by Tom Nunamaker | Dec 6, 2017 | Options trading

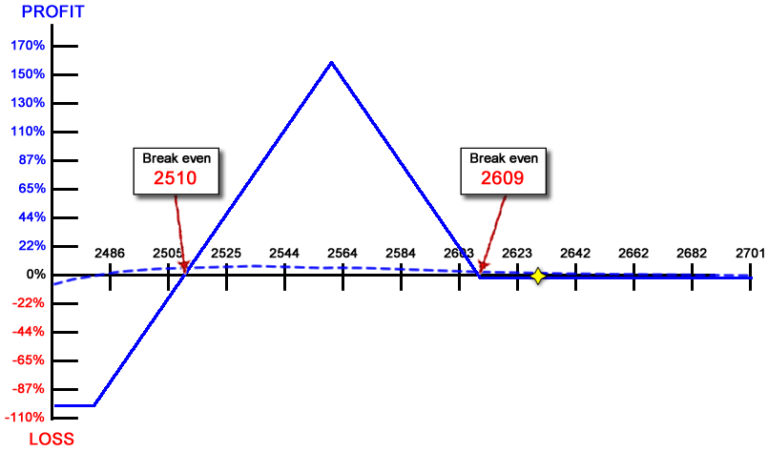

I've been bullish on the U.S. markets for some time but I primarily trade a market neutral strategy called the Road Trip Trade. Here's a sample of what a typical Road Trip Trade looks like: If I was correct with the bullish market direction opinion, I wanted to...

by Tom Nunamaker | Aug 26, 2017 | Equities, Futures trading, Options trading

If you remember Black Monday on October 19, 1987, you recall the market declined 22.68% in one day. This was the largest one-day percentage decline in the DJIA. It took until early 1989 for the market to recover to its previous high set in August 1987. In the...

by Tom Nunamaker | Jul 16, 2017 | Options trading, Trading

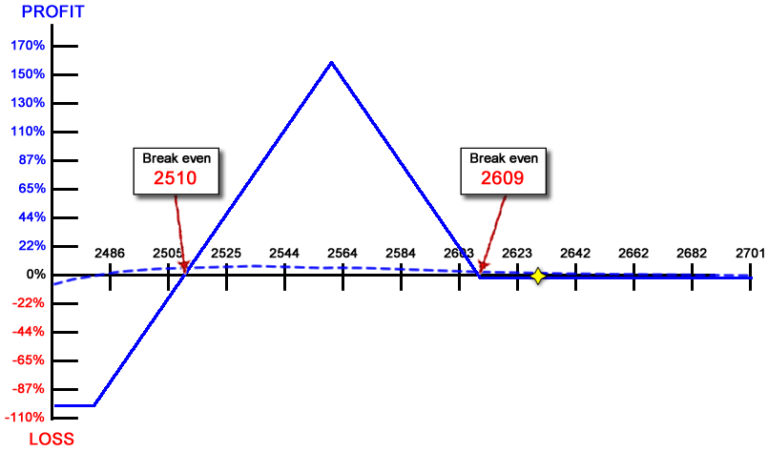

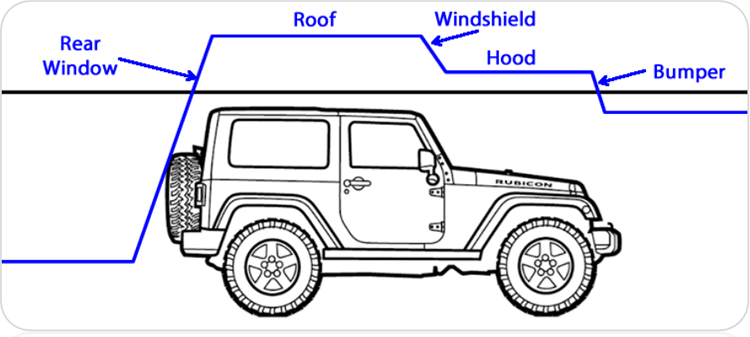

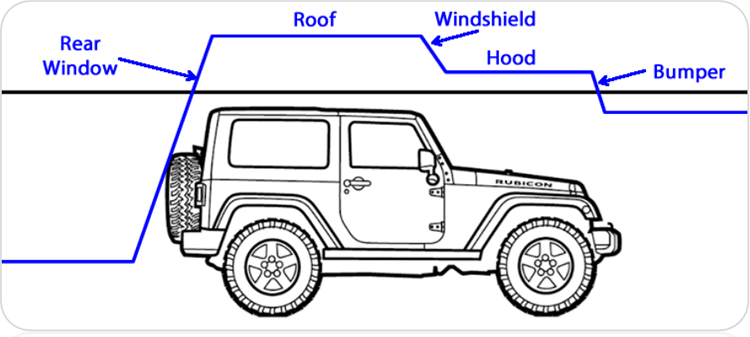

Dan Harvey, the Iron Condor supertrader, created the popular Weirdor trade several years ago. Jim Riggio, Paul Demers and others modified Dan's Weirdor with different trade management rules. This variation was named the Jeep trade to distinguish it from Dan's Weirdor....

by Tom Nunamaker | Nov 6, 2016 | General, News, Options trading, Trading

We all know the U.S. Presidential Election is on Tuesday, November 8th, just a few days away. We've seen how the S&P 500 has had nine straight days of losses, which hasn't happened since December 1980. The S&P 500 Let's take a look at the S&P 500 chart:...

by Bill Burton | Sep 10, 2016 | Options trading, Trading

“We are programmed to receive. You can check out any time you like, but you can never leave!” Hotel California, The Eagles In my last blog post, I discussed the nuances of change in implied volatility (IV) leading up to earnings release and following the...

by Bill Burton | Aug 27, 2016 | Options trading, Trading

One of the advantages of an option based approach to trading is the ability to capitalize on trades that have a statistically well-defined high probability of profit. When events occur with predictable regularity, the knowledgeable option trader can effectively...