REPLAY: Round Table with Greg Harmon

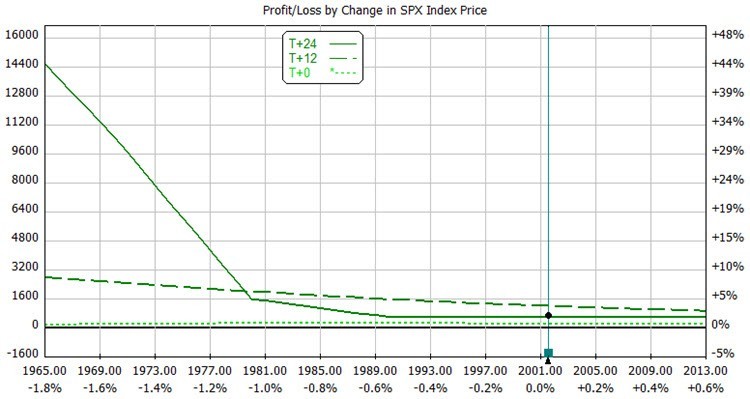

Greg Harmon, from Dragon Fly Capital, spoke about “Using Technical Analysis to Design Winning Options Trades.” Greg showed different setups and how he uses technical analysis to confirm his opinion of a stock in a trend and to create his price targets....

Tom’s Trading Update for September 17, 2014

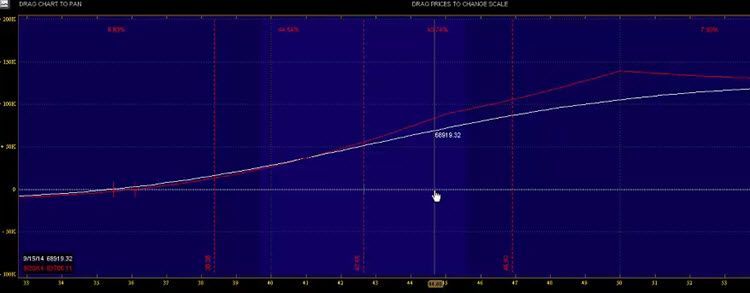

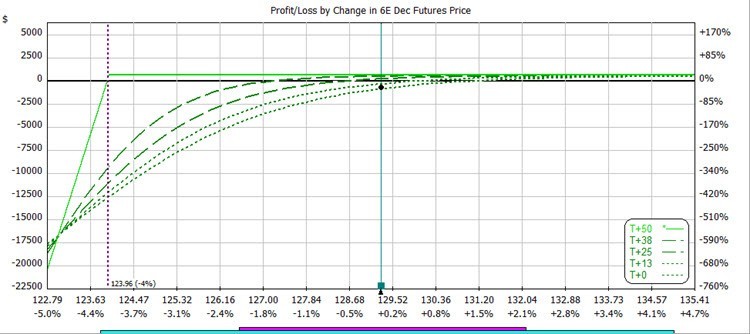

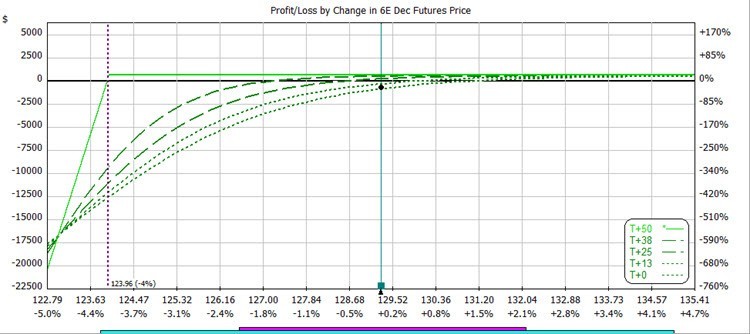

FOMC meeting announcement today. The U.S. equity markets hardly reacted but the U.S. dollar got stronger, so the EURUSD sold off about 90 pips. The 6E futures options trade is still down, but we are still at a very low delta so the trade is still in good shape! I...