We all know the U.S. Presidential Election is on Tuesday, November 8th, just a few days away. We've seen how the S&P 500 has had nine straight days of losses, which hasn't happened since December 1980.

The S&P 500

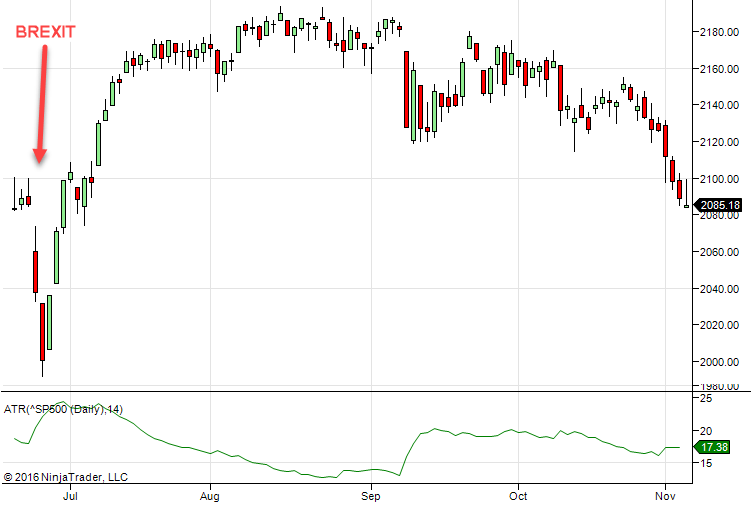

Let's take a look at the S&P 500 chart:

The decline has been fairly orderly, with the 14-day Average True Range (ATR) at 17.38. The ATR after the BREXIT vote was just over 24 with sharper movements over a short period of time. How as the VIX moved during that time?

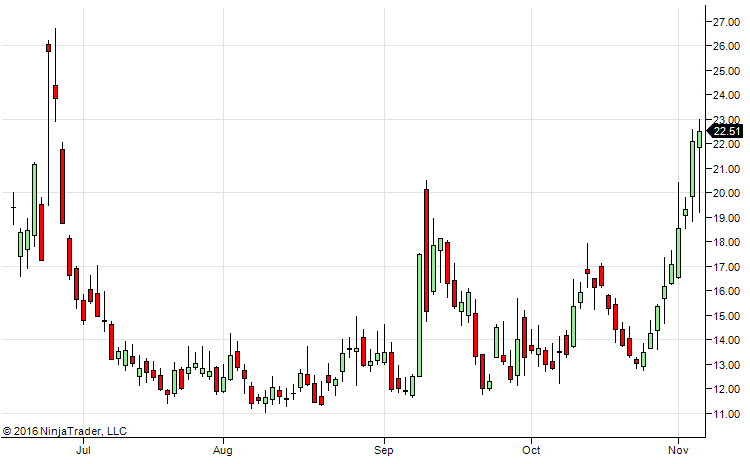

The VIX Index

Notice the VIX was a little higher after BREXIT. You can see that the recent nine-day sell off in the S&P 500 is reflected in the VIX steadily climbing to the current 22.51 price it closed at on Friday. Is that normal for the VIX going into a U.S. Presidential Election?

VIX Behavior Near U.S. Elections

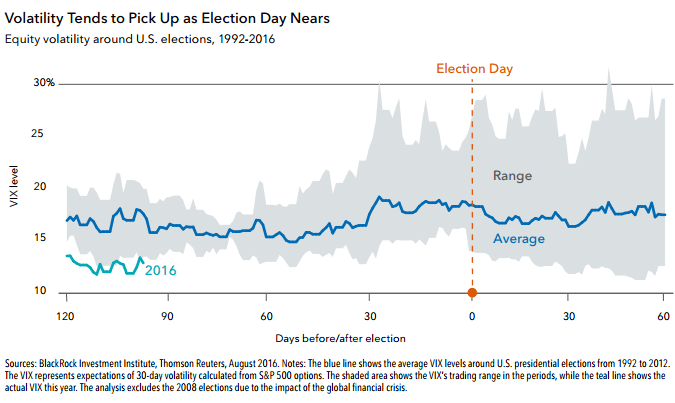

I found an interesting article written by Blackrock that looked at the VIX and how it behaved around U.S. elections. Here's an interesting chart from that article:

With the VIX at 22.51, we are in the upper end of the historical range. The chart is interesting in that the VIX tends to decrease after the election but not by much. I expect it will follow that same pattern after this election.

What will the market reaction be to the U.S. Election?

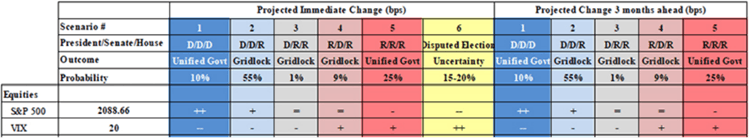

I found another article at MarketWatch that referenced a table from the Wall Street Journal predicting U.S. elections reactions.

The two most likely scenarios are mildly bullish (Clinton wins with gridlock) or mildly bearish (Trump wins with unified government). It seems unlikely that we would have a post-BREXIT type of move but anything is possible.

Summary

The rise in the VIX Index going into the U.S. presidential election is normal. After the election, expect the market to move with direction depending on which candidate wins. I don't expect a post-BREXIT type of move, but I have a lot of room on the downside in my trades just in case. Conservative traders may wish to scale back of their trades or go to 100% cash before the election results start coming in.

It is interesting to note that No Fortune 100 company CEO is backing the Republican Party nominee and none of then contributed to Trump’s campaign during this election. Compared to 2012 where a third contributed to Mitt Romney. Highly unusual for a Republican party nominee to be shunned by the Wall Street Elite.

http://fortune.com/2016/09/24/fortune-100-companies-donald-trump/