BLOG

Tom's Trading Update for August 26, 2014

I added three new trades today:

- New 6E futures options trade (Weirdor type of trade)

- New SPX options trade, DEC expiration butterfly

- New SPX options trade, SEP 19 expiration broken wing butterfly

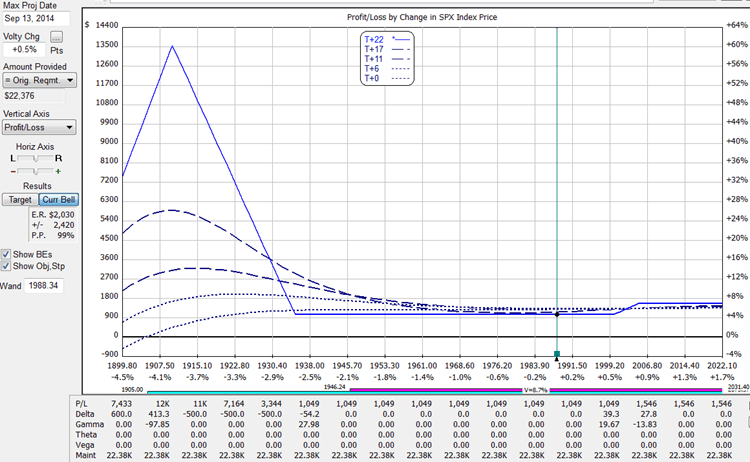

I reviewed my essentially closed Sep 13th trade. It has zero margin and has a guaranteed profit of $1222.

Enjoy the video!

The Round Table with Amy Meissner

Amy Meissner will join us on Thursday's Round Table to discuss her nested iron condor strategy. Amy was written up in Technical Analysis of Stocks & Commodities magazine as the “Queen of the Iron Condor.”

Tom's Trading Update for August 22, 2014

SPX closed higher today. I sold the 2005 call for $2.10 more than I bought the 2000 call today, so I now have a bull call spread put on for a credit!

Enjoy the video!

The Round Table: SPX Broken Wing Butterfly and VXX/UVXY Trades

The Round Table meeting had two parts. Tom showed the SPX Broken Wing Butterfly trade he's been trading. Then Jim showed his VXX and UVXY volatility based trades he's been doing.

Tom's Trading Update for August 21, 2014

SPX closed higher today. I sold the 2005 call for $2.10 more than I bought the 2000 call today, so I now have a bull call spread put on for a credit!

Enjoy the video!

Tom's Trading Update for August 20, 2014

SPX closed higher today. My extra long call helped and is looking great if the market keeps going higher. The trade is profitable and looking very good at this point.

Enjoy the video!

Tom's Trading Update for August 18, 2014

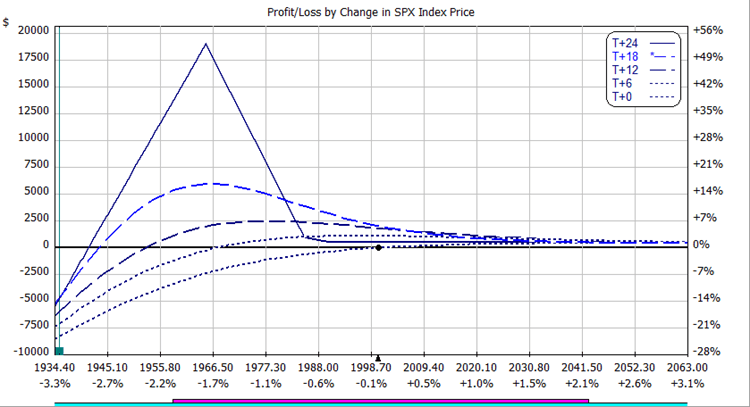

I closed my trades so I'm flat at the moment. The three primary reasons were:

- The trades were bearish butterflies and the market had moved to the large “tent” area, which meant Gamma was increasing and the T+0 line was bending down. The farther down the market goes, the worse the Gamma problem becomes with this trade.

- The Average True Range (ATR) of SPX and ES futures keeps increasing. The last two trading days, SPX had 25 and 23 points of intraday movement with the ATF over 16. Combining this with the Gamma problem means adjustments are frequent, which always hurts your profit.

- The losses were small so repositioning the trades makes more sense. The trade is not one I would put on now which is another reason to reposition the trades.

Tom's Trading Update for August 8, 2014

I closed my trades so I'm flat at the moment. The three primary reasons were:

- The trades were bearish butterflies and the market had moved to the large “tent” area, which meant Gamma was increasing and the T+0 line was bending down. The farther down the market goes, the worse the Gamma problem becomes with this trade.

- The Average True Range (ATR) of SPX and ES futures keeps increasing. The last two trading days, SPX had 25 and 23 points of intraday movement with the ATF over 16. Combining this with the Gamma problem means adjustments are frequent, which always hurts your profit.

- The losses were small so repositioning the trades makes more sense. The trade is not one I would put on now which is another reason to reposition the trades.

Tom's Trading Update for August 7, 2014

The video below reviews my SPX and ES futures options broken wing butterfly trades. The SPX closed down today. I bought a long put at 1915 for the ES futures options trade. I thought I was buying a put debit spread but actually sold it instead. Fortunately the trade was an intended small tweak with minor impact to the overall trade. I'll fix it tomorrow morning.

I showed how the futures options aren't quoted above $50 so I have to interpolate the price based on the prices that are quoted.

Enjoy the video!

VIX Trade Idea

Mark Fenton (at Sheridan Mentoring) wrote an article about an “interesting VIX trade.” Mark's trade was based on the assumption that the VIX could go a lot higher and that you wanted to buy calls. Let's look at his idea.

Mark started with a put credit spread and used the credit to lower the cost of the long call. The first question I have is why did he use a two lot of both put verticals and long calls? That's complicating the idea. Just use a one lot.

The second question I had is what is the expected return? Am I more likely to make money with a long call or with Mark's trade? Let's look at them

Long Call

The call Mark bought was a SEP 17 call for $1.75. Using the SEP 17 call volatility of 92.3%, the probability of profit is 33% and the Expected Return is $29 +/- $344. The expiration breakeven price is $18.78 (+15%). Note that the expected return is close to zero, which means the option market is pretty efficient. Margin required is $175.