Mark Fenton (at Sheridan Mentoring) wrote an article about an “interesting VIX trade.” Mark's trade was based on the assumption that the VIX could go a lot higher and that you wanted to buy calls. Let's look at his idea.

Mark started with a put credit spread and used the credit to lower the cost of the long call. The first question I have is why did he use a two lot of both put verticals and long calls? That's complicating the idea. Just use a one lot.

The second question I had is what is the expected return? Am I more likely to make money with a long call or with Mark's trade? Let's look at them

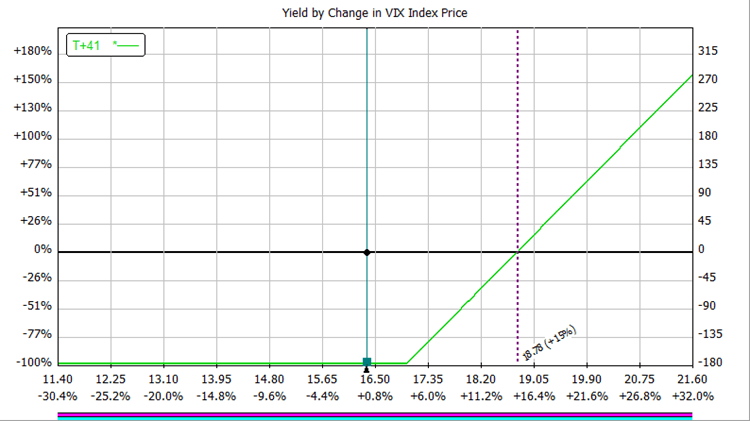

Long Call

The call Mark bought was a SEP 17 call for $1.75. Using the SEP 17 call volatility of 92.3%, the probability of profit is 33% and the Expected Return is $29 +/- $344. The expiration breakeven price is $18.78 (+15%). Note that the expected return is close to zero, which means the option market is pretty efficient. Margin required is $175.

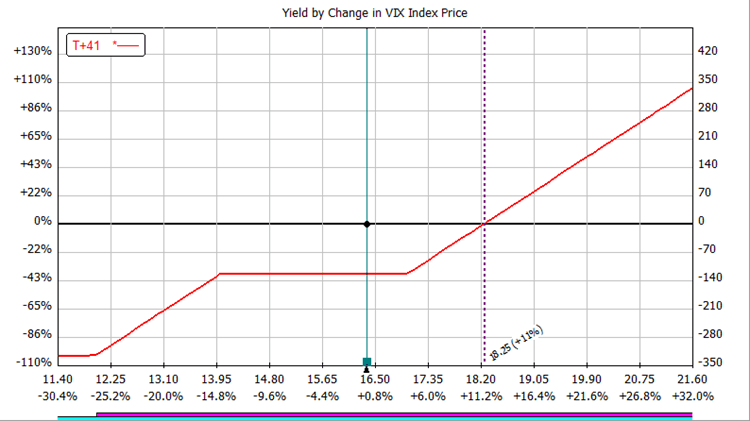

Put Credit Spread Plus Long Call

This is the combination trade. Notice the loss is about -38% from 12 to 14 compared to the long call's loss of -100%. The probability of profit is 36% with an expected return of $33 +/- $384. The expiration breakeven price is $18.25 (+11%), which is $0.53 lower than the long call alone. This represents the credit in the put credit spread. Margin required is $324, which is nearly double the cost of the long call.

Comparing the two trades

There are always trade offs when comparing different trades. In this case, the long call has a lower expected profit on a dollar basis; however, due to the lower cost of the trade, the yield is higher:

| Trade | Expected Return $ | Expected Return % |

|---|---|---|

| Long Call | +$29 | +16% |

| Combination | +$33 | +10% |

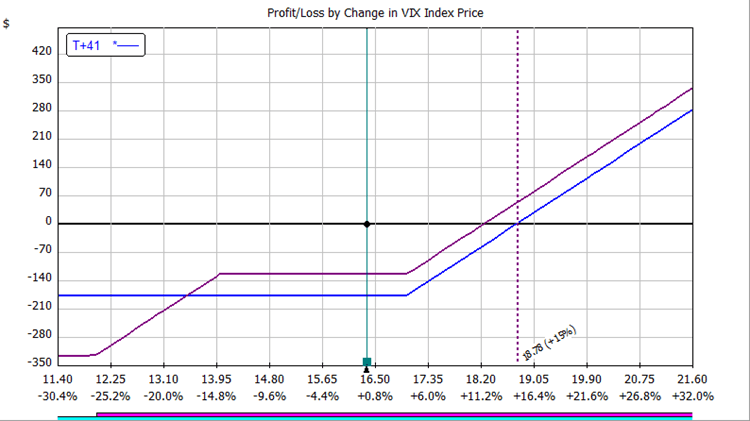

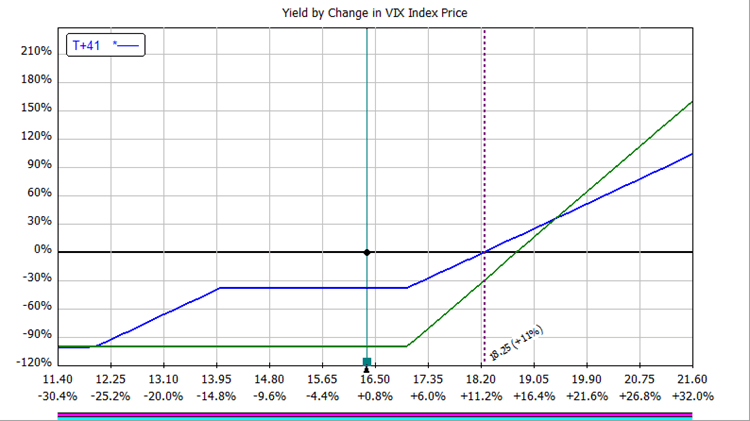

Here's what the two comparison charts look like. The first chart shows dollars and the second chart shows yield.

The long call has about half of the capital at risk, so the yields are higher. If you look at the chart with yields, notice the green line is steeper as the VIX price goes higher. The long call doesn't lose more dollars if the VIX price falls. The loss is limited to $175 no matter how low the VIX goes; however, on a yield basis, it's a -100% loss versus the combination spread's -38% loss with a lower yield.

Which One Is Better?

Neither. They each have pros and cons. The long call alone has a higher expected return, but you will lose the entire $175 investment if the VIX doesn't rally to your slightly higher breakeven price. The combination trade has a slightly lower expiration breakeven price, but will lose more dollars if the VIX falls. Because the margin required is higher, the yields are lower.

You have to weigh the pros and cons for any trades you are comparing. It's a bit like playing Whac-A-Mole. If you take care of one problem in a trade, it usually causes another problem.

Ray pointed out that the expected return for the long call was $29 +/- $344, yet the maximum possible loss would be -$175. I’ll have to ask Len Yates how OV estimates the expected return. I checked it on optionvue 7 and that’s what it says!

Tom, I believe Optionvue calculates expected return by looking at the P/L of 11 different points/slices on the risk graph. I am not sure how many +/- standard deviations they go. Please verify this with OptionVue, I could very well be off on this.

I saw Mark Fenton updated this trade in a video blog. One thing he said was to “double down” on this trade as it was losing. Call me crazy, but that seems like a terrible idea. What happened to control your losses and don’t chase losing trades?