Trading with Futures Options

About thirteen years ago, as I was approaching retirement from the U.S. Air Force, I knew I would have more time to devote to trading. I have a friend in Australia with two PhDs who built his own trading software in the 90s. His software exclusively used the ES...

Tom’s Trading Update for July 29, 2014

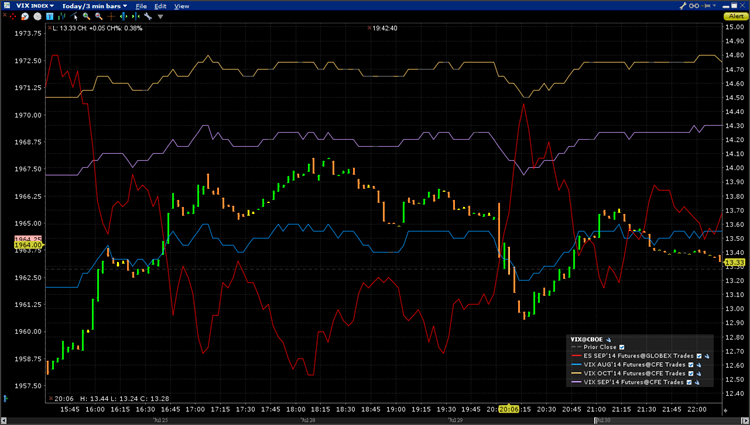

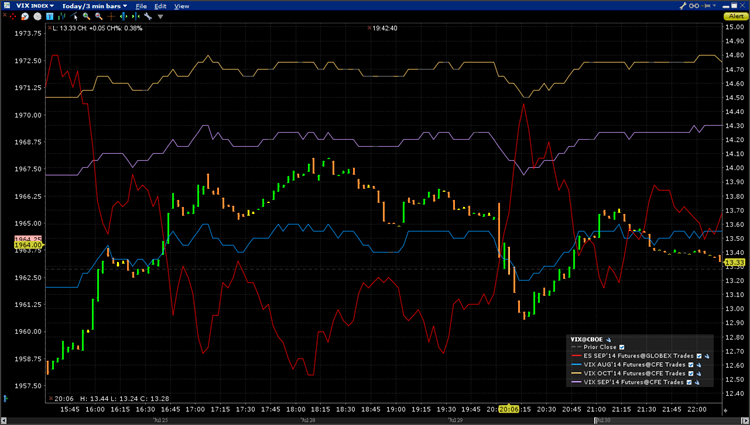

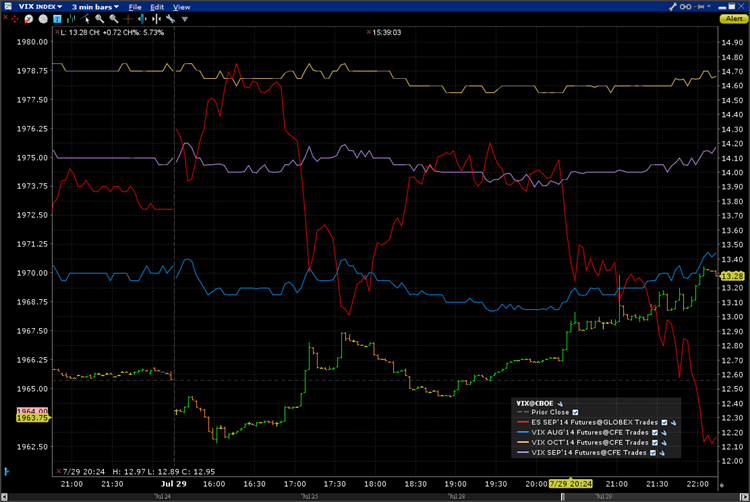

The video below reviews my SPX and ES futures options broken wing butterfly trades. I was filled on a put debit spread on the ES futures options after the regular market was closed. I'll update the trade with the new charts in the forums. Enjoy the video! Join us in...

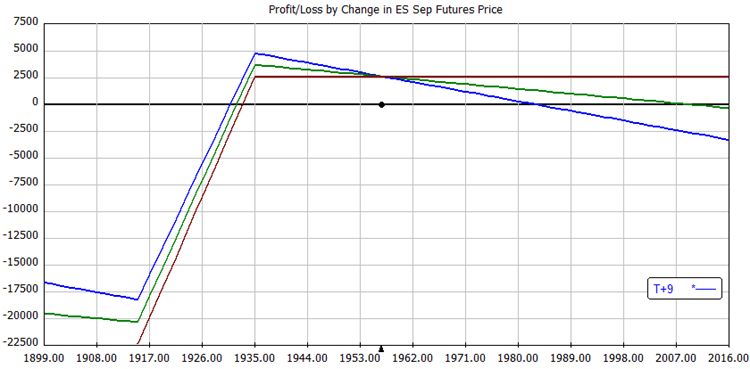

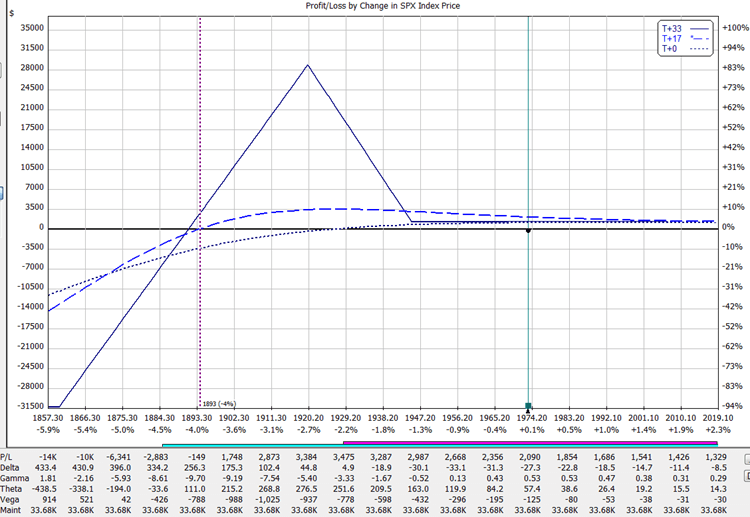

SPX Aug 23 (W4) Broken Wing Butterfly

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Aug 23rd with 33 days to expiration. The ten lot of puts are at 1945/1920/1860. The 1920's were about a -19 true delta (in OptionVue). I sold two lots at a $1.90 credit and eight lots at a...