by Tom Nunamaker | Apr 11, 2015 | Options trading, Trading

Steve Lentz, from OptionVue and Discover Options, presented “Volatility Edge Analysis of the Russell 2000.” Steve's data was very intriguing and showed how ofter option sellers have an edge on in the RUT. Steve is trying to use technical analysis to...

by Tom Nunamaker | Apr 7, 2015 | Options trading, Trading

Jerry Furst from Traders Education Network hosted the meeting. Jerry covered recent market action including technical analysis of Fibonacci lines and chart Join us in the forums to talk about trading. Our free member web site has all of the recordings, handouts, MP3,...

by Tom Nunamaker | Apr 4, 2015 | Options trading, Trading

Steven Place, from Trading With Options, presented “Income Trading Around The Earnings Cycle.” Steven had an interesting presentation that talked about term structure and how stocks move AFTER earnings announcements. After the presentation, Steven and Jim...

by Tom Nunamaker | Apr 1, 2015 | Options trading, Trading

Jerry Furst from Traders Education Network hosted the meeting. Tom entered a bearish EURUSD futures options trade and Jerry analyzed the price action of the 6E futures contract. Jerry showed his “Sell in May and Go Away” analysis and Jim talked about theta...

by Tom Nunamaker | Mar 28, 2015 | Options trading, Trading

Round Table with Bill Ghauri. Bill presented his Long and Short trading systems using his automated back testing solution. Bill reviewed the importance of risk and money management in trading and sizing your trades correctly. Bill showed his backtesting tool in action...

by Tom Nunamaker | Mar 23, 2015 | News, Options trading

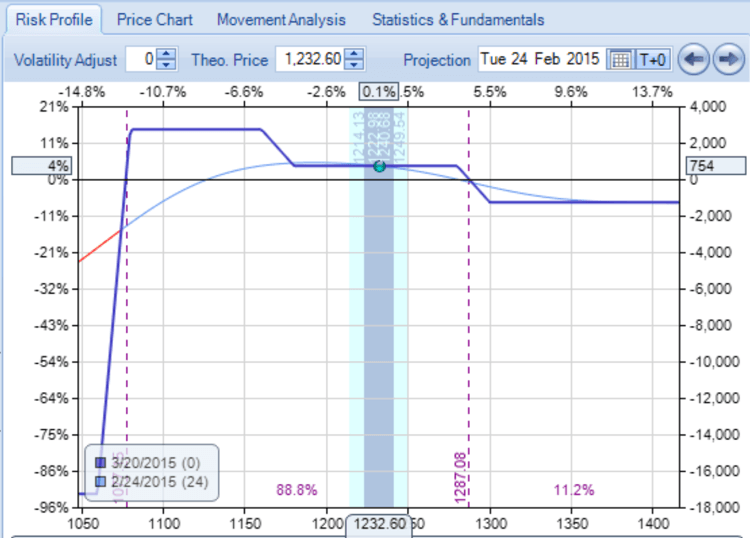

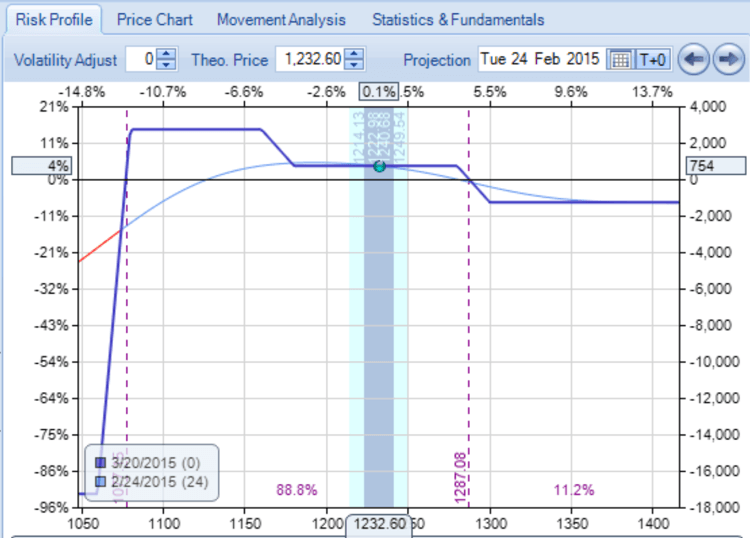

Amy Meissner launched her Weirdor trade alert service in Feb 2015 with a Weirdor trade using $18,661 of margin. The trade was open for 20 days and made a $701(+3.76%) profit. The would have paid for a six-month subscription with just one trade. This would have...