by Tom Nunamaker | May 18, 2014 | Options trading, Trading

Let me ask you a question. Which position is more risky? Selling a Covered Call Selling a Naked Put Most people would say selling a Covered Call is a great investment strategy, but selling a Naked Put is terribly risky. If you understand Option Synthetics, you'll know...

by Tom Nunamaker | May 14, 2014 | General

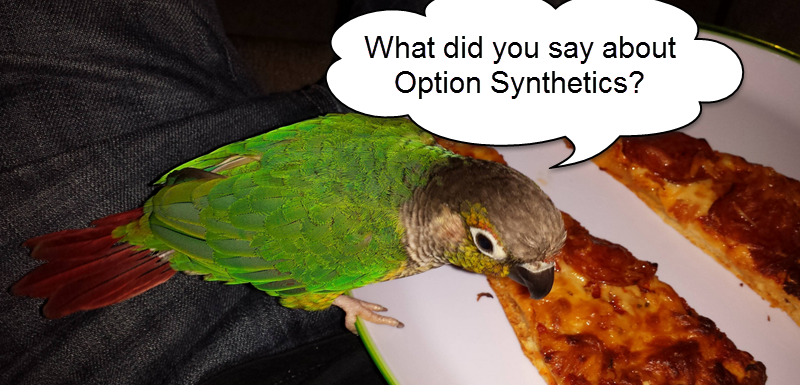

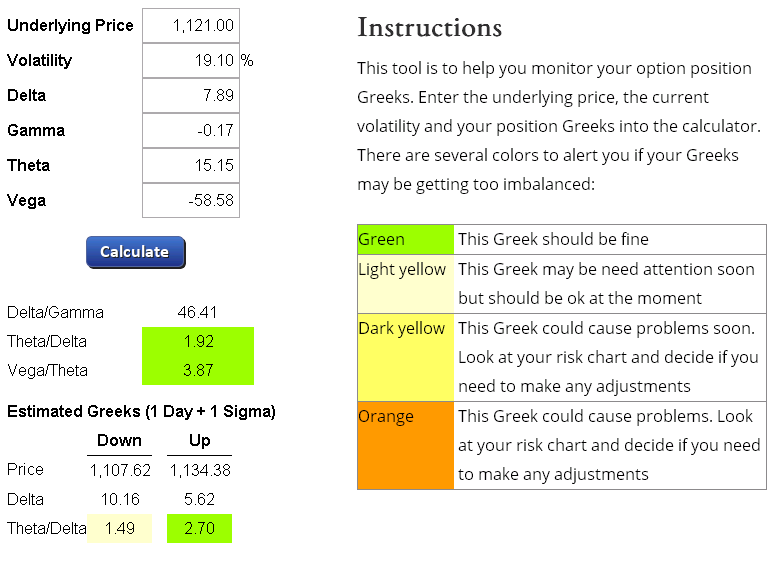

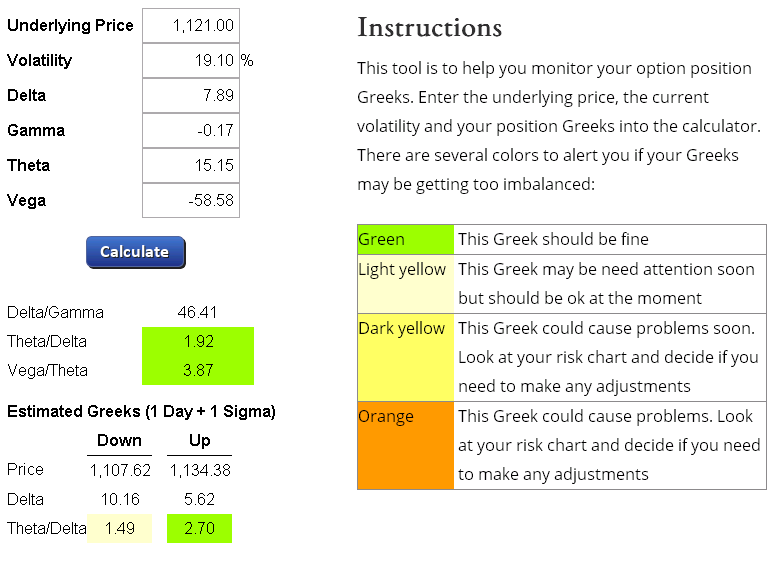

Dan Harvey has a spreadsheet he uses to help guide his contract sizes and manage his Weirdor trades. I extracted the option Greeks portion of it and created an online version which is at https://my.aeromir.com/go/c.option-position-greeks-calculator Here's a screen...