The EURUSD had a strong reversal today, gaining back close to 100 pips from the low of the day. The 6E futures options position was morphed into a put credit spread at a lower delta (from -23.5 delta to -9.5 delta). I increased the size 50% to have a net credit at expiration. The position is down about $1450 but Vega is over -500 so a small drop in volatility will have a massive effect.

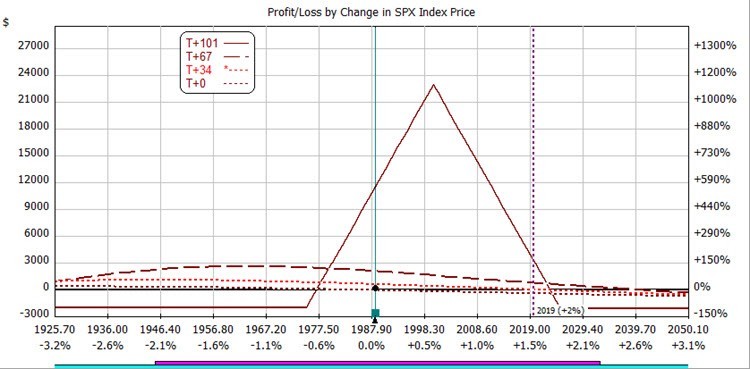

All of the SPX butterflies are profitable now. The SEP 19th expiration is getting close to the sweet spot. I locked in some profit and closed 1/2 of the trade today, which also reduces the margin requied.

Enjoy the video!

Join us in the forums to discuss these trades or your own!