by Tom Nunamaker | Jun 5, 2014 | General

I put an SPX Jun 28 Broken Wing Butterfly (BWB) on yesterday. They seem to be what many of my option trading friends are trading these days. With volatility at historic lows, trading Iron Condors, Weirdors and Jeeps is very difficult because the premium is so low. The...

by Tom Nunamaker | Jun 2, 2014 | General

I read an article about position sizing using married puts with long stock at radioactivetrading.com. Kurt's strategy of married puts is a good idea, but if you remember from my article on option synthetics, that: Long Stock + Long Put = Long Call Kurt could achieve...

by Tom Nunamaker | May 28, 2014 | General

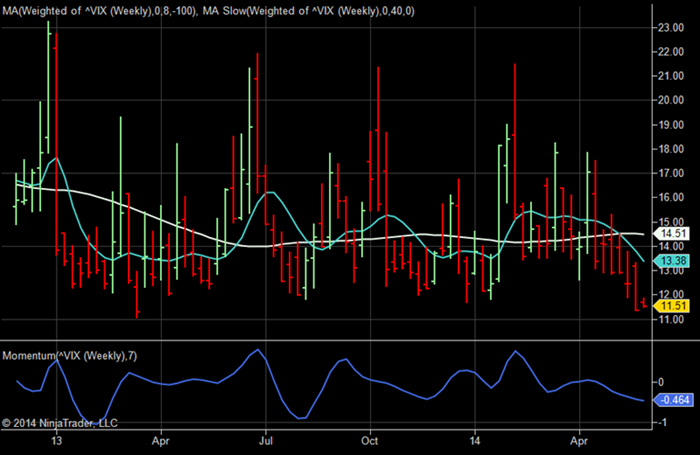

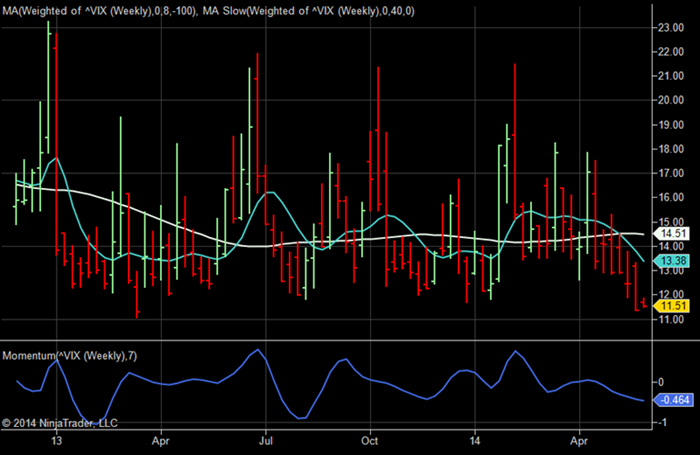

The CBOE announced they are adding half-point strikes for the CBOE Volatility Index (VIX) options. The half-point strikes will be listed for the near-term expiration month and in the strike price range of 10 to 15 (i.e. 10.5, 11.5, 12.5, 13.5 and 14.5 strikes). The...

by Tom Nunamaker | May 14, 2014 | General

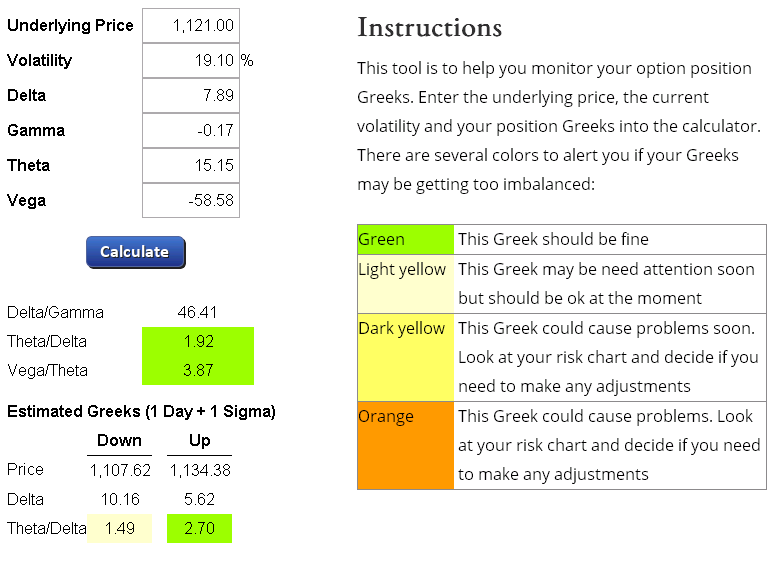

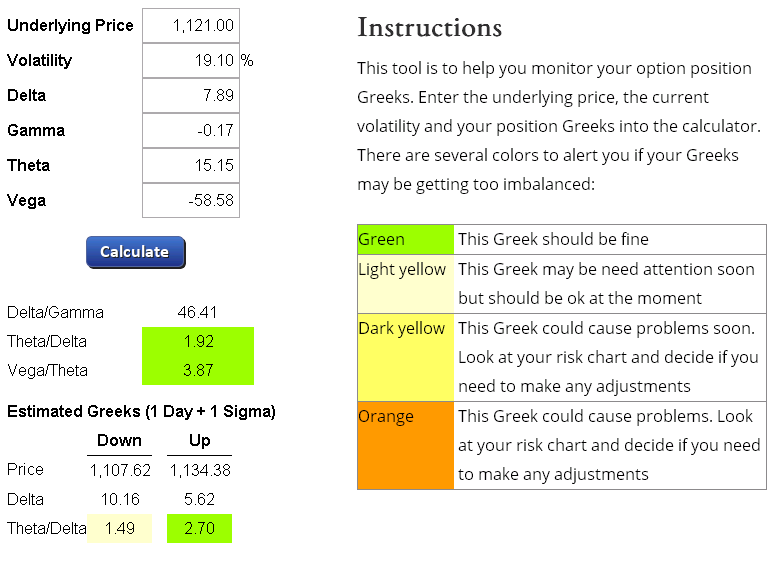

Dan Harvey has a spreadsheet he uses to help guide his contract sizes and manage his Weirdor trades. I extracted the option Greeks portion of it and created an online version which is at https://my.aeromir.com/go/c.option-position-greeks-calculator Here's a screen...

by Tom Nunamaker | May 10, 2014 | General

I started a June Weirdor/JEEP yesterday. We just moved the account I'm trading from ThinkOrSwim (TOS)to Interactive Brokers (IB) for several reasons: – Better execution and lower commissions – Opening the account through LiveVol will give access to LiveVol...

by Tom Nunamaker | May 7, 2014 | General

I posted in the forums about seting up OptionVue correctly to get the correct greeks for VIX options. Jim sent me an interesting link to six figure investing's article on “Thirteen Things Your Should Know About Trading VIX Options.” Bullet point...