by Tom Nunamaker | May 29, 2015 | News, Options trading, Trading

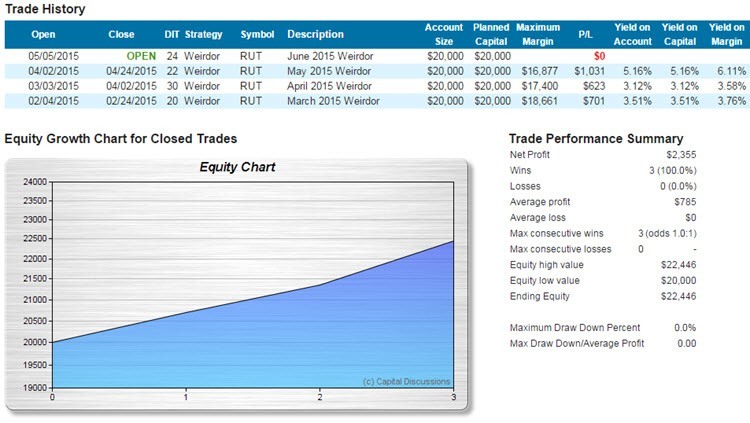

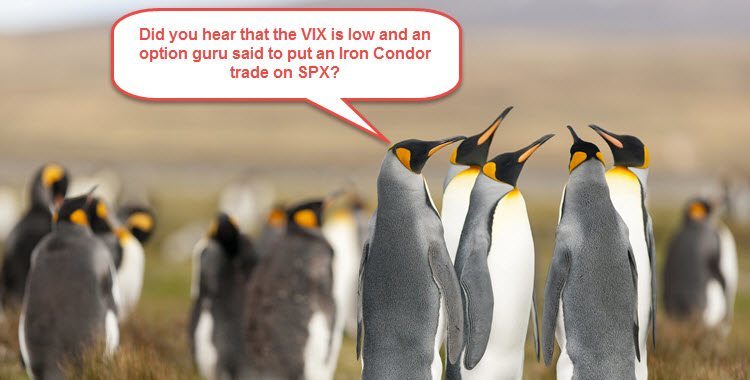

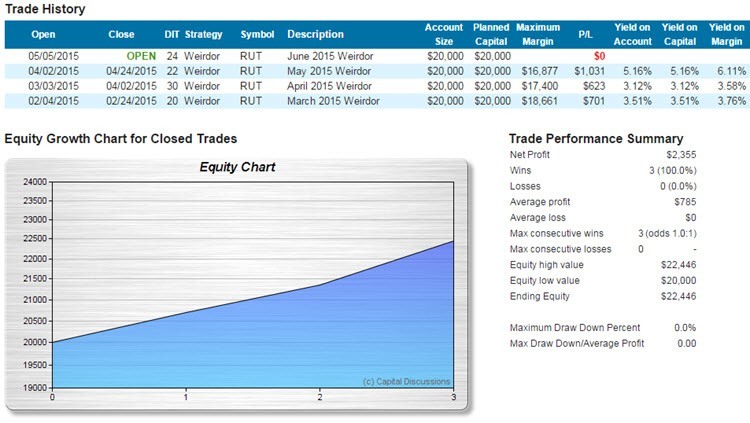

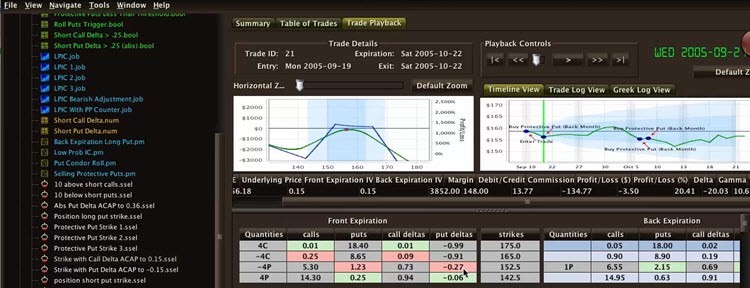

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade...

by Tom Nunamaker | May 24, 2015 | News, Options trading, Trading

Bill Ghauri presented “The VIX Sniper”. Bill showed how he makes his trading decisions using the VIX and technical analysis. Bill reviewed his recent trades and how he uses risk and money management to get such a great Expectancy. Learn more about Bill's...

by Tom Nunamaker | May 8, 2015 | Options trading, Trading

Have you seen option gurus writing articles or doing videos about trades that they like? A typical article might mention how high or low the VIX is and present a possible trade, including strikes, credits/debits, margin, risk and perhaps even break evens. Do people...

by Tom Nunamaker | May 5, 2015 | Options trading, Trading

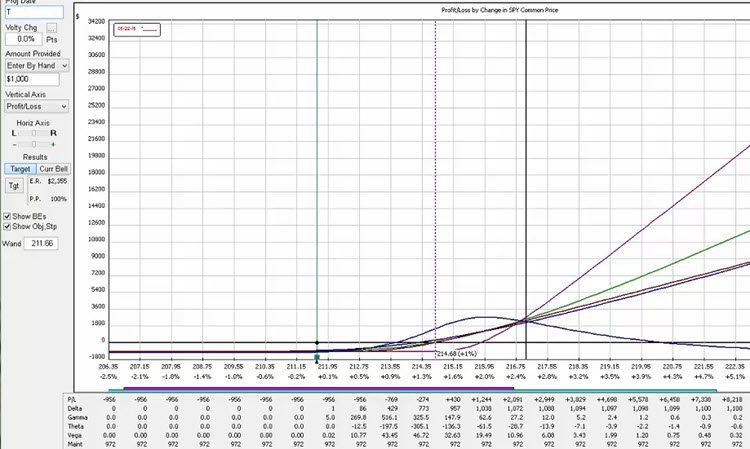

Jerry Furst from Traders Education Network hosted the meeting. Jerry reviewed his outlook for the markets, including the upcoming economic events. Himanshu Raval agreed with Jerry's assessment of the SPX and RUT. Near the end of the session, Jerry demonstrated how he...

