by Tom Nunamaker | Nov 14, 2015 | Options trading

Dan Harvey is a well known options trader who specialized in Iron Condor trading for many years. Dan had an article published about him in SFO magazine in 2008. Over time, Dan noticed several problems with Iron Condors so he modified them to address their...

by Tom Nunamaker | Oct 29, 2015 | News, Options trading

Rhino Trade Alerts Brian Larson's popular Rhino trade is very forgiving in large market moves. It was designed to have minimum adjustments over the life of the trade so it is suitable for traders who have full time jobs and can't be at their computers during the...

by Tom Nunamaker | Oct 27, 2015 | News, Options trading, Trading

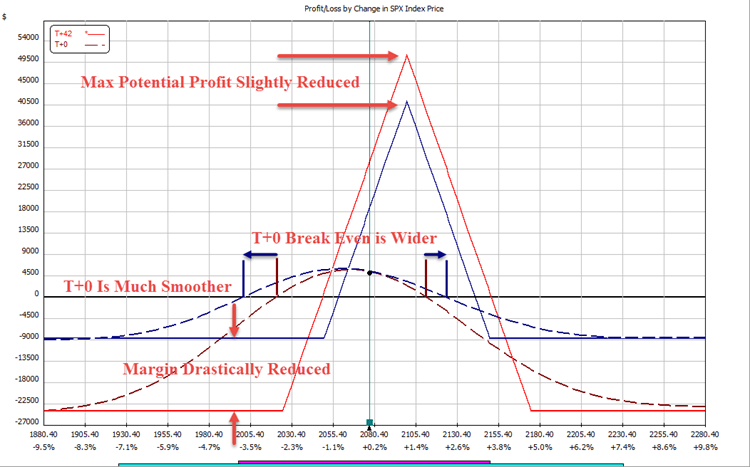

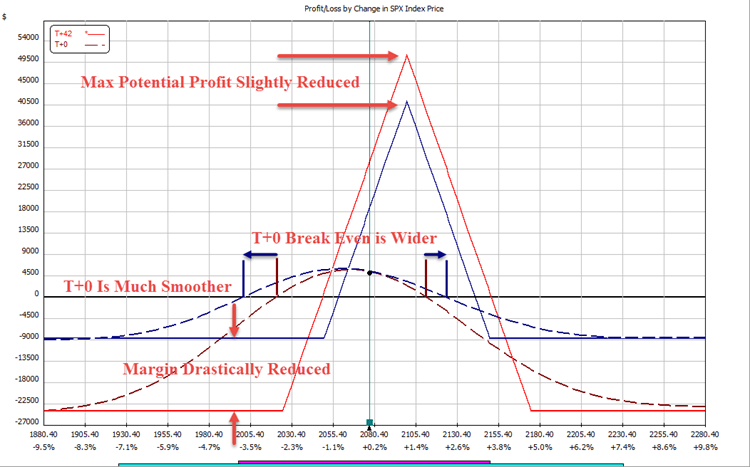

Tom Nunamaker is presenting the Reverse Harvey on the Round Table this week on Thursday at 4:30pm ET. The Reverse Harvey is a great trade adjustment technique to use as your trades are making money. The Reverse Harvey Reduces margin, sometimes by over 50% Flattens the...

by Tom Nunamaker | Oct 17, 2015 | Options trading, Trading

This article was originally published in the Yahoo group “Option Club” on Dec 19, 2009 at https://groups.yahoo.com/neo/groups/OptionClub/conversations/messages/17583. I'm re-writing it with more current information. Option Risks The absolute most important...

by Tom Nunamaker | Oct 14, 2015 | General, News, Options trading

If you're getting started with option trading, or want a refresher, check out our new Beginner Trading Group. Jerry Furst, from Trader's Education Network, hosts the group and does a great job teaching option trading concepts and answering your questions. Join the...

by Tom Nunamaker | Sep 30, 2015 | General, Options trading, Trading

Charles Cottle, aka the “Risk Doctor”, is presenting “Position Dissection and Alternate Hedging Strategies” on Wednesday September 30, 2015 at 4:30pm Eastern Time. With the increase in volatility in the markets, Charle Cottle's presentation...