Practical Options Tactics (POT) is the premier course at StratagemTrade.com taught by Scott Ruble, also known as J.L. Lord. POT is a comprehensive learning environment that includes regular classes, market analysis and opinions by a veteran floor trader and a portfolio of trades that are updated constantly.

POT has three categories of trades:

- POT (Traditional). About 60% of the trades fall into this category. They are trades designed to teach a balance between risk and reward while showing new techniques and strategies.

- LITE (Long-Intermediate Term Examples). These are slower moving trades suitable for part-time traders. Roughly 30% to 35% of POT trades will be LITE trades.

- FAST (Power Trading/Day Trading). These are short or very short term examples. During fast-moving markets, the very short term trades have the highest Gamma and firepower possible. Many professional market-makers and day traders trade these types of trades. Roughly 5% to 10% of the trades will be FAST trades since Scott wants good setups before entering these trades.

Mini-POT is a subset of Scott's full-POT.

- Trades and email: These are all identical in full-POT and mini-POT.

- Mini-POT UPDATES will include all trade examples but may contain abridged versions of strategy analysis.

- Classes: Full-POT has a class every week. Mini-POT has one class and one Q&A webinar per month.

- Direct access to Scott: Only for full-POT subscribers, not mini-POT.

- Aeromir extras: Only for mini-POT subscribers.

What do you get with Mini-POT?

Mini-POT has many ways to help you learn:

Full-POT and mini-POT overlap in several ways:

- Trades – Follow all of Scott's Paper Trade Positions.

Emails – Scott sends roughly four to six emails every day. These include Scott's market analysis, his market opinions and how he is going to trade based on his market opinions.

Class – One 90 to 120-minute training class per month on the first Wednesday of the month. You can watch the recording anytime.

Position Sheets – Scott's positions sheets are available to full-POT and mini-POT subscribers. The position sheets are Scott's spreadsheets that track every leg of all of his trades.

Mini-POT adds the following exclusive benefits:

- Q&A webinar – One 90 to 120-minute Q&A webinar per month on the third Thursday of the month. You can watch the recording anytime.

- Discussion forums

- General discussion forum – For students to ask questions for each other so everyone can learn

- Questions for Scott – Ask your questions to Scott for the monthly Q&A webinar

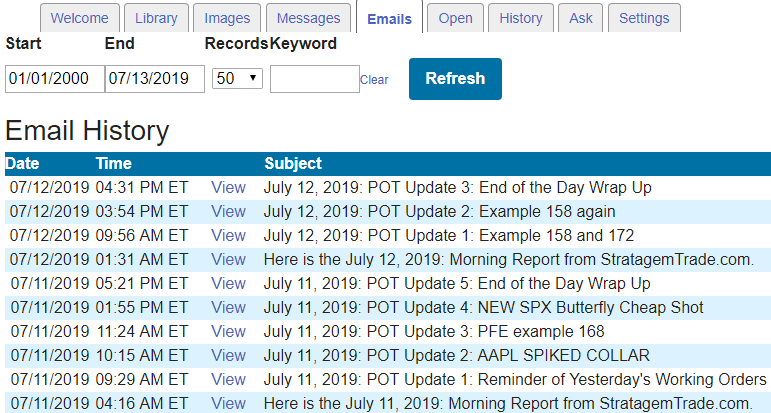

- Email History – Easily find all POT emails on the “Emails” tab on the class page. You don't have to search through your emails to find the one you're looking for!

Private Workspace – Real-time interaction with other mini-POT subscribers that is cross-platform. 50% of mini-POT users use Slack.

Private Workspace – Real-time interaction with other mini-POT subscribers that is cross-platform. 50% of mini-POT users use Slack.

Frequently Asked Questions

Scott starts the year with a $100,000 in a Thinkorswim paper money account. POT typically uses about 20% to 25% of the margin available. If you are mirroring the POT trades for education purposes, you can scale your trades down using SPY or fewer contracts.

NOTE: All trades in Mini-POT are hypothetical using a paper money account. Past performance is not necessarily indicitive of future results.

How much should I expect to make?

POT trades are NEVER to be considered trading advice. They are educational examples ONLY.

In 2019, Scott's students wanted to focus on maximizing the return so Scott has slightly altered his trading to do just that. As of July 12, 2019, the paper money account is at $206,000, which is +106% increase since January 1st.

Should position Deltas be long or short?

Scott has been trying to maintain positive Delta of approximately +100 in SPX. He will flip it negative or flat if he feels the market has event or trading risk.

By carrying positive Delta, there is risk on the downside. Scott attempts to create Rolling Thunder hedges to offset the negative effects of a market decline if he is positive Delta.

In December 2018 the POT portfolio lost about -4% while the market declined -20% due to the Rolling Thunder hedges. When the market recovered, the long Deltas kicked in the account swelled to a new high.

What about the Vega Risk?

POT trades generally start as directional trades using vertical spreads. This minimizes Vega exposure. As soon as a position generates profit, or starts moving against the optimal direction, the trades are adjusted to reduce risk further. Sometimes completely eliminating all risk in any direction. If the market moves against the trade, losses can accrue. Scott attmpts to minimize these losses by reducing risk if possible.

Can I get filled at the same prices?

It is a coin toss. 50% of the time you will get better fill prices and 50% of the time it will be worse. Over time, it should average out. If the underlying moves significantly after the POT fill and you haven't been filled, you can also adjust your strikes to where the current market is.

- Futures options trade nearly 24 hours per day during the week

- Spread prices over $5 are in $0.25 increments.

- Liquidity is good but not as good as SPX options

- Liquidity at night is less, but fills are possible.

POT equity trades can't be traded using futures options.

This sounds good. What is my investment?

The good news is Mini-POT is half the price of full-POT!

You still get all of the trades and emails that full-POT members get but you only get one training class per month and the monthly Q&A webinar. You get all of the Aeromir enhancements to POT that full-POT subscriber's don't have access to.

Get started with any of these plans:

Already a full-POT member at stratagemtrade.com?

Add Mini-POT for only $65/month. Contact support@aeromir.com for details.

Managed accounts: LEF Capital LLC is preparing managed accounts to trade the Mini-POT style of trades using ES futures options. Click for more information.

Delivery: All products and subscriptions are delivered electronically on our member's website. Your account will be created for you if you do not have one already within 15-minutes of submitting your order. Access for most subscriptions is immediate but forums logins are created manually, normally within 24-hours.

10% Military discount available to NATO country active duty, reserve and guard members, retirees and veterans with an honorable discharge. Thank you for your service!

Refund Policy: Fees for subscriptions and online classes from Aeromir Corporation are nonrefundable. No exceptions.

See our billing policy for more information.

For Educational Purposes Only!

Trade alerts in this service are made in paper trading account with Reg-T margin. The purpose of the service is for you to watch a professional trader trade so you can learn how to do it yourself by following along and asking questions.

Aeromir Corporation and Scott Ruble at Stratagem Trade are not broker dealers or investment advisors. The Mini-POT trades are NOT trade recommendations. We don't know you or your situation and have no way of knowing what level of risk is appropriate for you. You have to make your own trading decisions.

The risk of loss in trading options and futures can be substantial so please be aware of all of your risks prior to placing any live trades.

Know your risks by reading the OCC Characterisitics and risks of standarized options. and the FINRA Security Futures Risk Disclosure Statement.