Ricardo Sáenz de Heredia launched his first trade in his Premium Alerts service on Thursday. One of the three types of trades Ricardo sends to his subscribers are a weekly trade. This week's trade is already in the black.

Trade Entry

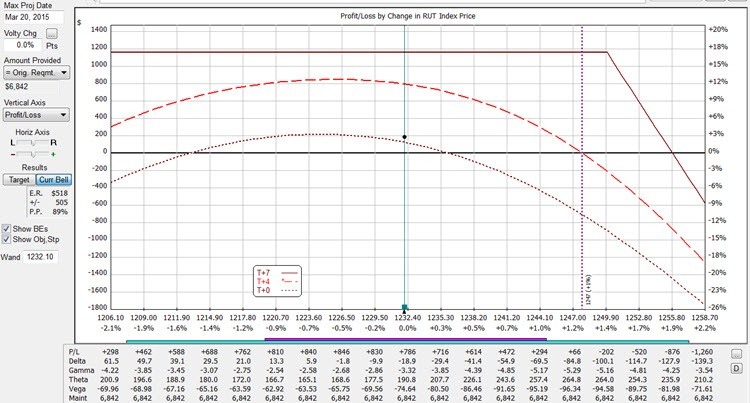

Ricardo sold an Iron Condor on the RUT for $6.45 and at the close on Friday, it is trading for $4.82. Ricardo already has a $163 profit per spread. That would pay for his monthly subscription already!

The Greeks

The option Greeks are:

| Delta | -25.15 |

| Gamma | -3.48 |

| Theta | 158.2 |

| Vega | -144.9 |

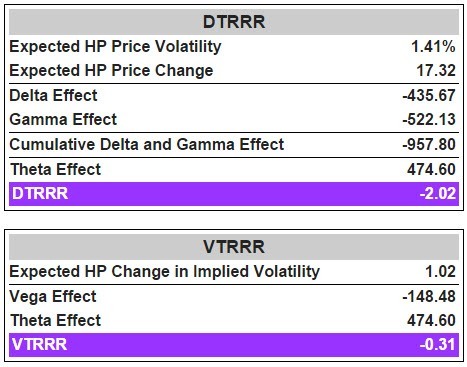

Plugging these values in the Brian Johnson's spreadsheet (you can get the spreadsheet by purchasing Brian's book here), we see these numbers:

These are reasonable values for DTRRR and VTRRR. Dan Harvey likes a DTRRR of 2.0 or less so we're close to Dan's more conservative ratios. The high theta helps keep the ratios under control.

These trades typically come off on Tuesday I believe. You have a bit less market exposure than traditional monthly trades and you have four times the number of trading cycles so you can recoup losses faster.

Summary

While I wouldn't want my entire portfolio in this trade, it is fantastic for diversification. The current trade has an 89% probability of being profitable on Tuesday.

Weekly options that Ricardo trades are very good performers that can easily justify the cost of a subscription to Ricardo's Premium Alerts. I put a 2 lot on myself a bit later than Ricardo and I'm up +$184 in less than one day. Subscription paid for the month!

I am new to option margin trading. The margin is 8000 , the stop loss is how much?

I believe the max loss is the initial credit received (or maybe something like 1.5 times the credit received). I forwarded this to Ricardo to get the definitive answer.

Yes, the stop loss is the equivalent to the cash flow. Credit originally received.