John Locke published a good article on trading goals earlier today. Trader's commonly ask “what can I make each month trading?” Can I make $1000 per month? $5000 per month? What's my number?

This is really a question about what monthly yield or return want to make. How much capital you have and what your average yields are will determine what your average profits are.

We can't control the monthly returns. Those depend on what the market does and how we react to it and trade. Unfortunately, “monthly income” is only possible with a job or an annuity. Trading is neither one of these.

What can I expect? What is possible?

All trades have pros and cons. You have to evaluate what your risk tolerance is versus the potential reward to see what trades fit your trading style. After you pick your basket of strategies that fit your trading style, you need to track your performance so you know what your yields are (high, low, average). You can use this for planning of what you can estimate what you might make in a given month. John Locke calls it a “possibility” of what you can make. This is a great way to think about it.

If I know my average yield is x% and I'm trading $y capital with that strategy, my possible returns are $y times x%. There is no guarantee you'll actually achieve this but it gives you a rough estimate of what is possible.

Markets change. How do I know when my trading isn't working any longer?

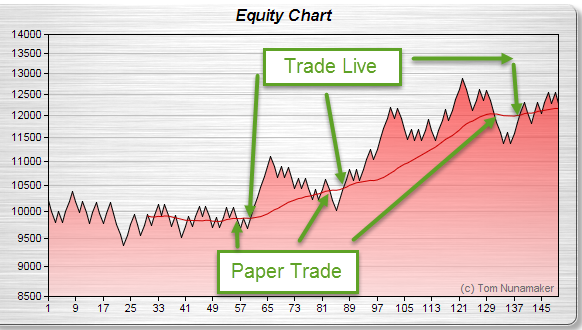

All trading systems have good and bad cycles. Joe Ross taught me this simple technique to monitor your performance. Plot your trade results and add a moving average indicator of the trade balance. When the actual equity falls below the moving average, switch to paper trading until the account balance is above the moving average. Here's an example:

This switches you to paper trading mode when your results start to fade and gets you back trading live when your trading system is working again.

Conclusion

Trading returns are not constant. You need to plan to have a variable income if you rely on trading profits to live on. If you track your performance and compare the current equity to a trailing moving average, you can see visually if your trading is starting to change for the worse (and when to go live again when it starts working again).