I've been bullish on the U.S. markets for some time but I primarily trade a market neutral strategy called the Road Trip Trade. Here's a sample of what a typical Road Trip Trade looks like:

If I was correct with the bullish market direction opinion, I wanted to participate in the rally.

The accounts I trade are in a Commodity Trading Advisor (CTA) firm.

In the CTA, I can only trade futures and futures options. If I was able to trade equity options I would trade SPX options and use shares of SPY to add long Delta's to my portfolio. The ratio is 10:1 of SPY to SPX. To add 5 SPX Deltas, I would buy 50 shares of SPY.

Simple, Easy and No Option Greeks except Delta to worry about.

Since there are no micro futures contracts, I would have to buy a long futures contract; however, the Delta adjustment is too much.

How about a Long Call?

To add Delta's, it's a simple matter to buy an out-of-the-money call. This lifts the upside of the risk chart nicely. I like to purchase a 15-20 Delta long call so it's not too expensive but it will appreciate as the market rises at a reasonable rate.

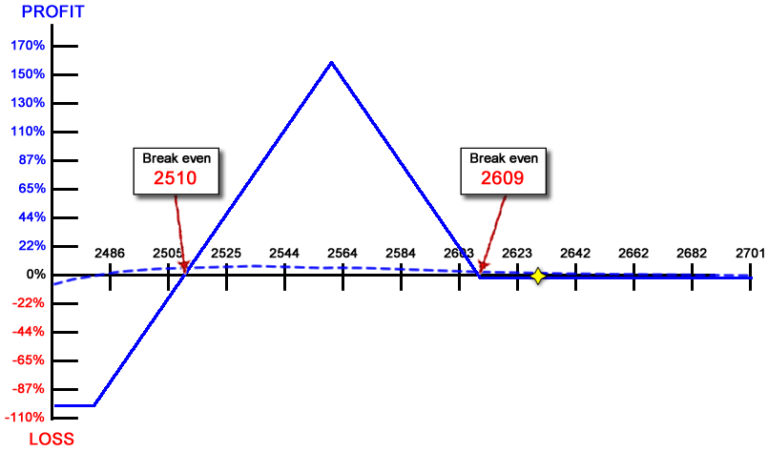

Here's what the position would look like with an additional long call (I picked an 18 Delta)

I like to partially or completely offset the cost of the long call by selling a put credit spread. This is what the trade would look like with the last piece of a put credit spread:

This position will take advantage of a market move higher.

The Combination

The example above illustrates a bullish combination trade. You can also construct a bearish combination trade to protect your portfolio for a large down move.

The Bullish Combination Trade

The bullish combination trade is constructed by purchasing a long call and sell a put credit spread to offset the cost of the call.

You don't have to pay for the call completely. This is an example of a bullish combination trade:

Pros and Cons

The bullish combination is a great way to participate in a market rally; however, if you are wrong in your assessment of market direction, the puts keep the losses small on the call. If the market drops, you will lose money on the calls and puts. The call premium loss will be reduced due to volatility rising.

The Bearish Combination Trade

The bearish combination trade is constructed by purchasing a long put and sell a call credit spread to offset the cost of the put.

You don't have to pay for the put completely. This is an example of a bearish combination trade:

Pros and Cons

The bearish combination is one way to protect a position or portfolio in a market rally. The main problem with using this structure close to the money in a falling market is the risk of getting whip sawed. If the market suddenly reverses and heads higher, volatility will come out and you'll lose money in the puts quickly due to Delta and Volatility effects. For this reason, we typically make our initial adjustment to protect the downside using a put debit spread.

Summary

The combination trade can be a good way to participate in a market rally or protect against a market decline. Both bullish and bearish combination trades are directional trades. Beware of using bearish combination trades in a fast moving market as a whip saw can lose value quickly.