BLOG

REPLAY: Round Table with John Locke

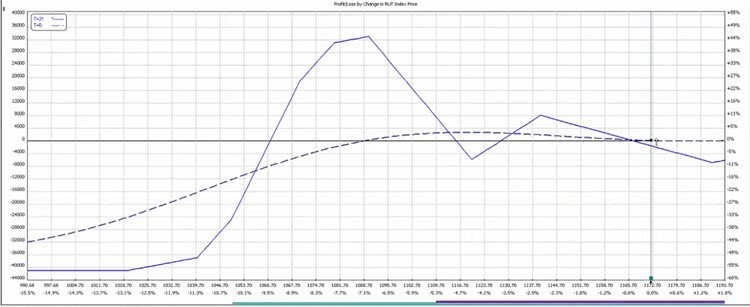

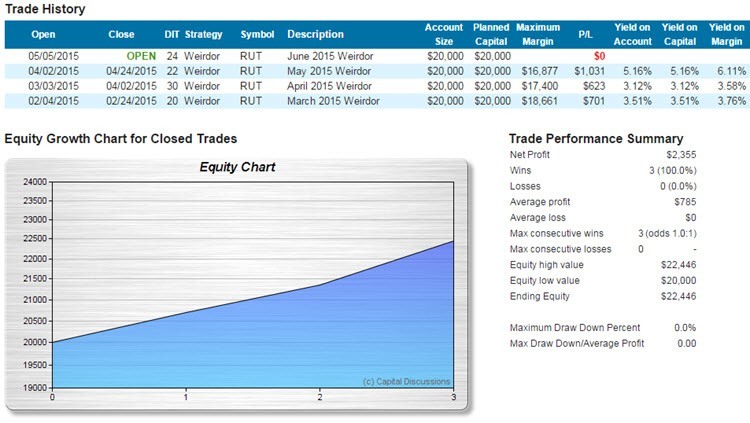

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade performance, how her window expands for adjusting over time and answered questions.

Learn more about Amy's Weirdor alert service.

Enjoy the replay!

REPLAY: Round Table with Amy Meissner

Amy Meissner updated her Weirdor trade results and showed how she changes her window to trigger adjustments. Amy answered questions about the Weirdor trade and showed how it's low draw downs have a superior equity growth chart.Amy reviewed her Weirdor trade performance, how her window expands for adjusting over time and answered questions.

Learn more about Amy's Weirdor alert service.

Enjoy the replay!

REPLAY: Round Table with Bill Ghauri

Bill Ghauri presented “The VIX Sniper”. Bill showed how he makes his trading decisions using the VIX and technical analysis. Bill reviewed his recent trades and how he uses risk and money management to get such a great Expectancy.

Learn more about Bill's Alpha service here.

Enjoy the replay!

Alexa Rankings Scoreboard

We just added a new scoreboard for Alexa rankings for option related web sites. The scoreboard only includes web sites with an Alexa ranking under 4,000,000. The scores are similar to golf: lower is better.

See the current scoreboard

The scoreboard is updated every six hours

A Trade I Like…

>

Have you seen option gurus writing articles or doing videos about trades that they like? A typical article might mention how high or low the VIX is and present a possible trade, including strikes, credits/debits, margin, risk and perhaps even break evens.

Do people put these trades on?

Unfortunately yes.

While trade ideas are interesting, they are seldom actionable for several reasons:

Market Analysis for May 4, 2015

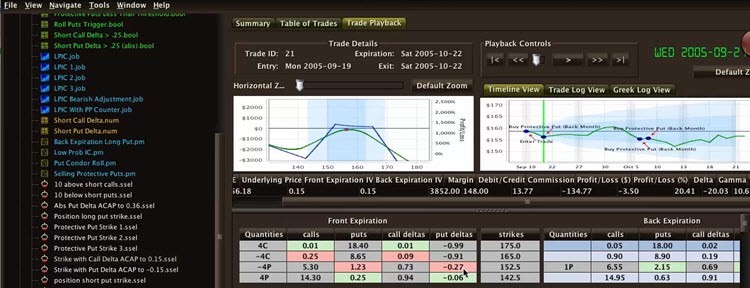

Jerry Furst from Traders Education Network hosted the meeting. Jerry reviewed his outlook for the markets, including the upcoming economic events. Himanshu Raval agreed with Jerry's assessment of the SPX and RUT. Near the end of the session, Jerry demonstrated how he uses the spread finder in OptionVue and talked about repairing a long put position that is in trouble.

