Wayne Klump presented how increasing volatility effects portfolio performance on the Round Table on Friday.

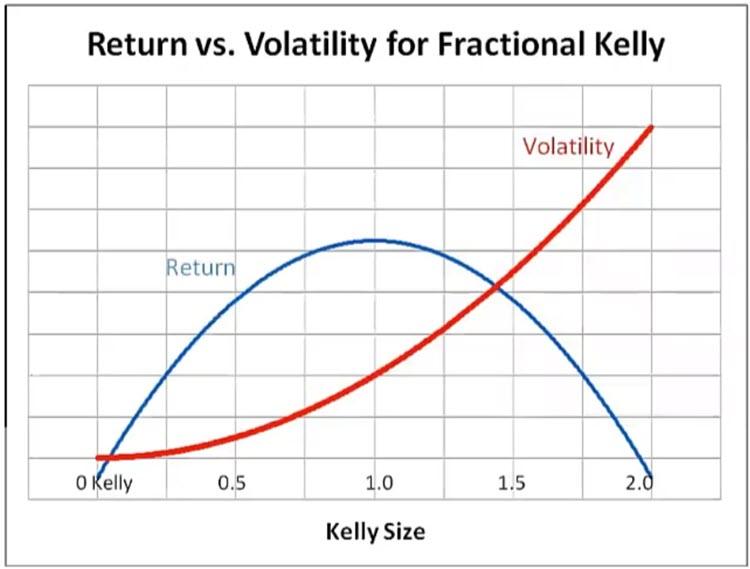

Wayne compared two portfolios with different win percentages and returns. Wayne talked about the Fractional Kelly Criterion and how to apply it.

Over the last 13-years, Wayne's Sleep Well Portfolio has had much lower volatility than the general market, yet nearly the same returns. For example, the market sell off earlier this year was roughly -35% but the Sleep Well Portfolio was down -8%.

The smaller volatility of returns improves overall portfolio performance and helps you sleep better at night.

The current Sleep Well Porfolio performance is always at https://my.aeromir.com/go/c.sleep-well-performance