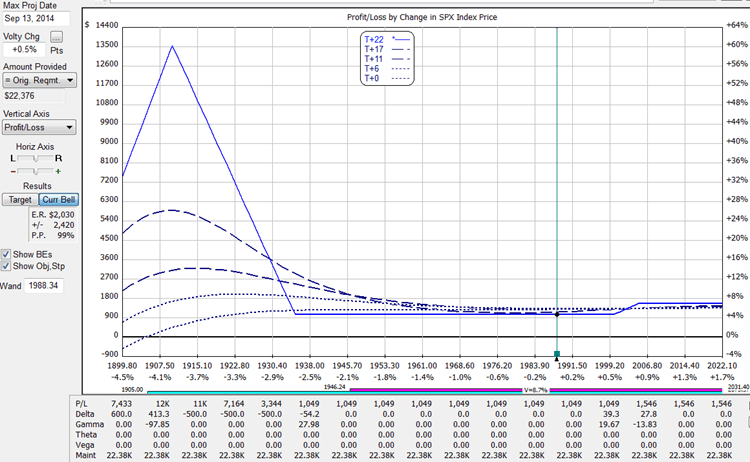

by Tom Nunamaker | Aug 22, 2014 | Options trading, Trading

SPX closed about 4 points lower today. The trade has a 99% probability of profit at this point. I'm hoping for a small rally or a small sell off. Either case would bring in more profit. Enjoy the video! Join us in the forums to discuss these trades or your...

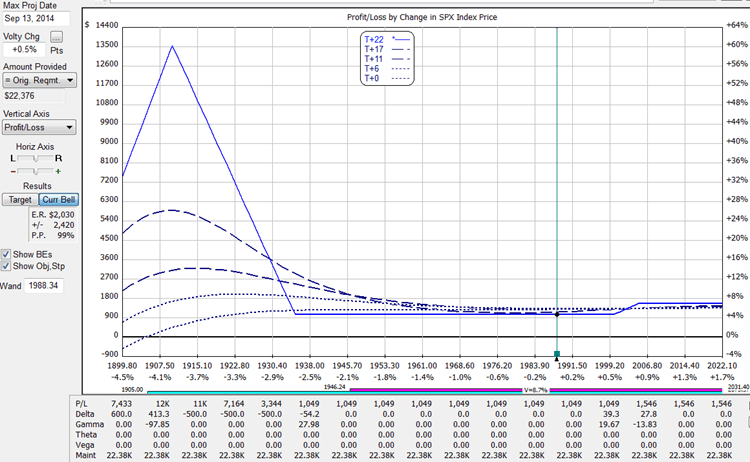

by Tom Nunamaker | Aug 22, 2014 | Options trading, Trading

SPX closed higher today. I sold the 2005 call for $2.10 more than I bought the 2000 call today, so I now have a bull call spread put on for a credit! Enjoy the video! Join us in the forums to discuss these trades or your own!

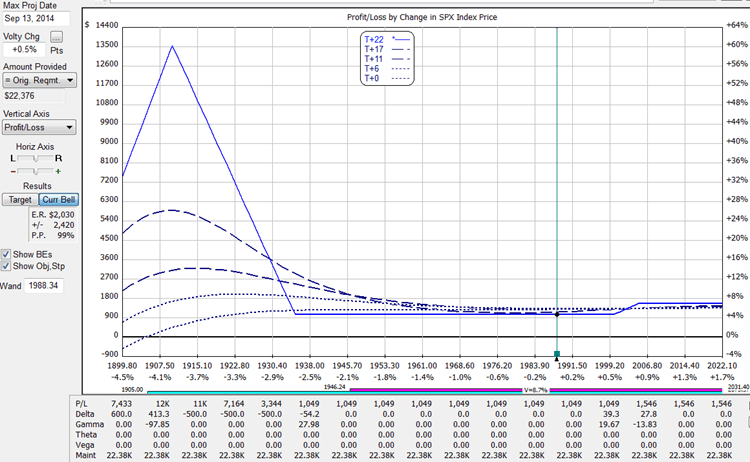

by Tom Nunamaker | Aug 21, 2014 | Options trading, Trading

SPX closed higher today. My extra long call helped and is looking great if the market keeps going higher. The trade is profitable and looking very good at this point. Enjoy the video! Join us in the forums to discuss these trades or your own!

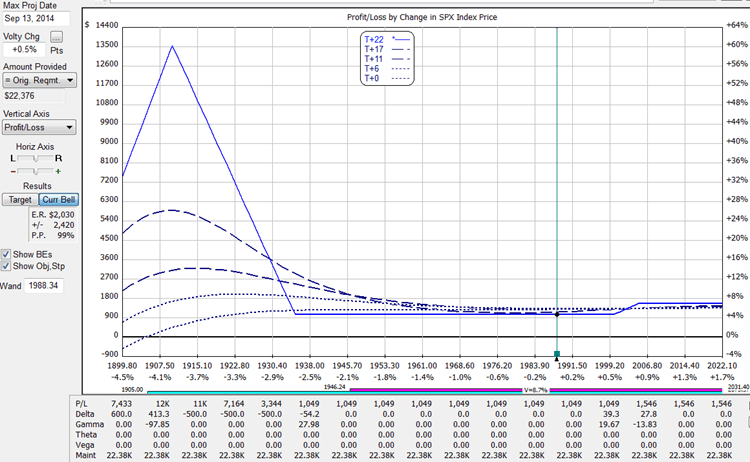

by Tom Nunamaker | Aug 19, 2014 | Options trading, Trading

I put on a new SPX broken wing butterfly at the end of last week. This is yesterday's update. The trade is profitable and looking very good at this point. Enjoy the video! Join us in the forums to discuss these trades or your own!

by Tom Nunamaker | Aug 9, 2014 | Options trading, Trading

I closed my trades so I'm flat at the moment. The three primary reasons were: The trades were bearish butterflies and the market had moved to the large “tent” area, which meant Gamma was increasing and the T+0 line was bending down. The farther down the...

by Tom Nunamaker | Aug 8, 2014 | Options trading, Trading

The video below reviews my SPX and ES futures options broken wing butterfly trades. The SPX closed down today. I bought a long put at 1915 for the ES futures options trade. I thought I was buying a put debit spread but actually sold it instead. Fortunately the trade...