Dan Harvey and I have been making some changes to the Road Trip Trade service.

Early on with the Road Trip Trade, Dan started adding layered trades on top of his Road Trip Trades. Some subscribers requested that we trade the Road Trip Trade only with Reverse Harvey (RH) adjustments and no layering.

This is when we split the trade into two services in one:

- SPX Road Trip Trades. These trades are the Road Trip Trade with Dan's layered trades.

- ES Futures Options Road Trip Trades. These trades followed the original Road Trip Trade with only Reverse Harvey's for adjustments.

With the grinding up market, the ES futures options trades have had small yields on total capital at risk, which is normal with the Road Trip Trade.

I have been trading client capital with LEF Capital Advisors LLC using the Road Trip Trade for some time. I trade these trade with layers and I will use a market opinion to add more bullish or bearish layers to take advantage of longer market trends. This approach has improved yields in the accounts I trade with the average account up +5% this quarter already.

We sent a survey to our subscribers asking if they would like to continue with Dan's ES Futures Options Road Trip Trades or have me transition to using my trades for the class.

90% said they wanted to see my trades.

Effective with the 16Feb 2018 expiration cycle, I am taking over the ES futures options positions.

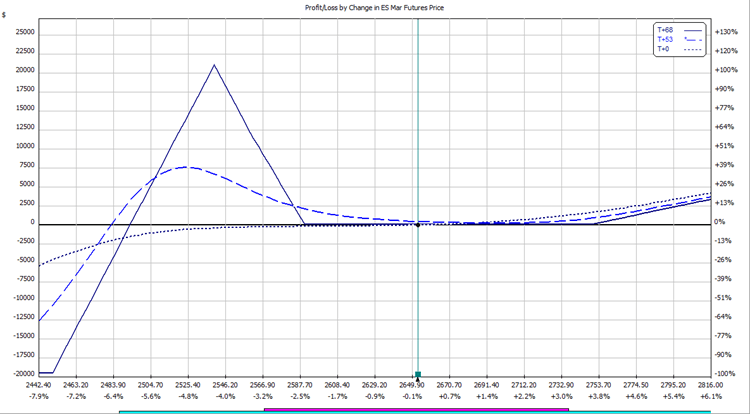

Here is the current trade:

As you can see on the right side of the chart, it rises due to a long call to improve yields if the bullish market outlook is correct.

I created a system to manage the client accounts using what I call “buckets.” Each bucket is a $20,000 maximum defined risk trade. I do this because at Interactive Brokers, a retirement account trading SPAN margin is treated very similarly to RegT margin. By definining a trade by the maximum risk, I can guarantee that I won't over-margin any accounts.

I have five open positions at any one time.

The margin for each bucket is approximately $20,000 so to trade all five open positions, a $100,000 account would be required. Subscribers don't have to follow all of the trades however. You may find that you only want to trade the monthly expiration cycles for example. In this case, you would have two or three open positions, which would require $40,000 or $60,000 of capital.

This trade was opened on December 1st. The 28Feb 18 expiration cycle will be opened next week.

I am excited to be taking over the ES futures options Road Trip Trades. If you'd like to learn more about the Road Trip Trade, sign up for a 15-day trial.

excepional learning experience !! THANK YOU !