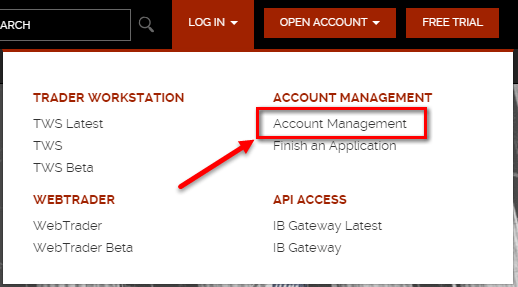

Interactive Brokers – Choosing Your Market Data

I've used Interactive Brokers for about 15 years. I was recently reviewing my Market Data Subscriptions and realized that there are a lot of choices for new users of Interactive Brokers to navigate. If you are an option trader who primarily trades the U.S. equity...CBOE to List SPX Wednesday-Expiring Weeklys Options

I came across an interesting announcement from CBOE that they are adding a new SPX weekliy option that expires on Wednesdays! OptionVue and OptionNET Explorer have some work to add the new options into their software now! Here's the CBOE press release: CHICAGO, Feb....