BLOG

REPLAY: Round Table with Amy Meissner – The Queen of Iron Condors

Amy Meissner, also known as the Queen of the Iron Condor, presented “Weirdor – A Variant of the Condor.” Amy showed her trade guidelines and walked through her SEP and OCT 2014 live trades and answered many questions about her strategy. If you like the Weirdor trade, you have to watch this replay.

Amy Meissner, also known as the Queen of the Iron Condor, presented “Weirdor – A Variant of the Condor.” Amy showed her trade guidelines and walked through her SEP and OCT 2014 live trades and answered many questions about her strategy. If you like the Weirdor trade, you have to watch this replay.

Enjoy the replay!

Join us in our free members web site to download all of the different formats of this video. The library has PDF files, MP3 audio files, MP4 downloads and more. Click here to join us.

The Round Table with Amy Meissner on Thursday Nov 20th

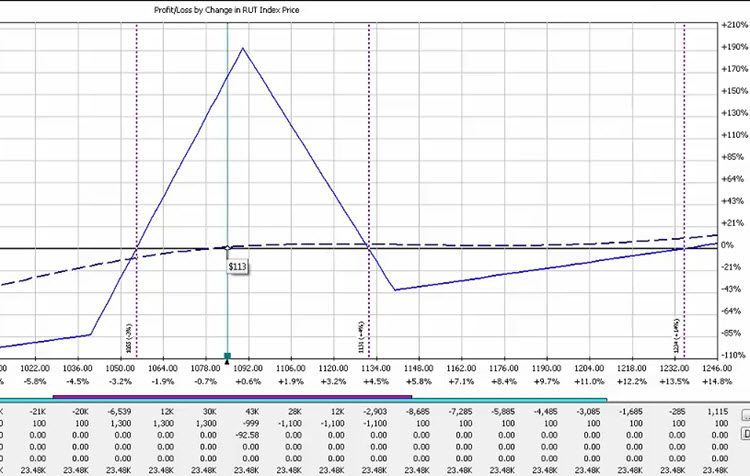

Amy Meisnner will present “Weirdor – A Variant of the Condor”. Amy is known as the “Queen of the Iron Condor” and has changed her trading style in the last few years to her version of Dan Harvey's Weirdor. In this presentation, Amy will show you her trading guidelines and walk through several examples of how she is trading now.

REPLAY: Round Table with Seth Freudberg

Seth Freudberg, from the Options Tribe, presented “Becoming an options trading professional.” Seth talked about what it takes to be a professional trader and his observations from running the SMB option trading desk. Seth showed the speeding weirdor trade, which is a modification of the Dan Harvey Weirdor.

Enjoy the replay!

The Floater Trade

Jim Riggio put an SPX trade on about two months ago when the SPX was at 2000. Jim put a 90-day (DEC expiration) 1975/2000/2025 butterfly on. Nothing fancy or unbalanced. I put the same trade on the next day.

Jim and I took two different approaches to managing the trade

But what does this have to do with that duck?

Loving the M3

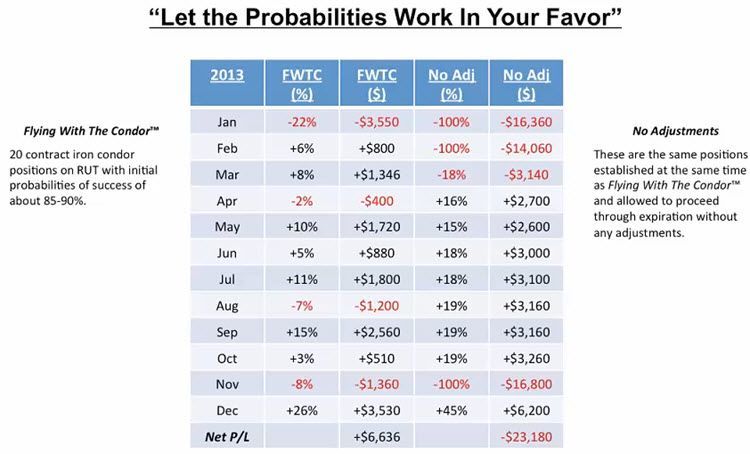

I remember back in the day when I was learning “income trading”. I used to trade the “not so” mighty iron condor strategies. Yes, the very same strategies that have regained popularity in the low volatility markets over the last 2 years. I can still recall how everyone loved these strategies back then and how I jumped on board just in time to experience the change in market conditions that took all those traders out. What a mess!

It was at that point I said “never again”! Never again will I blindly follow some trading system that someone else tells me is great. Never again will I be in a system I don’t understand. Never again will I trade a strategy that isn’t adaptable to market conditions.

My massive failure sent me on a quest to develop a way to trade profitably in any market condition. And after thousands of trades and hundreds of hours I finally did it…

The Round Table with Ricardo Sáenz de Heredia on Thursday Nov 6th

Ricardo Sáenz de Heredia from Option Elements will present “Scaling Into Short Vega Monthly Positions”. Ricardo will use his current trade to show how he scales into his trades and why. Ricardo runs the Spanish division of Option Elements but the presentation will be in English, his native language.

REPLAY: Round Table with Dr. Duke (Kerry Given)

Dr. Duke (Kerry Given) from Parkwood Capital talked about Option Trading Myths. Kerry reviewed how to calculate expected return.

Enjoy the replay!

Options Trading for Income with John Locke for October 27, 2014

A great way to improve your trading results is by keeping up to date with the latest trading techniques and current market conditions!

Click HERE and join me every Monday at 9 AM EST for our free “Options Trading for Income” Webinars! Where you get expert analysis of the markets and the opportunity to follow along with the best options trading strategies in the business.

The Round Table with Dr. Duke on Thursday Oct 30th

Author Kerry Given, also known as “Dr. Duke”, from Parkwood Capital LLC, presents “Option Trading Myths” on Thursday October 30th at 6:00pm ET. Dr. Duke will show you if it's better to buy or sell options, if it's an advantage to be a market maker and the relationship between probabilities and option pricing.

Click here to register for this free event

We will record this event and post it in our free members area.

Get your free login here if you don't have one already.

The Round Table with Marc Principato on Thursday Oct 23rd

Marc Principato, CMT, will show how to isolate high probability support or resistance levels and how to validate key reversals. Marc will discuss what option strategies to use for these conitions.

Click here to register for this free event

We will record this event and post it in our free members area.

Get your free login here if you don't have one already.