by Tom Nunamaker | Aug 4, 2014 | Options trading, Trading

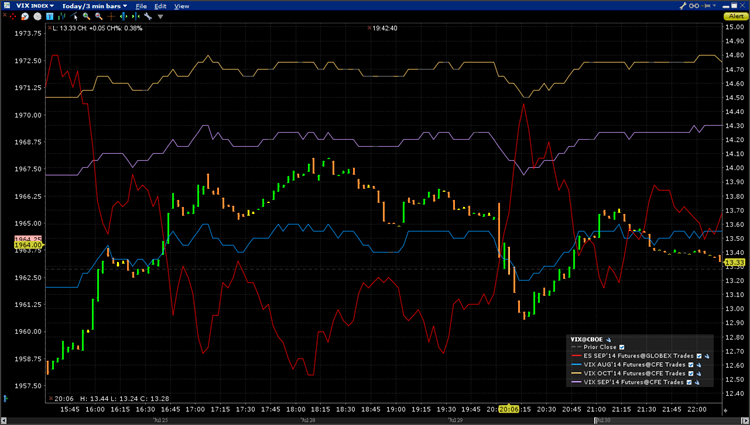

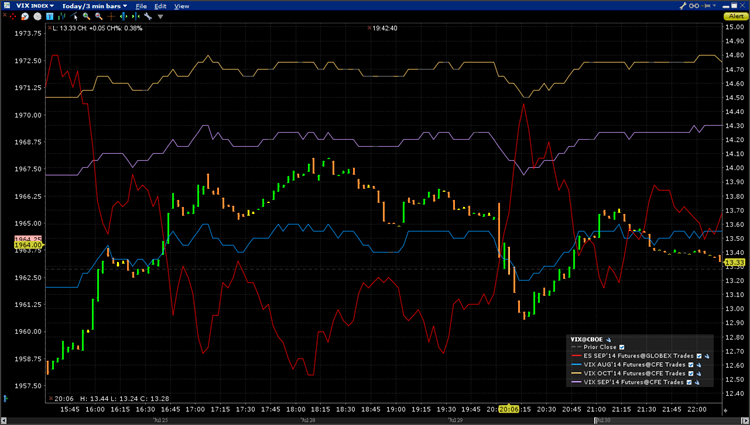

The video below reviews my SPX and ES futures options broken wing butterfly trades. The SPX closed up over 13 points and had another day with a large intra-day swing of nearly 22 points. Average True Range bumped up to 16. Enjoy the video! Join us in the forums to...

by Tom Nunamaker | Aug 1, 2014 | Options trading, Trading

The video below reviews my SPX and ES futures options broken wing butterfly trades. The SPX closed down a few points but had quite a bit of movement intraday. Enjoy the video! Join us in the forums to discuss these trades or your own!

by Tom Nunamaker | Jul 31, 2014 | Options trading, Trading

The video below reviews my SPX and ES futures options broken wing butterfly trades. The GDP and FOMC announcement moved the markets twice today. Both times up initially, then a pull back. The SPX closed nearly where it started but had nearly a 17 point range…so...

by Tom Nunamaker | Jul 30, 2014 | Options trading, Trading

About thirteen years ago, as I was approaching retirement from the U.S. Air Force, I knew I would have more time to devote to trading. I have a friend in Australia with two PhDs who built his own trading software in the 90s. His software exclusively used the ES...

