by Tom Nunamaker | Jan 28, 2015 | Options trading, Trading

Tom Nunamaker and Tony Sizemore, from Option Elements, reviewed the market. Jim Riggio commented to Tom that the ECB added 10B/month with no fixed end date. With the ECB starting Quantitative Easing, the Japanese central bank in full swing he doesn't see how the...

by Tom Nunamaker | Jan 28, 2015 | Options trading, Trading

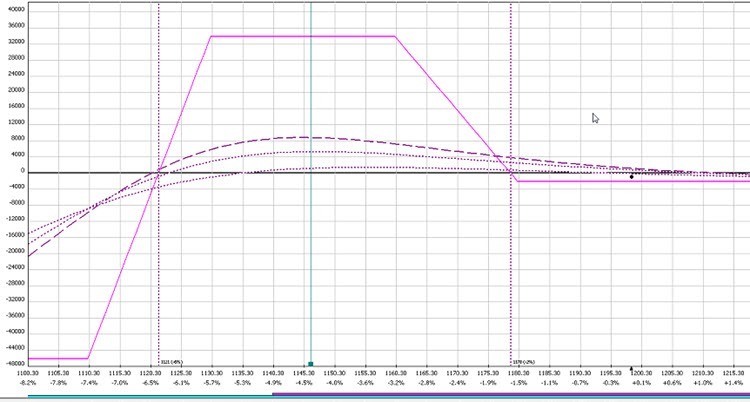

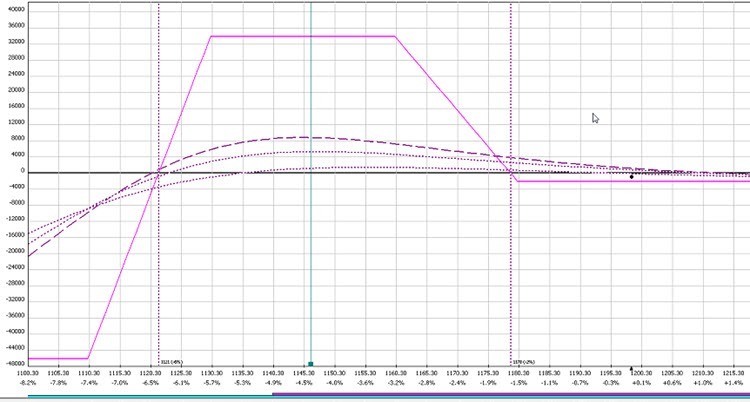

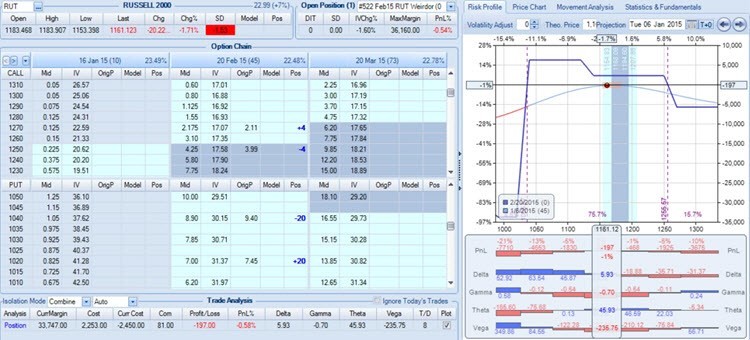

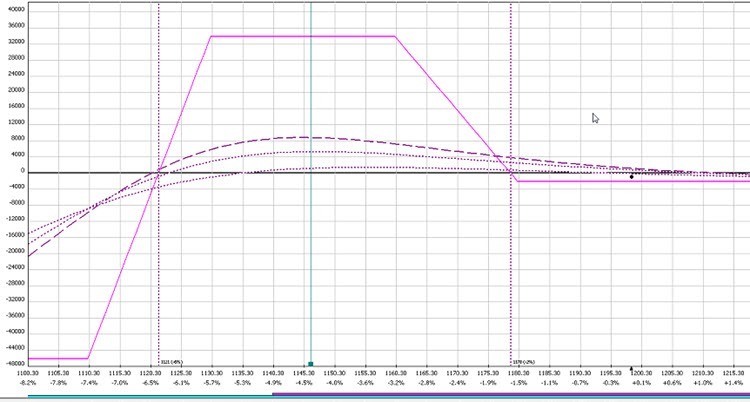

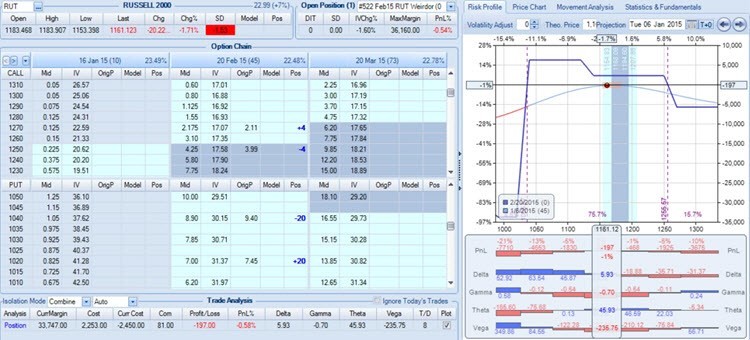

Amy Meissner, also known as the “Queen of Iron Condors”, updated us with her current Weirdor trade that she is getting ready to take off for a profit. Amy is starting a new trade alert service for customers to follow her live Weirdor trades in real time....

by Tom Nunamaker | Jan 23, 2015 | Options trading, Trading

Amy Meissner is back to present on the Round Table on Tuesday January 27th at 4:30pm Eastern Time. Amy will review her most recent live trade and update her live trading results. Amy will answer your questions about her Weirdor trade. Click here to register for this...

