This article originally appeared at Locke In Your Success.

I remember back in the day when I was learning “income trading”. I used to trade the “not so” mighty iron condor strategies. Yes, the very same strategies that have regained popularity in the low volatility markets over the last 2 years. I can still recall how everyone loved these strategies back then and how I jumped on board just in time to experience the change in market conditions that took all those traders out. What a mess!

It was at that point I said “never again”! Never again will I blindly follow some trading system that someone else tells me is great. Never again will I be in a system I don’t understand. Never again will I trade a strategy that isn’t adaptable to market conditions.

My massive failure sent me on a quest to develop a way to trade profitably in any market condition. And after thousands of trades and hundreds of hours I finally did it. I finally understood what the heck I was doing. I was so excited that I wanted to teach others how to do the same thing so I went to work and reverse engineered what I did into a learning process that can be repeated by anyone with an intermediate to advanced level of options education. The trading systems you see today, the M3, Bearish Butterfly, ROCK and M21 are the result of this process.

The process starts with the M3 and Tuesday after the RUT dropped 140 points and then rebounded 110 points, I was thinking about how much really appreciate a trading system like the M3.

When you look at almost any market neutral strategy, the dreaded whipsaw is almost certain death. Unless of course you let the trade take on too much risk, and then…you happen to get lucky. If that was your experience congratulations, you won the trade. Unfortunately, you also reinforced poor trading decisions. Decisions that over time will eventually bring you back to a losing trader.

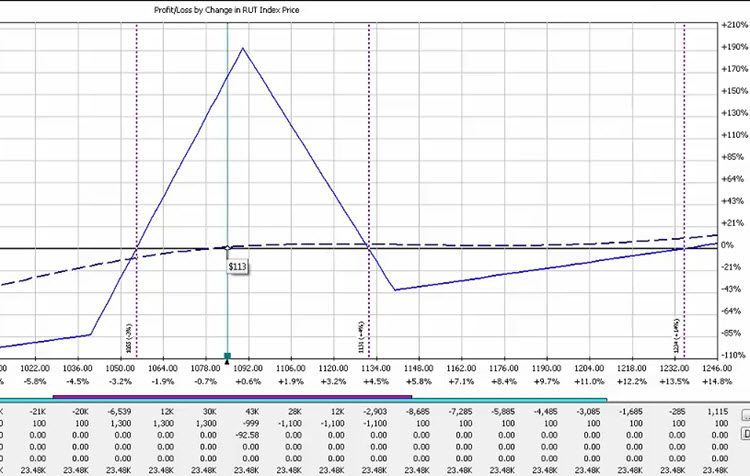

With the M3 however, I easily followed the market down, always keeping my risk in check to the down side. And when the reversal came? No problem, I just followed the market back up. No huge draw downs, no excessive risk, no watching the market all day. And I’ve been able to teach hundreds of other traders do the same thing. I love this trade!

Now I’m not necessarily saying November expiration is going to be a winning month, the jury is still out on that one but if there is a loss it will be small and controlled leaving me the ability to get back into the next market cycle and get back on track.

The M3 truly is the gateway to becoming a successful, full time, complex options trader. For more information on these incredible strategies visit www.lockeinyoursuccess.com and join me every Monday morning for the free Options Trading for Income Weekly Webinar.

John