BLOG

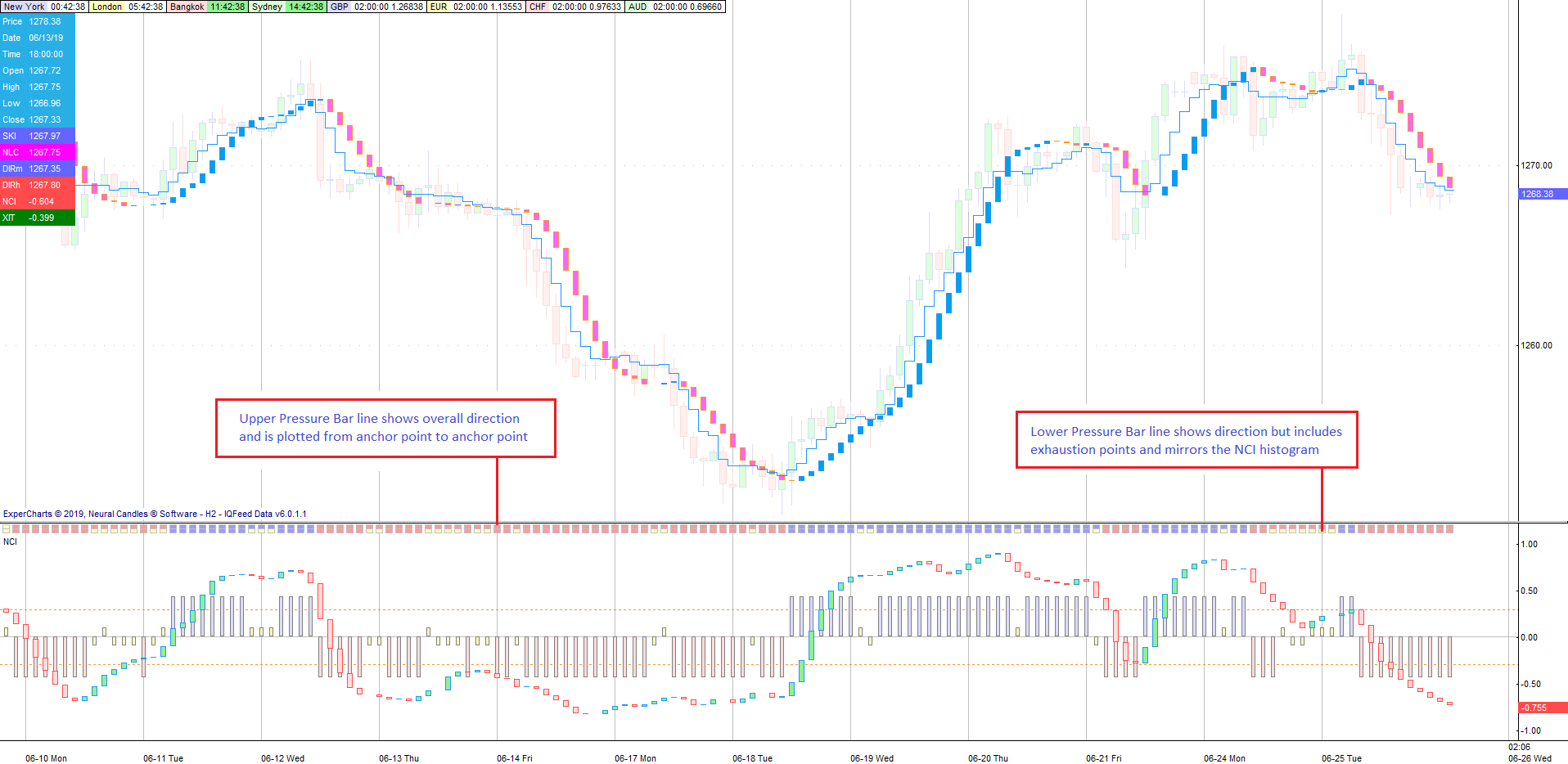

ExperSignal Update

ExperCharts is the software underlying the ExperSignal trade alert service, which is coming soon. Read more about the updated progress with ExperCharts and the trade alert service ExperSignal.

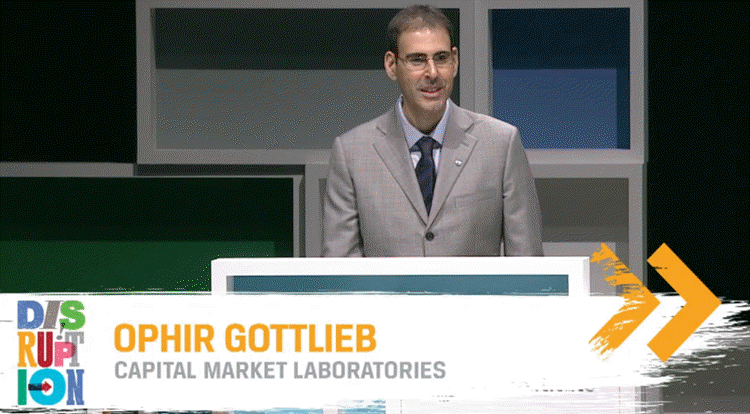

CMLViz TradeMachine Webinar Replay with Ophir Gottlieb

CMLViz CEO Ophir Gottlieb will walk through how to use his TradeMachine, including finding backtested strategies and setting up alerts for those strategies.

