BLOG

Sheridan Mentoring Implements Annual Fee

Sheridan Options Mentoring is implementing a new administration fee. Previously, mentoring students had access to the member website without paying additional fees. Starting November 1st, all Sheridan mentoring students are required to pay the $300 annual membership fee.

Dan Sheridan had thought about charging a fee many years ago. We had a discussion about it in the Sheridan Forums back then and Dan decided to scrap the idea. The idea is back and will be enforced starting next month.

The Round Table with John Locke on Thursday Oct 9th

Professional trader and option educator John Locke, presents “M3 – The Road to Mastery” on Thursday Oct 9th at 4:30pm ET. John will show you a market neutral trading system that performs well in most market conditions. The M3 is the culmination of several years of tweaking John's original bearish butterfly.

Click here to register for this free event

We will record this event and post it in our free members area.

Get your free login here if you don't have one already.

Tom's Trading Update for September 19, 2014

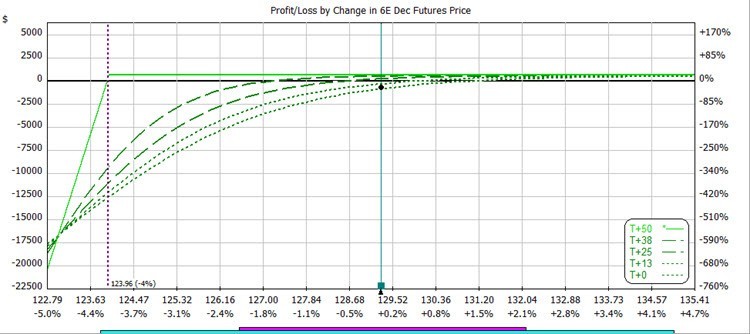

EURUSD sold off another 90 pips so our futures options position with the 6E contract lost some ground; however, the delta is still about -8 so no problem for now. New BWB trade in SPX OCT 17 expiration. The OCT 10 and DEC expiration trades are fine.

Enjoy the video!

Tom's Trading Update for September 18, 2014

The market recovered after the FOMC meeting announcement. 6E futures options are down but have recovered about $1000 of losses and are poised for a winner. I just have to wait it out and hope nothing makes the EURUSD go further South.

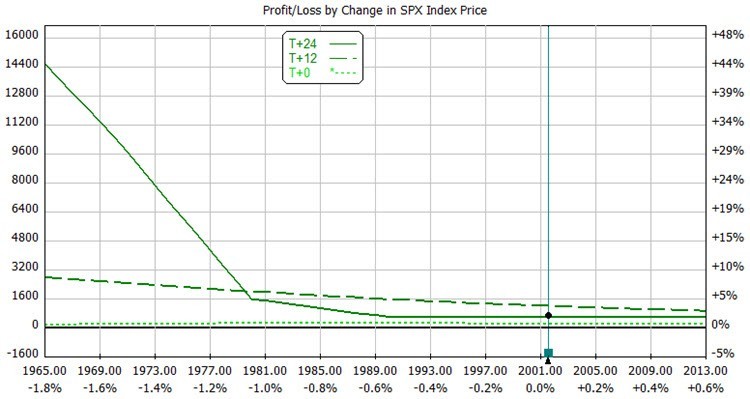

The SPX trades are doing great. +$1100. I raised the expiration profit line on the Oct 11th expiration and I am looking to add more trades on expiring in 27-35 days tomorrow.

Enjoy the video!

REPLAY: Round Table with Greg Harmon

Greg Harmon, from Dragon Fly Capital, spoke about “Using Technical Analysis to Design Winning Options Trades.” Greg showed different setups and how he uses technical analysis to confirm his opinion of a stock in a trend and to create his price targets.

After the price targets are established, Greg looks at the options chain to see how he is going to play the trade. Greg manually reviews 1,000 stock charts every week in his search for the ten best trading opportunities for his premium subscribers.

Enjoy the replay!

Tom's Trading Update for September 17, 2014

FOMC meeting announcement today. The U.S. equity markets hardly reacted but the U.S. dollar got stronger, so the EURUSD sold off about 90 pips. The 6E futures options trade is still down, but we are still at a very low delta so the trade is still in good shape! I closed the RUT weekly trade for +$850 in profit in two days. The SPX trades are all doing well as SPX stays around 2000.

Enjoy the video!

How Professionals Traded the Alibaba IPO

Jim Riggio and former Goldman Partner Ian Scott have been buying Yahoo calls for the last two months for the Alibaba IPO. See why they did that and how their results have been.

Enjoy the video!

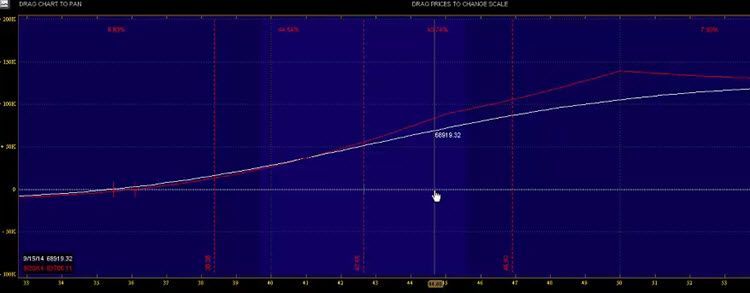

Tom's Trading Update for September 15, 2014

I updated my trades in SPX, RUT and 6E futures options. The RUT call credit spread was +$850 in one day! I'm trying to close it on Tuesday. SPX is drifting lower but we are negative delta so that's ok. 6E is going sideways which will help us; however, volatility keeps increasing to the option prices haven't started to decrease much. It's similar to an earnings event with the vote in Scotland on Thursday.

Enjoy the video!

Tom's Trading Update for September 12, 2014

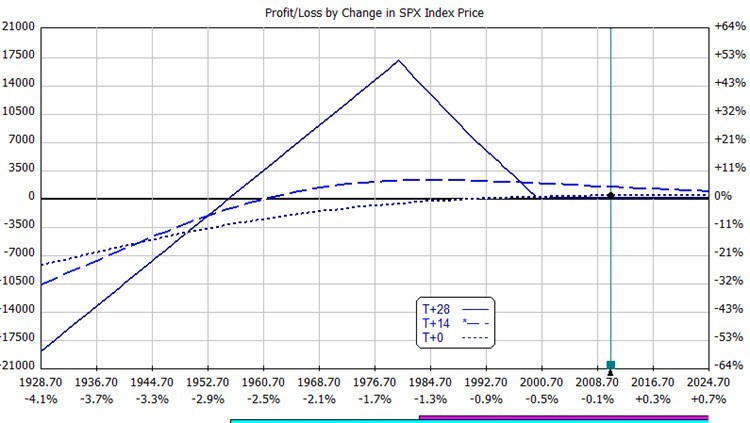

I updated my trades in SPX, RUT and 6E futures options. I had to adjust the near term SPX trade to flatten the T+0 line a bit but the trade is still in great position. The RUT is a weekly trade…a call credit spread and the 6E futures options (on the EURUSD) is recovering nicely with lots of time until expiration.

Enjoy the video!

REPLAY: Round Table with Len Yates

Len Yates, founder and CEO of OptionVue International, was our guest last night on the Round Table. Len showed us the latest volatility modeling he's implemented into OptionVue software that more accurately simulates the volatility changes that occur in a stock before and after their earnings announcements.

Len then showed us the new earnings tools in OptionVue. These are an addon but look to be quite powerful for finding great earnings play opportunities.

Enjoy the replay!