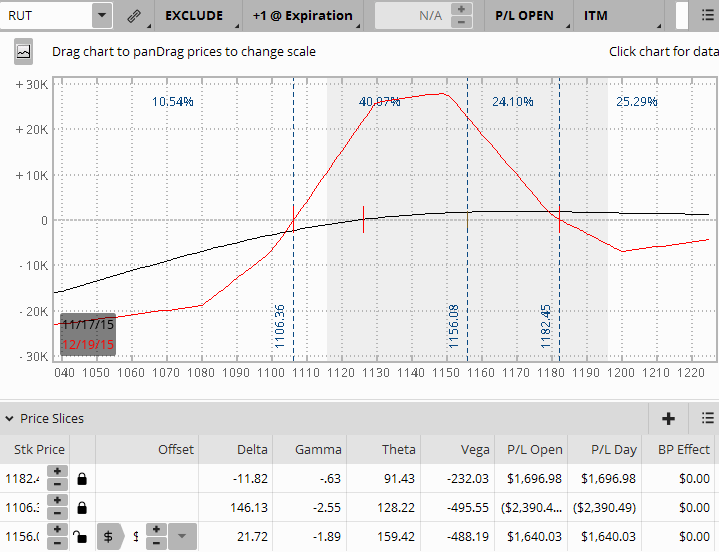

RUT position on ThinkOrSwim’s Analyze Page (Figure C)

I take a screenshot of the position from the TOS Analyze page and bring it with me. Some traders tether their laptops to their cell phones for coverage while on the road. This eliminates the need to bring a screenshot of their position.

The ThinkOrSwim mobile platform gives less information than the ThinkOrSwim Analyze page (Figure C), making it difficult to manage a complex position from my cell phone. The TOS mobile platform WILL tell me the positions you have open, but it will NOT show the current Greeks, or profit and loss, including any adjustments that have been made. In other words, it doesn't take into effect the realized profits and losses in this trade. It states only the profits and losses in the options contracts currently open.

The TOS mobile platform does, however, tell me how much my profit or loss has changed since the previous day's close for the entire position. Having the screenshot handy will tell me where the trade's P & L stood the previous day. Therefore, I can get an idea about how the trade is faring at the present time.

- I am aware of the free Wi-Fi locations such as McDonalds, Starbucks, a public library, etc. Some of these require registering ahead of time. If you plan to go this route for your trade management in the event of an emergency, sign up ahead of time. Also, research the steps you need to take to keep your financial information secure if you're using public Internet access. Do all this well ahead of time.

All your plans will be well and good as long as you can plan. What if you can't plan? What if your internet access goes down, or someone calls with an emergency that allows you time to do nothing more than gather up your keys and cell phone? If this happens, you only have time to react with no time to plan. Be prepared by putting in place the actions I have outlined above.

“By failing to prepare, you are preparing to fail.” Benjamin Franklin

Even when your position seems to be doing well, you should always know where or how it could get into trouble. Always have an idea what you'd do if that disaster hit. And at the risk of repeating myself, always have the trading desk's telephone number readily available so you don't have to look for it.

Some of you will have other solutions for handling those times when you're away from your trading desk, whether due to planned time away or to an emergency. Just be sure you have taken the proper precautions and steps to manage your positions appropriately and as per your trade plan.

Was this helpful? Feel free to comment or ask questions.

Interesting article. However, there is one error. Midway through you state “The TOS mobile platform WILL tell me the positions you have open, but it will NOT show the current Greeks, ….”. On the TOS Mobile on my iPhone, I have been able to see the Greeks of my positions quite easily under “Positions”. You might need to go into the “Columns Editor” and you can add Delta, Gamma, etc. I use this all the time while on the move.

Thanks for the tip Tim!

The days of the office runner passing information from desk to desk are certainly over; the speed that business software can perform the same tasks has completely usurped the runner’s position. As with much in the modern world, rapidity and efficiency are paramount.