Have you seen option gurus writing articles or doing videos about trades that they like? A typical article might mention how high or low the VIX is and present a possible trade, including strikes, credits/debits, margin, risk and perhaps even break evens.

Do people put these trades on?

Unfortunately yes.

While trade ideas are interesting, they are seldom actionable for several reasons:

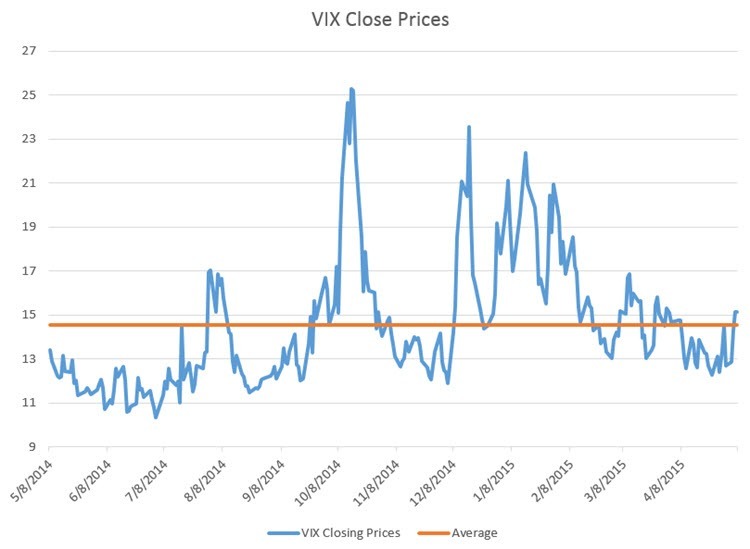

- If someone says the VIX is low, what does that mean? Do the calculation yourself. Here is a chart of the VIX closing prices in the last 12 months:

The average price was 14.54968. I'd like to know what the data says versus someone's subjective opinion. If VIX is above 14.55, you can expect reversion to the mean and a trading edge if you are selling volatility. If VIX is below 14.55, you can expect volatility to rise, which would benefit option buyers. These numbers do change! Keep your own data so you know how to interpret the market yourself. - “This is a trade I'm considering…” often means the “guru” isn't really considering the trade at all. They are merely creating a hypothetical trade with no intention of actually trading it. They just describe the trade but don't put it on or monitor it or try to actually make money with it.

Anyone can do this.

Find out if your “guru” is actually trading or not. Many times these “I'm considering…” trades are never intended to actually be traded by the guru. If they aren't trading it, should you be?

- Prices change. The chance of you getting filled at the price in the article or video you found is low. If you can get filled at a better price, has the market moved enough to warrant changing the trade?

- Yields are often quoted in terms of the margin used on the trade. Is that realistic? The equity growth charts we produce at Capital Discussions are based on the account size, not on the margin for the trade.

You need to consider how much any one trade's risk is exposing your entire portfolio to. Directional traders often use Fractional Risk Per Trade of 1% to 2% of the total portfolio. Please size your trades to keep your portfolio risk under control.

I've known option traders who used 80% of their portfolio on one trade with a 15% maximum loss. That could potentially be a 12%+ loss to the entire portfolio from one bad trade. That's a recipe for disaster.

Summary

If a guru says s/he is looking at a trade, that means very little. Ask what trades they put on in live accounts, how they managed the trades and what results they had trading. Keep risk in mind with respect to your entire portfolio and size your trades correctly. Don't get fooled by yield based on the margin. Yield has to be in the context of the entire portfolio.

Good article to remind us that not all “gurus” actually trade. Former market makers usually are not good retail traders. They often made money from advantages they had on the floor (buying at the bid, selling at the ask, razor thin stock margins, seeing the order flow etc). Be especially suspicious of them as they might not have traded in over 10-years. Would you want to learn how to be a surgeon from someone who hasn’t operated in over 10-years?

I agree Karl. I know of more than one former market maker like that. They can talk the talk but the walk they walked was different than retail traders. I suspect many of these educators are getting their current information from their students who are trading live versus their own personal trading.