by Tom Nunamaker | Jun 24, 2015 | News, Options trading

We are pleased to announce the roll out of our new Gold Membership at Capital Discussions. The new Gold Membership will be in effect on Friday, June 26, 2015 at 4:30pm Eastern Time. We will always have the core part of our community be free. The Gold Membership adds...

by Tom Nunamaker | Jun 13, 2015 | News, Options trading, Trading

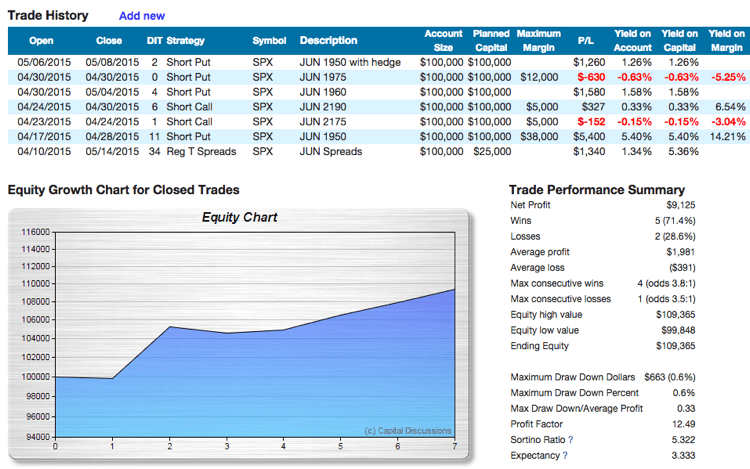

Ricardo Saenz De Heredia reviewed his trading service performance and showed examples of some recent trades. Ricardo currently has the highest return of all Capital Discussions experts. His earnings plays have many small losses but Ricardo said the winners can be...

by Tom Nunamaker | Jun 6, 2015 | News, Options trading, Trading

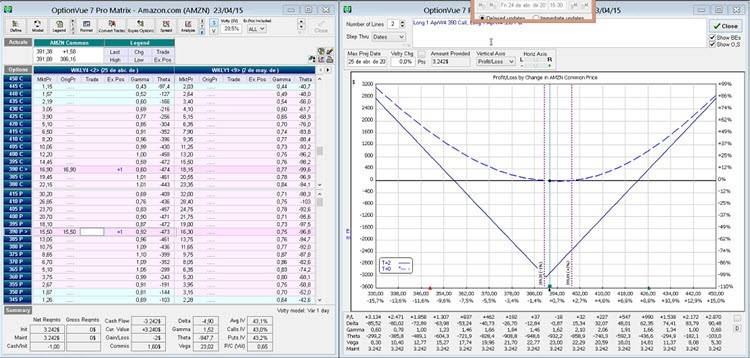

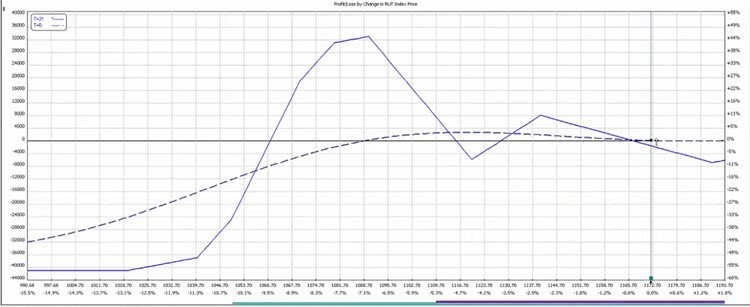

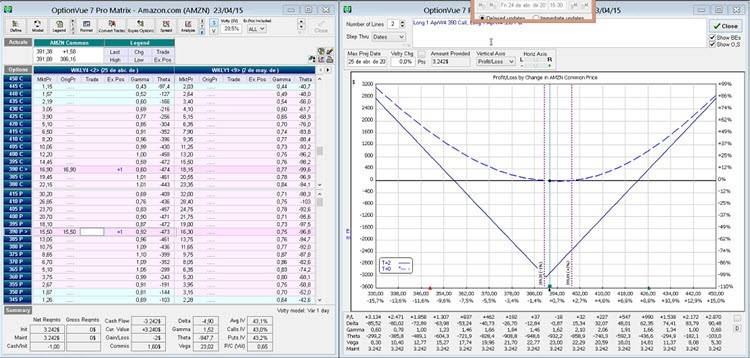

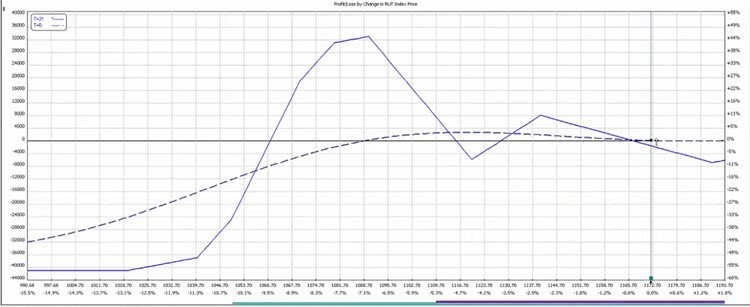

John Locke, from Locke In Your Success, reviewed lessons from his “Advanced Position Management” seminar. John used OptionVue's back trader to walk through a very volatile period last year with a hypothetical M3 trade on and showed some of the adjustment...

