BLOG

Who’s Running The Ship?

When you think of a large cruise ship and the way that it’s run. Who runs the ship, the captain or the crew?

When you think of a large cruise ship and the way that it’s run. Who runs the ship, the captain or the crew?

If you’re like most people you would say the captain….. and you’d be wrong. As you think about all the things that need to be done on the ship, keeping the engines running, taking care of all the wants and needs of the passengers, the entertainment, the food preparation, the cleaning, the navigation, the weather and all the moment by moment decisions that must happen in order to make the ship work; there is no way that the captain could be personally involved in even 2% of those decisions.

If the captain were to get caught up in things like deciding when the ships engine is due for an oil change or deciding what seasoning is going to be on the fish dinner tonight or the brand of glass cleaner used to wash the windows then the ship couldn’t function. There’s absolutely no way the captain would be able to be involved with all that stuff AND make the important decisions that need to be made in order to get the ship safely where it needs to go.

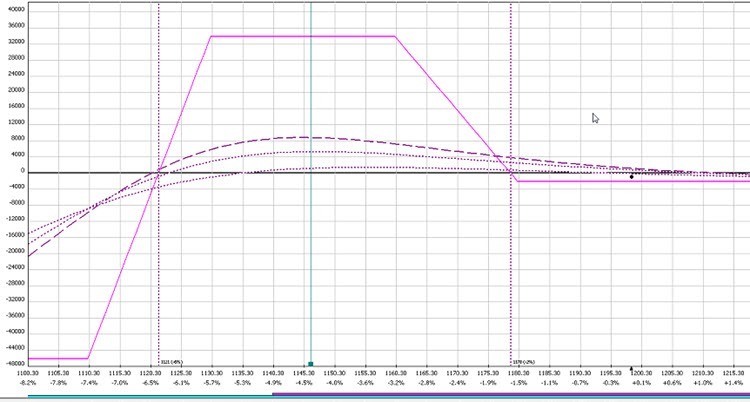

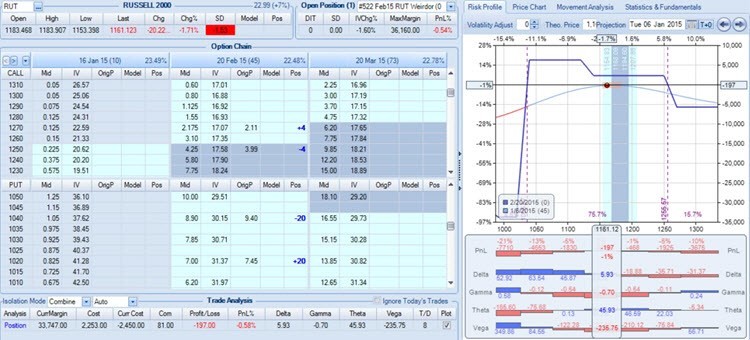

Amy Meissner's Launches her Trade Alerts

Amy Meissner launched her trade alert service for the Weirdor strategy. Amy explained how the Weirdor trade works and gave a walk through of the class page and explained how the alert service works.

Get more information about Amy's trade alerts service for her Weirdor trade.

Market Analysis for Feb 2, 2015

Jim Riggio and Tom Nunamaker were joined by Himanshu Raval, the “Calendar King”, to analyze the current markets. Himanshu relies on Woodie's CCI and he explained how he uses it to given him clues about the market direction.

The Round Table with Larry Richards on Thursday Feb 5th

Larry Richards, from QuantyCarlo, presents “Automated Option Back Testing” on Thursday February 5th at 6:00pm ET. Larry will show you an exciting new tool coming to the market soon. QuantyCarlo automates the tedious task of back testing option strategies. QuantyCarlo trading plans have entry, adjustment and exit rules so you can quickly back test your ideas with over 10-years of option historical data.

Click here to register for this free event

We will record this event and post it in our free members area.

Get your free login here if you don't have one already.

Market Analysis for Jan 26, 2015

Tom Nunamaker and Tony Sizemore, from Option Elements, reviewed the market. Jim Riggio commented to Tom that the ECB added 10B/month with no fixed end date. With the ECB starting Quantitative Easing, the Japanese central bank in full swing he doesn't see how the market can go very low. Jim said there is no market safety net. It's a trampoline.

REPLAY: Round Table with Amy Meissner

Amy Meissner, also known as the “Queen of Iron Condors”, updated us with her current Weirdor trade that she is getting ready to take off for a profit. Amy is starting a new trade alert service for customers to follow her live Weirdor trades in real time.

Enjoy the replay!

The Round Table with Amy Meissner on Tuesday Jan 27th

Amy Meissner is back to present on the Round Table on Tuesday January 27th at 4:30pm Eastern Time.

Amy will review her most recent live trade and update her live trading results. Amy will answer your questions about her Weirdor trade.

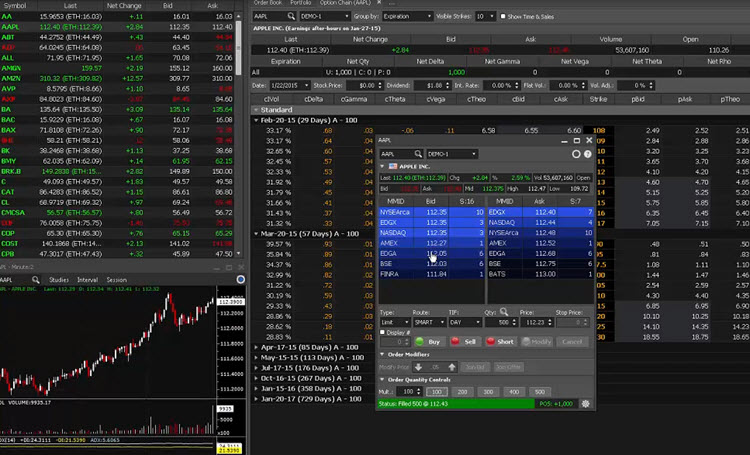

REPLAY: Round Table with Jamie Ruetz: Obsidian

The Round Table with Jamie Ruetz on Thursday Jan 22nd

Jamie Ruetz, from Silexx, will show us their option trading platform called Obsidian on the Round Table on Thursday, Jan 22nd at 4:30pm ET.

Jamie will cover:

- Obsidian's advanced orter entry modules including Spread Maker

- Position Analyzer to visualize your positions and advanced stock charts

- Next generation Portfolio Module

- And more…

REPLAY: Round Table with Jerry Furst: Technical Analysis for Option Traders

Jerry Furst from the Traders Education Network. Jerry discussed technical analysis and how he trades options based on his market opinion.

Enjoy the replay!