by Tom Nunamaker | May 4, 2015 | News, Options trading, Trading

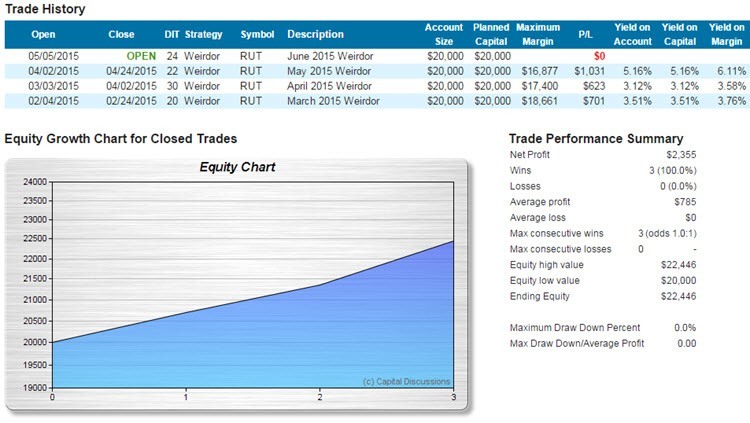

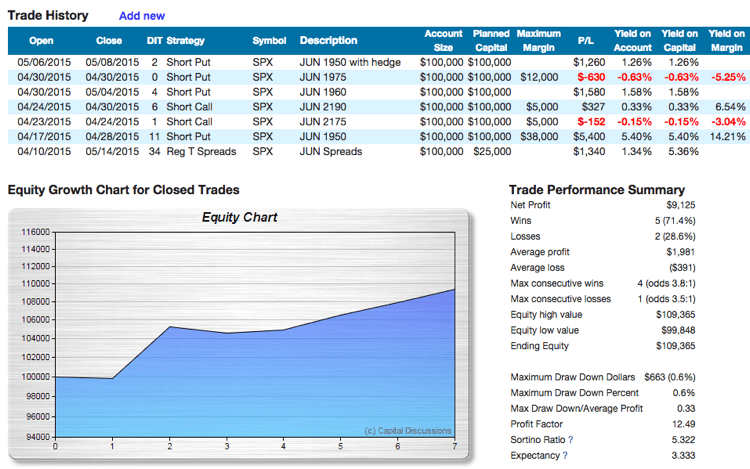

I've been following Bill Ghauri's Alpha Alerts's short put and call trades on SPX and doing very well. I really like the simple approach of selling options similar to a directional trader but also getting a trading edge with volatility and time decay. A few years ago,...

by Tom Nunamaker | Apr 28, 2015 | Options trading, Trading

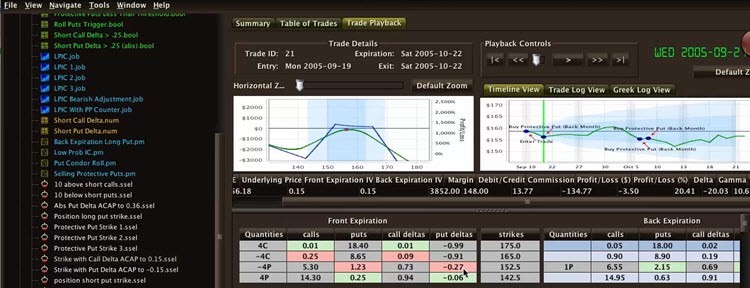

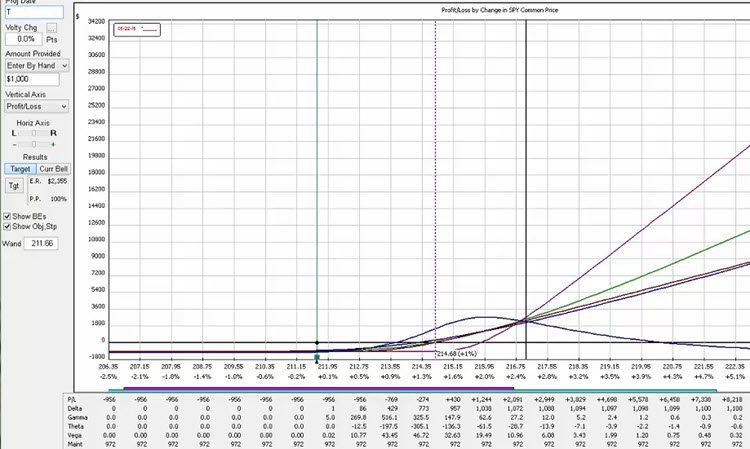

Larry Richards, from QuantyCarlo, walked through a trade scenario by establishing a baseline for the trade and then starting to build a trading plan within QuantyCarlo software. Enjoy the replay! Register for the next QuantyCarlo Education webinar on May 12th here...