by Tom Nunamaker | Oct 31, 2014 | Options trading, Trading

Ricardo Sáenz de Heredia from Option Elements will present “Scaling Into Short Vega Monthly Positions”. Ricardo will use his current trade to show how he scales into his trades and why. Ricardo runs the Spanish division of Option Elements but the...

by Tom Nunamaker | Oct 31, 2014 | Options trading, Trading

Dr. Duke (Kerry Given) from Parkwood Capital talked about Option Trading Myths. Kerry reviewed how to calculate expected return. Enjoy the replay! Join us in our free members web site to download all of the different formats of this video. The library has PDF files,...

by John Locke | Oct 28, 2014 | Options trading, Trading

This article originally appeared at www.lockeinyoursuccess.com A great way to improve your trading results is by keeping up to date with the latest trading techniques and current market conditions! Click HERE and join me every Monday at 9 AM EST for our free “Options...

by Tom Nunamaker | Oct 23, 2014 | Options trading, Trading

Author Kerry Given, also known as “Dr. Duke”, from Parkwood Capital LLC, presents “Option Trading Myths” on Thursday October 30th at 6:00pm ET. Dr. Duke will show you if it's better to buy or sell options, if it's an advantage to be a market...

by Tom Nunamaker | Oct 22, 2014 | Options trading, Trading

Marc Principato, CMT, will show how to isolate high probability support or resistance levels and how to validate key reversals. Marc will discuss what option strategies to use for these conitions. Click here to register for this free event We will record this event...

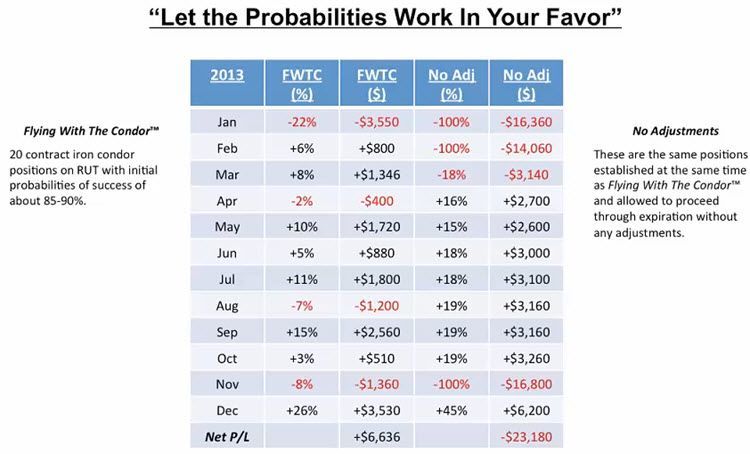

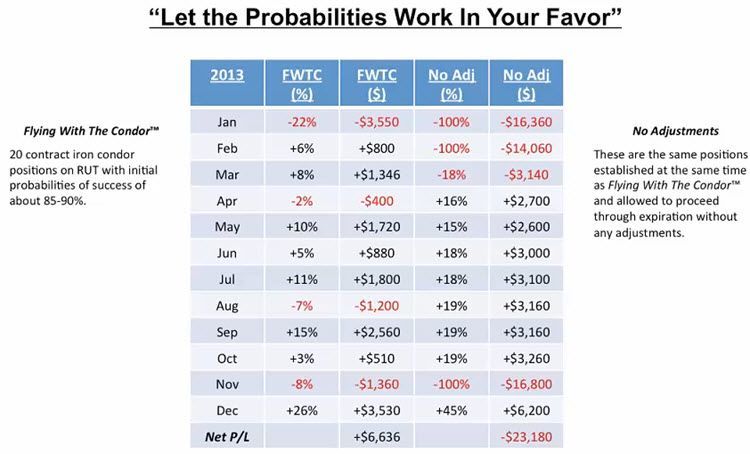

by John Locke | Oct 19, 2014 | Options trading, Trading

This article originally appeared at Locke In Your Success. Anyone who’s looked at my trading style can clearly see I’m always short volatility. This often brings up the question, “Aren’t you scared that a rise in volatility is going to cause a loss?” Scared? Not at...