I've been following Bill Ghauri's Alpha Alerts‘s short put and call trades on SPX and doing very well. I really like the simple approach of selling options similar to a directional trader but also getting a trading edge with volatility and time decay.

A few years ago, I created a Naked Option Margin Calculator that's been very popular. One thing that calculator doesn't do is help you decide how many contracts to sell.

How do you know how to size your option trade?

Two key principles all traders should be aware of are risk and money management. Directional traders like to keep the risk of any one trade to 1% to 2% of the total portfolio. This helps avoid blowing out your account.

Option Traders Generally Don't Use Fractional Risk

I know quite a few option traders that will trade up to 80% of their margin available. They might have risk guidelines like “lose a maximum of 15% of your margin used.” If you did lose 15% of 80% of your portfolio, you would have a total portfolio draw down of 12%. This is much higher than directional traders would ever consider, yet option traders do it frequently.

Is there a better way?

Yes! By using the principles directional traders use, we can calculate the correct number of contracts to sell and still keep total portfolio risk under control. The tool I created is specifically designed to work with selling short options, but it should work with any option trade.

How does it work?

The tool is at https://members.capitaldiscussions.com/go/c.option-position-sizer and is straight forward to use. Fill in the numbers on the left in the input boxes and the calculator will tell you how many contracts to sell.

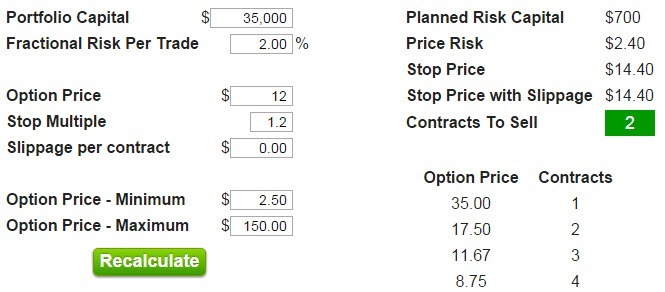

For example: with a $35,000 account and a 2% fractional risk per trade, we are considering selling an option for $12 with a stop multiple of 1.2 and no slippage:

The stop multiple is what determines your stop price. A $12 option with 1.2 stop multiple is taking 20% of the option price as the amount of risk we are willing to take on this trade. That is $2.40. Adding that to the entry price of $12 gives us a stop price of $14.40 and tells us to sell two contracts.

Two contracts have $240 of risk each, or $480 of total risk selling two contracts. That is below the $700 limit we've established as the maximum amount of risk we are willing to take on any one trade. If we sell three contracts, we would be taking $240 times three which equals $720 of risk, which is just above the maximum amount of risk we are willing to expose our portfolio to.

The tool has a list of what option price each number of contracts can support to keep your risk at or below your planned risk capital. If you have an option price, find the first entry on the table just above your price to get a quick estimate of how many contracts you'll be able to sell.

For example, if you were considering a $10 option, the first option price about $10 is 11.67 with three contracts. If you enter $10 in the option price, you'll see it calculates the number of contracts to sell at three.

Summary

This new tool (at https://members.capitaldiscussions.com/go/c.option-position-sizer ) can help you determine how many contracts to sell when selling options. It should also work with selling spreads if you enter in the spread price.

You can leave feedback on the tool at the bottom and click the “Like” button if you enjoy using the tool.