by Tom Nunamaker | May 29, 2015 | News, Options trading, Trading

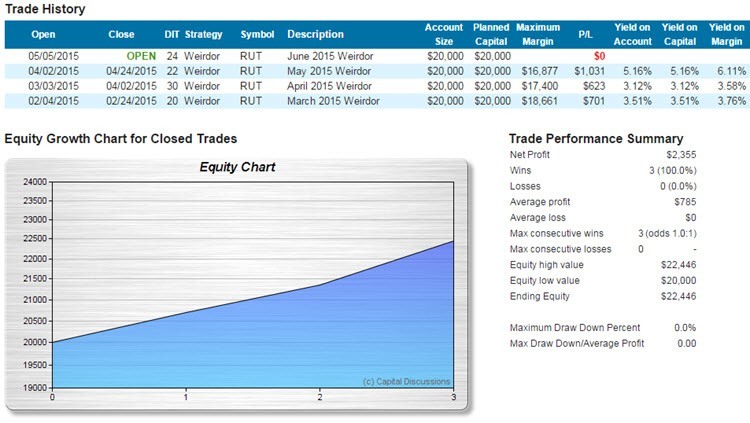

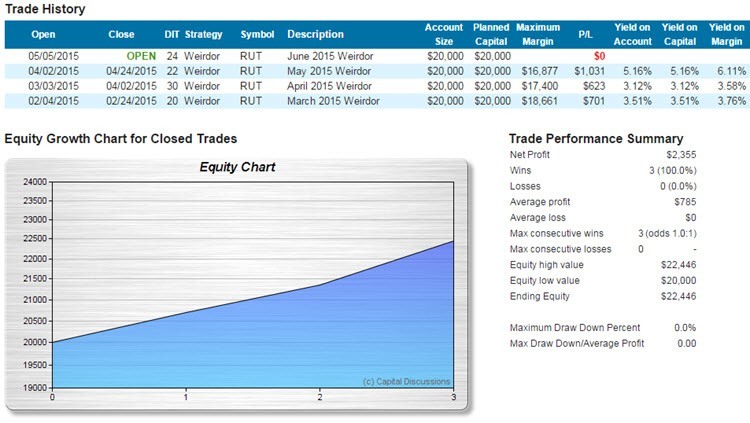

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade...

by Tom Nunamaker | May 24, 2015 | News, Options trading, Trading

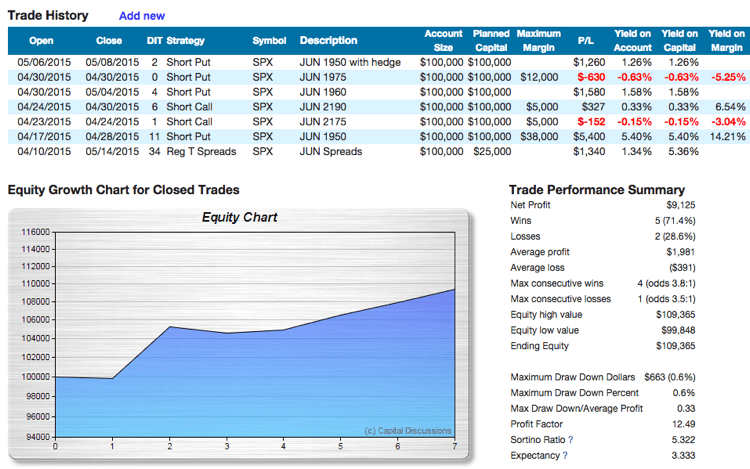

Bill Ghauri presented “The VIX Sniper”. Bill showed how he makes his trading decisions using the VIX and technical analysis. Bill reviewed his recent trades and how he uses risk and money management to get such a great Expectancy. Learn more about Bill's...

by Tom Nunamaker | May 8, 2015 | Options trading, Trading

Have you seen option gurus writing articles or doing videos about trades that they like? A typical article might mention how high or low the VIX is and present a possible trade, including strikes, credits/debits, margin, risk and perhaps even break evens. Do people...