New Tool: Option Position Sizer

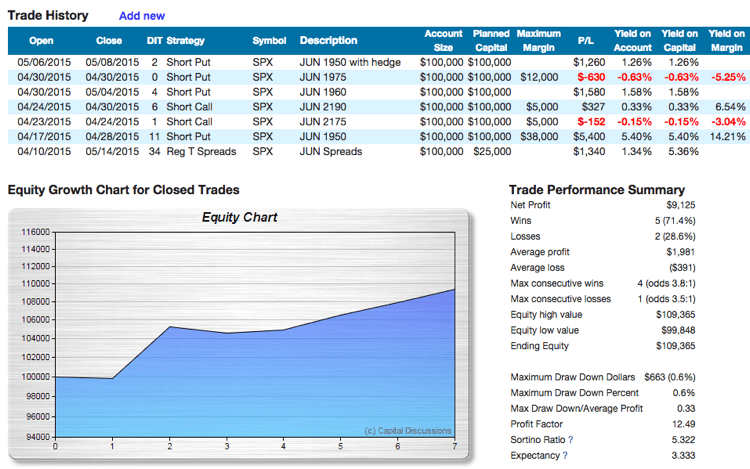

I've been following Bill Ghauri's Alpha Alerts‘s short put and call trades on SPX and doing very well. I really like the simple approach of selling options similar to a directional trader but also getting a trading edge with volatility and time decay.

A few years ago, I created a Naked Option Margin Calculator that's been very popular. One thing that calculator doesn't do is help you decide how many contracts to sell.

How do you know how to size your option trade?

Two key principles all traders should be aware of are risk and money management. Directional traders like to keep the risk of any one trade to 1% to 2% of the total portfolio. This helps avoid blowing out your account.

Option Traders Generally Don't Use Fractional Risk

REPLAY: QuantyCarlo Education on April 28, 2015

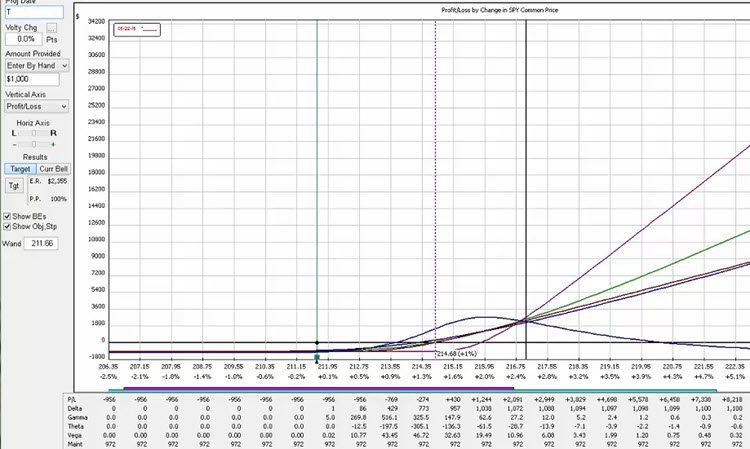

Larry Richards, from QuantyCarlo, walked through a trade scenario by establishing a baseline for the trade and then starting to build a trading plan within QuantyCarlo software.

Enjoy the replay!

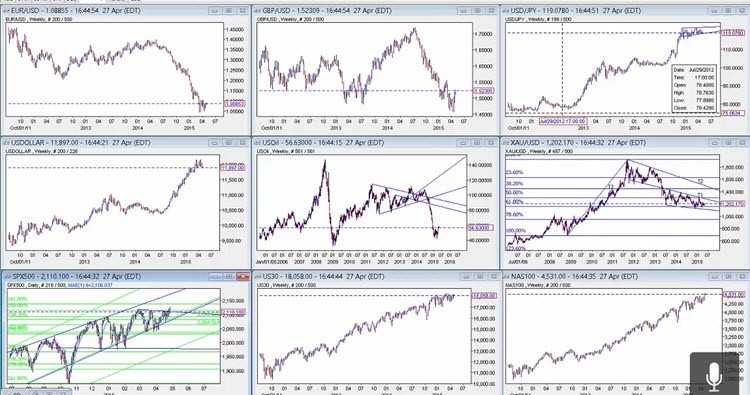

Market Analysis for Apr 27, 2015

Jerry Furst from Traders Education Network hosted the meeting. Himanshu Raval joined on the panel. Jerry and Himanshu discussed the current market and speculated if it would continue higher or not.

Market Analysis for Apr 20, 2015

Jerry Furst from Traders Education Network hosted the meeting. Jerry covered recent market action including technical analysis of Fibonacci lines and chart. Himanshu Raval showed his Woodie's CCI analysis of SPY and IBM