Mini-POT is LIVE!

Mini Practical Options Tactics (Mini-POT) is now live. Read what mini-POT adds to full-POT and what the differences are.

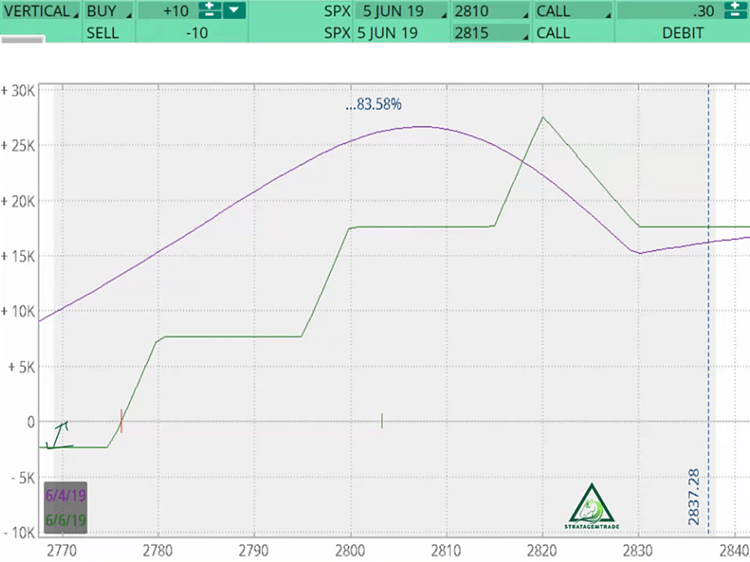

Mini-POT Trades Webinar Replay

Scott Ruble is starting a Mini-POT class next week. Watch Scott explain how it works in the video replay.

Mini-POT Trades are coming

Stratagem Trade's Practical Options Tactics (P.O.T.) trades are coming to Aeromir. Mini-POT is a smaller version of Scott's flagship product that is +91% YTD in 2019.

What Everybody Ought to Know About Option Synthetics

Synthetic options are something all options traders should know about. Learn how they work. It's easier than you think!

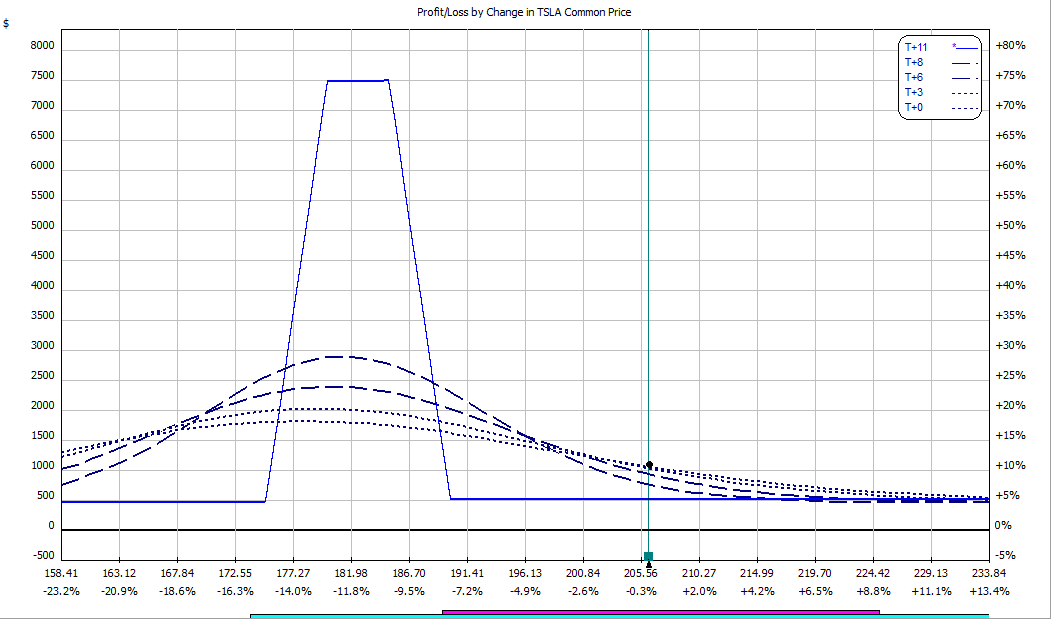

Using Options For Swing Trading

Tom modified a trade Steve Spencer did at SMB to reduce risk while still keeping a good profit potential

Amy's Alerts Update

Amy Meissner's 14-day, weirdor and nested iron condor trade alert services are being suspended.

Chargeback Offenders

We had seven chargebacks in 10-seconds. In an effort to fight fraud, we are publishing a list of chargeback offenders.

Join the Aeromir Slack Community

The Aeromir free slack community let's you interact with other option traders in real time and on all platforms.