Dr. Terry Allen, from Terry's Tips, published a very interesting 100-week back test of the RSI to see if it predicts market direction for the following week.

Terry used the following RSI numbers for 2-day, 3-day and 5-day RSI readings:

Very overbought – an RSI reading of greater than or equal to 85.0

Overbought – greater than or equal to 75.0

Neutral – between 30.0 and 75.0

Oversold – less than or equal to 30.0

Very oversold – less than or equal to 20.0

Extremely oversold – less than or equal to 10.0

Here's how the last 100-weeks of readings on SPY were distributed:

Neutral – 47 weeks

Overbought – 16 weeks

Very Overbought – 22 weeks

Oversold – 5 weeks

Very Oversold – 8 weeks

Extremely Oversold – 2 weeks

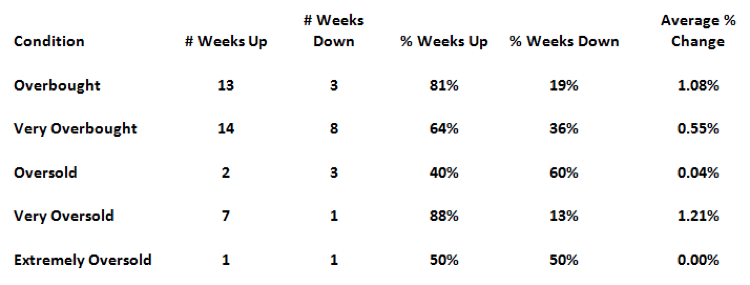

Here are the numbers that show what happened to SPY in the week after the condition reported in each of Terry's Saturday Reports:

When SPY is overbought, the technicians would expect that the market would be weaker in the next week, but just the opposite was true. In fact, in 81% of the weeks when it was overbought, SPY rose in the subsequent week. It also went up in 64% of the weeks when it was very overbought.

Clearly, being overbought or very overbought is an absolutely worthless indicator of a lower market. In fact, in subsequent weeks, for the most part, the market outperformed. If the market rose by the average percentage when it started out either overbought or very overbought every week of the year, it would go up by over 61% for the year. In other words, being overbought or very overbought is an excellent chance to bet on a higher market for the next week (rather than the opposite).

The oversold condition is an entirely different story (based on the last 100 weeks). Being oversold or extremely oversold is essentially a meaningless indicator – the market rose or fell in just about the same number of weeks following one of those conditions. However, being very oversold seems to be an excellent indicator of a higher market. In 83% of the weeks when it was very oversold, it rose in the subsequent week. The average market gain in those weeks was 1.21% (62% annualized).

Another interesting result is that anytime SPY is anything except neutral, it is a decent indication that the market will move higher in the next week. Being very oversold is the best positive indicator, but being overbought is almost as good a positive indicator (even though this is absolutely contrary to what many technicians would expect).

Last Friday, SPY was very oversold. That occurs in only 8% of the weeks, and for the past 100 weeks, the market was higher 83% of the time in the subsequent week. As I write this before the market opened on Thursday, so far, SPY has dropped by exactly $3 (1.45%). This time around, it looks like even the historically most reliable indicator is not working as expected, either.

Bottom line, if you are trying to get a handle on the likely one-week performance of the market based on the overbought-oversold condition on Friday, you are bound to be disappointed. These indicators just don’t work, except possibly the very oversold indicator (and this week is a reminder that even this one is not always right, either). Maybe the results would be different if you checked on the one-day or two-day changes rather than the one-week variations, but that is something for someone else to check out.