New Trade Planner for Option Traders

There is a new tool to help option traders plan their option trades. The tool helps traders Allocate capital for each trade Calculate the target exit price Calculate the target maximum loss price Estimate the commissions and fees for the trade Calculate the yield on...

Improvements for Traders with Small Accounts

Brokerages have changed significantly over the past 20 years. Aspiring traders with small accounts now can participate with much smaller accounts than in the past. When first thinking about trading, most if not all traders start with stocks. However, the cost of...

Using Options For Swing Trading

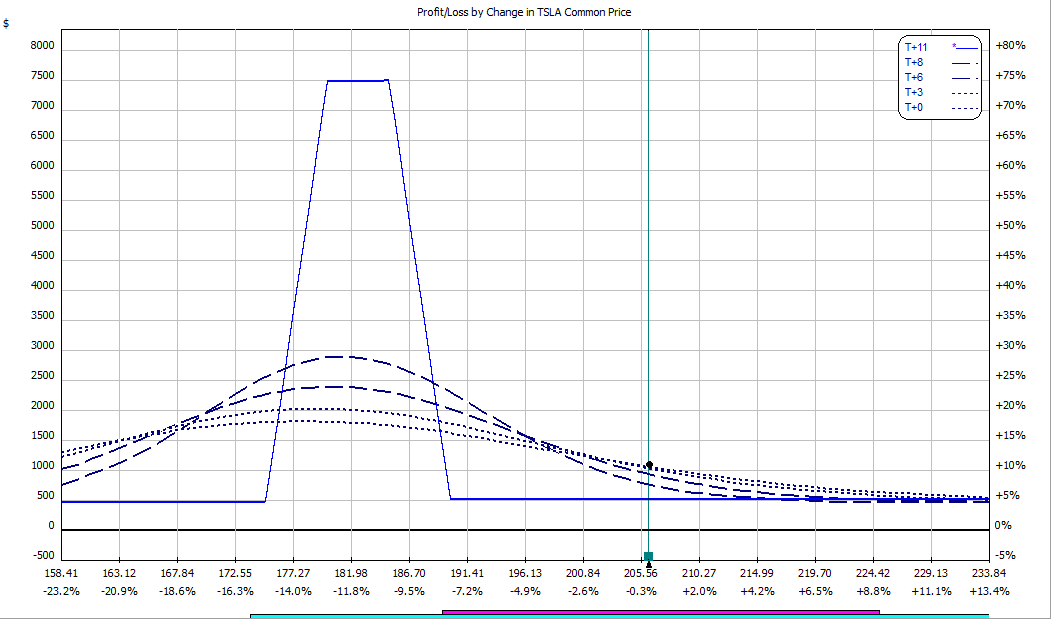

Steve Spencer at SMB posted a video of how to use options for swing trading. Steve used a synthetic stock position with a split strike, done for a credit. The video was posted at https://www.youtube.com/watch?v=nMq1TZFBToE Is that the best trade we can put on? Steve's...