by Tom Nunamaker | Aug 26, 2017 | Equities, Futures trading, Options trading

If you remember Black Monday on October 19, 1987, you recall the market declined 22.68% in one day. This was the largest one-day percentage decline in the DJIA. It took until early 1989 for the market to recover to its previous high set in August 1987. In the...

by Tom Nunamaker | Nov 6, 2016 | General, News, Options trading, Trading

We all know the U.S. Presidential Election is on Tuesday, November 8th, just a few days away. We've seen how the S&P 500 has had nine straight days of losses, which hasn't happened since December 1980. The S&P 500 Let's take a look at the S&P 500 chart:...

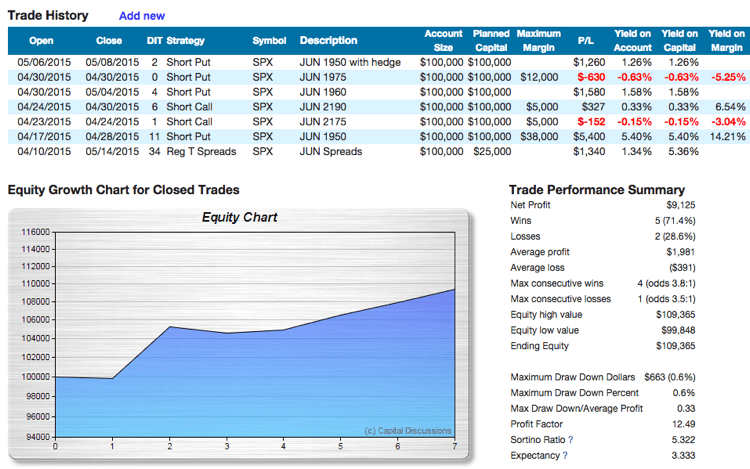

by Tom Nunamaker | May 24, 2015 | News, Options trading, Trading

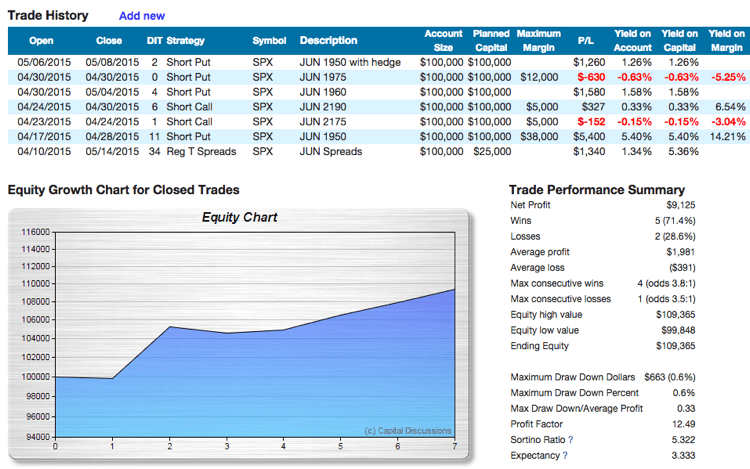

Bill Ghauri presented “The VIX Sniper”. Bill showed how he makes his trading decisions using the VIX and technical analysis. Bill reviewed his recent trades and how he uses risk and money management to get such a great Expectancy. Learn more about Bill's...

by Tom Nunamaker | Aug 7, 2014 | Options trading, Trading

Mark Fenton (at Sheridan Mentoring) wrote an article about an “interesting VIX trade.” Mark's trade was based on the assumption that the VIX could go a lot higher and that you wanted to buy calls. Let's look at his idea. Mark started with a put credit...

by Tom Nunamaker | Jun 7, 2014 | News

The VIX held above 11 most of the day yesterday but closed with a thud at the low for the day of 10.73! The last time the VIX was below 11 was on Feb 23, 2007 when it closed at 10.58. On Jan 24, 2007, the VIX closed at 9.89. The lowest price I saw on a 14-year chart...