by Tom Nunamaker | Jan 23, 2015 | Options trading, Trading

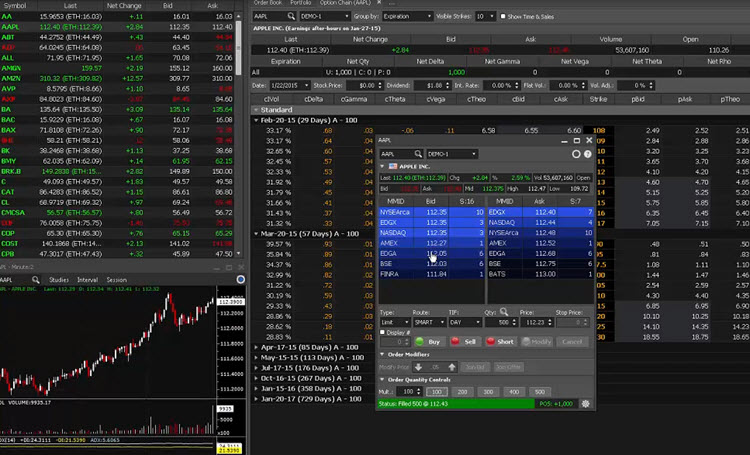

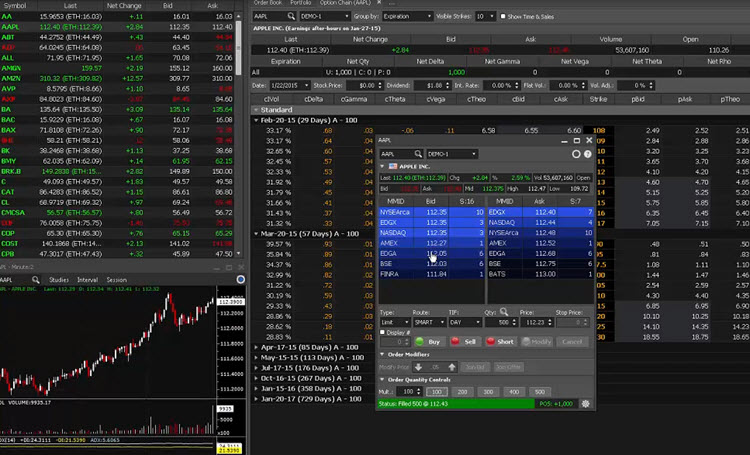

Jamie Ruetz, from Silexx, presented their professional option trading platform called Obsidian. This software is used by many institutional traders. Enjoy the replay! Join us in our free members web site to download all of the different formats of this video. The...

by Tom Nunamaker | Jan 20, 2015 | Options trading, Trading

Jamie Ruetz, from Silexx, will show us their option trading platform called Obsidian on the Round Table on Thursday, Jan 22nd at 4:30pm ET. Jamie will cover: Obsidian's advanced orter entry modules including Spread Maker Position Analyzer to visualize your positions...

by Tom Nunamaker | Jan 16, 2015 | Options trading, Trading

Jerry Furst from the Traders Education Network. Jerry discussed technical analysis and how he trades options based on his market opinion. Enjoy the replay! Join us in our free members web site to download all of the different formats of this video. The library has PDF...