BLOG

Tom's Trading Update for September 11, 2014

The EURUSD is starting to consolidate, which will help our put credit spread position. The short delta is -7.9 so we're in pretty good shape.

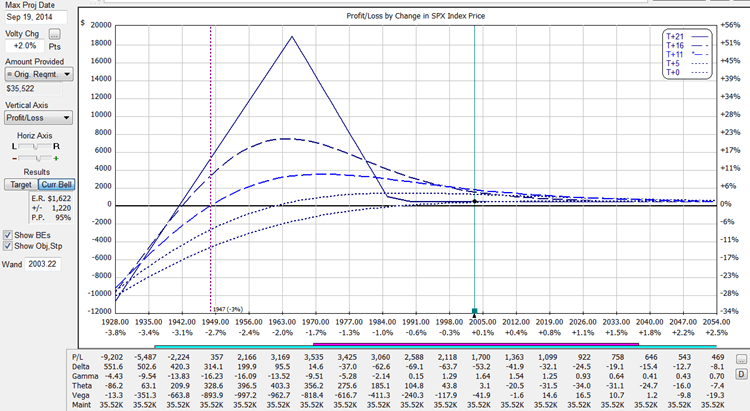

SPX continues to stay near 2000 which is helping all of the butterfly positions. Over all slight negative delta with good positive theta.

Enjoy the video!

Tom's Trading Update for September 10, 2014

I closed the SPX butterfly expiring this week for a $70 credit ($5 in commissions), so the net was +$1287 in profit. The 6E futures options position is now at a -10 delta with two new contracts added today. Cash at expiration is +$700 but we have nearly two months to go but lots of room. Time to let Theta do its magic.

Enjoy the video!

Tom's Trading Update for September 9, 2014

The EURUSD had a strong reversal today, gaining back close to 100 pips from the low of the day. The 6E futures options position was morphed into a put credit spread at a lower delta (from -23.5 delta to -9.5 delta). I increased the size 50% to have a net credit at expiration. The position is down about $1450 but Vega is over -500 so a small drop in volatility will have a massive effect.

All of the SPX butterflies are profitable now. The SEP 19th expiration is getting close to the sweet spot. I locked in some profit and closed 1/2 of the trade today, which also reduces the margin requied.

Enjoy the video!

The Round Table with Len Yates on Thursday Sep 11th

OptionVue Systems International Founder Len Yates joins us on Thursday's Round Table to discuss “OptionVue 7: Features and Models for Earnings.” Len has unique insight into the inner workings of Option Analyais software. He has been coding the OptionVue platform for over 20-years.

Tom's Trading Update for September 5, 2014

The EURUSD crashed hard yesterday, down 200 pips. I had to go into defensive mode on the weirdor. Today, EURUSD rallied a little so the price chart is stabilizing for now.

SPX continues to go sideways and theta is kicking in. All three of the SPX trades look fine.

Enjoy the video!

REPLAY: The Round Table with Michael Benklifa on Thursday Sep 4th

Author Michael Benklifa joined us on Thursday's Round Table to discuss how to “Think Like an Option Trader.” This is the title of Michael's most recent book.

Enjoy the replay!

Tom's Trading Update for September 3, 2014

EURUSD rallied a little but volatility came out so the position is nearly breakeven now. SPX is still hovering around 2000 so our SPX flies are all doing well. Nothing to do today.

Enjoy the video!

Tom's Trading Update for September 2, 2014

EURUSD is fairly flat this week but volatility has risen so we are under water. There is still a lot of time left in this Weirdor trade and our primary put delta is still under -10.

My SPX trades are still all doing fine. Nothing to do but wait for all three of them.

Enjoy the video!

Tom's Trading Update for August 29, 2014

I wrapped up the week net positive profit. The 6E futures options (EURUSD) are down as the EURUSD fell and it is a bullish position. Fortunately it is over 70-days to expiration so it is nice and wide. The EURUSD nearly hit a 1-year low today so We'll see where it goes next week.

My SPX trades are all doing fine. Nothing to do but wait for all three of them.

Enjoy the video!

The Round Table with Amy Meissner Replay

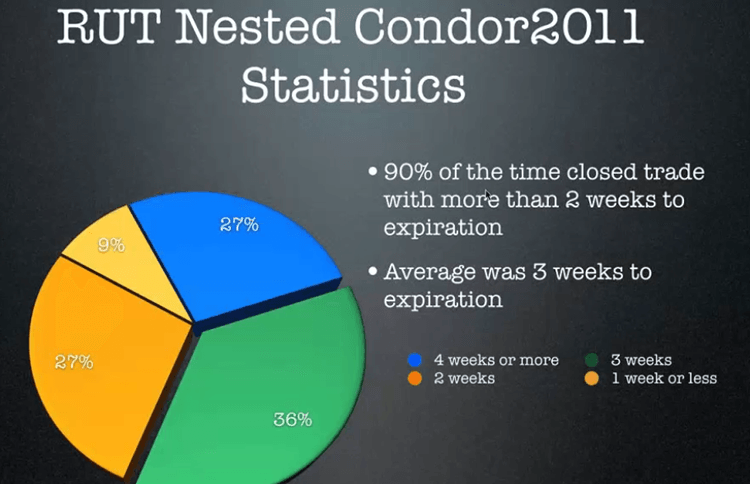

Amy Meissner, “the Queen of Iron Condors”, presented her Nested Iron Condor strategy tonight. Amy's results clearly show that iron condor traders have struggled in the last year or two but the returns are still good.

Enjoy the replay!