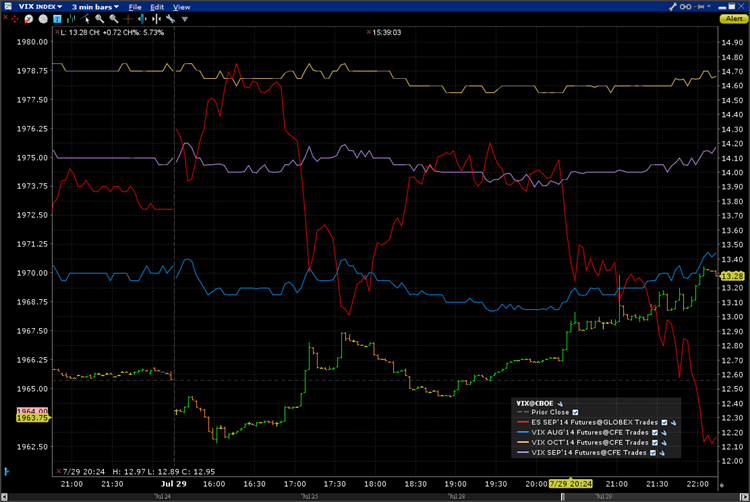

by Tom Nunamaker | Jul 29, 2014 | Options trading, Trading

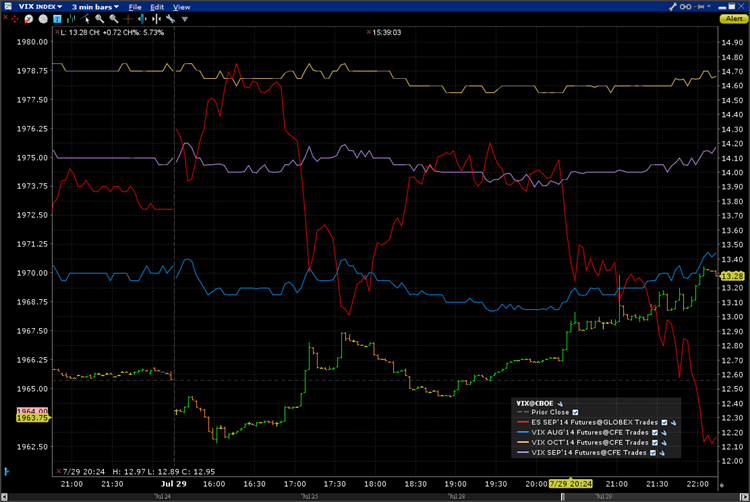

The video below reviews my SPX and ES futures options broken wing butterfly trades. I was filled on a put debit spread on the ES futures options after the regular market was closed. I'll update the trade with the new charts in the forums. Enjoy the video! Join us in...

by Tom Nunamaker | Jul 21, 2014 | Options trading, Trading

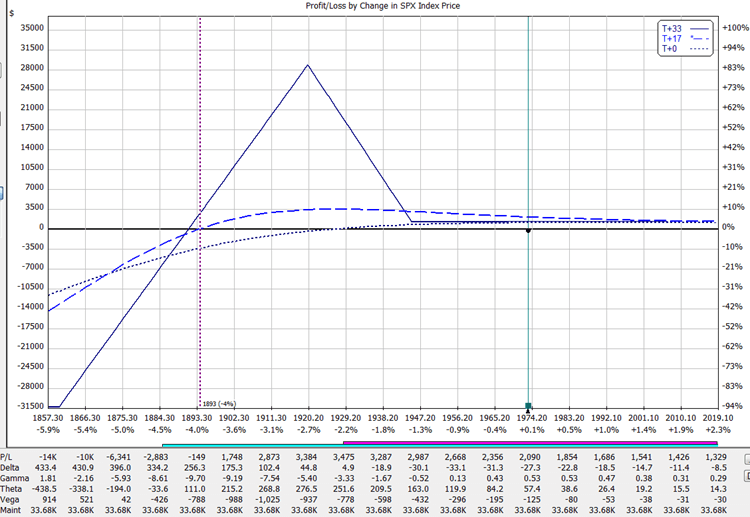

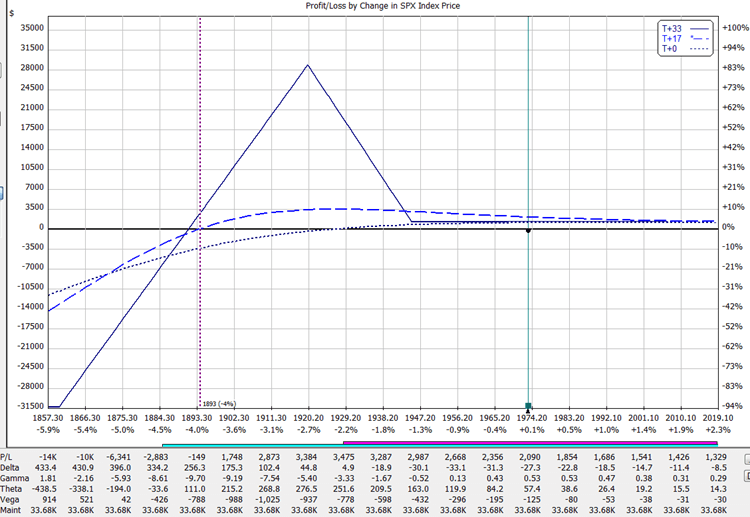

Time for a new trade in SPX. Another broken wing butterfly trade expiring on Aug 23rd with 33 days to expiration. The ten lot of puts are at 1945/1920/1860. The 1920's were about a -19 true delta (in OptionVue). I sold two lots at a $1.90 credit and eight lots at a...