BLOG

Adam Grime's Weekly Market Review is Available!

Adam Grimes published an institutional newsletter on the markets. MarketLifePlus is a new product that is an abbreviated version of the institutional newsletter. Adam has written books on technical analysis. He is a prolific writer, market technician and a great educator.

Road Trip Trade News

Tom Nunamaker is taking over the Road Trip Trade ES futures options trades starting with the 16Feb 2018 expiration cycle.

The Combination Trade

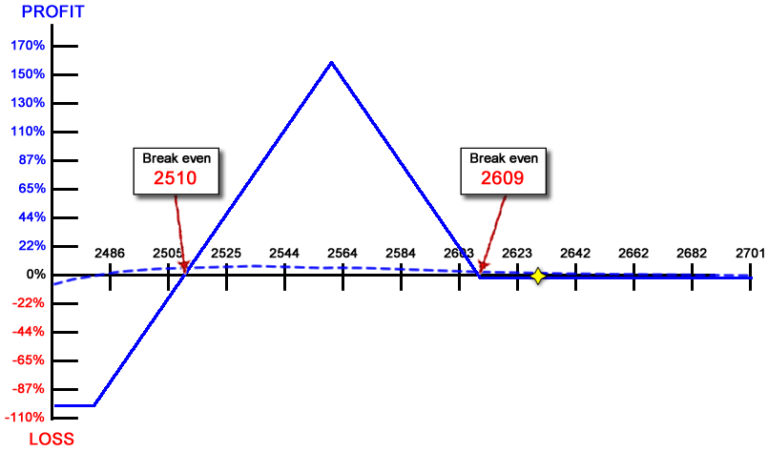

The Combination Trade is a good way to participate in a market rally and can be used to defend against a market move down with caution. Tom uses bullish combination trades with his Road Trip Trades when he thinks the market is bullish.

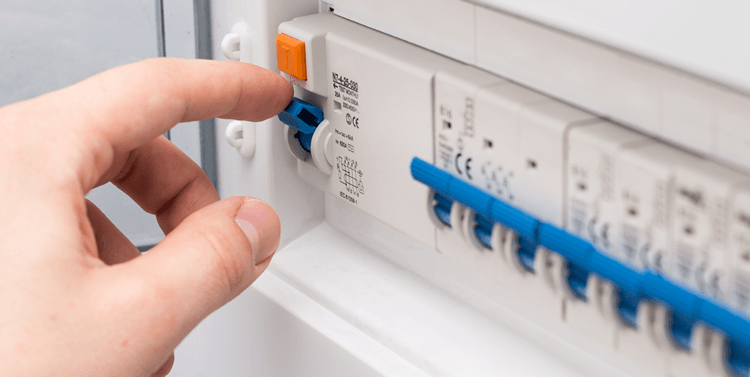

Trading Curb – Market Circuit Breakers

Black Monday's 22.7% decline lead to market circuit breakers being created. Learn about the market circuit breakers and some ideas about how to hedge your portfolio for a 20% or more decline.

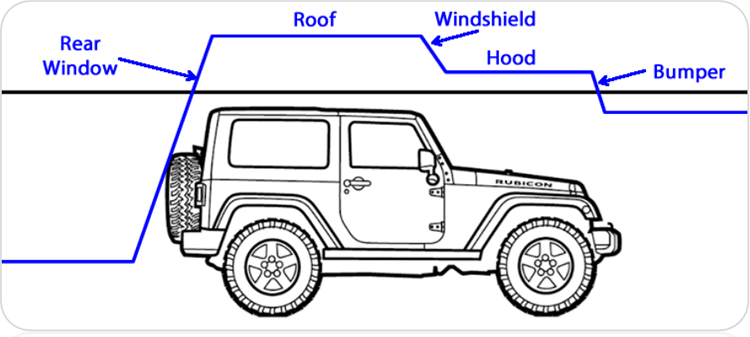

Jeep Trade Alerts Initial Trial

Paul Demer's is starting a Jeep Trade Alert service to trade a variation of Dan Harvey's Weirdor. Join the trial at https://cdlinks.us/jeep

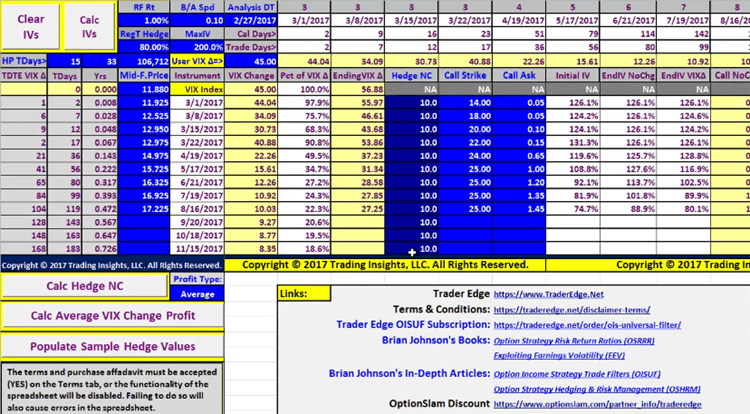

Round Table with Brian Johnson – Hedging Income Option Trades

Noted author Brian Johnson from Trader Edge is joining Capital Discussions on the Round Table on Wednesday 19 April at 11:00 am Eastern Time. Brian will present “Hedging Income Option Trades.”

Remember the Basics

Winning traders don't underestimate the psychological part of trading. Although you certainly cannot trade profitably without adequate capital or reliable trading strategies, your personal psychology also plays a significant role. Consider what master traders have...

How the U.S. Election Will Effect the Markets

We all know the U.S. Presidential Election is on Tuesday, November 8th, just a few days away. We've seen how the S&P 500 has had nine straight days of losses, which hasn't happened since December 1980. The S&P 500 Let's take a look at the S&P 500 chart: The decline...

Trading Options Around Earnings Releases, Part II

"We are programmed to receive. You can check out any time you like, but you can never leave!" Hotel California, The Eagles In my last blog post, I discussed the nuances of change in implied volatility (IV) leading up to earnings release and following the announcement....

Trading Options Around Earnings Releases, Part I

One of the advantages of an option based approach to trading is the ability to capitalize on trades that have a statistically well-defined high probability of profit. When events occur with predictable regularity, the knowledgeable option trader can effectively...