Tom’s Trading Update for September 19, 2014

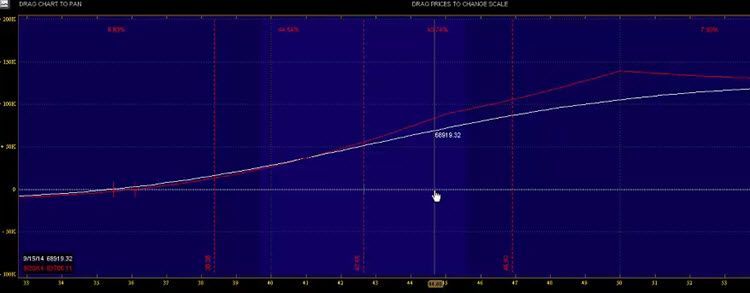

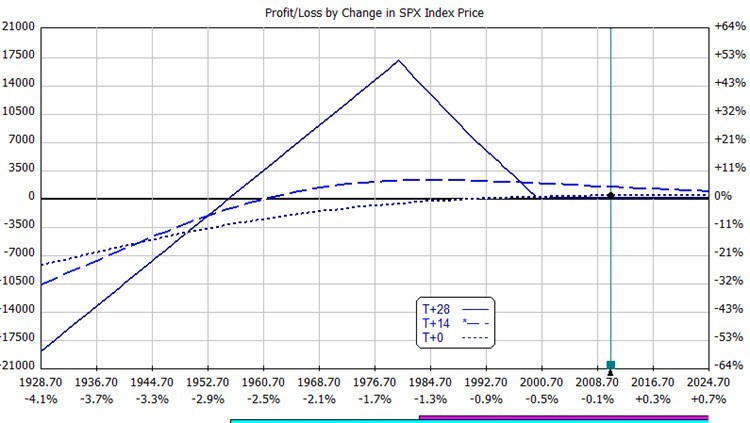

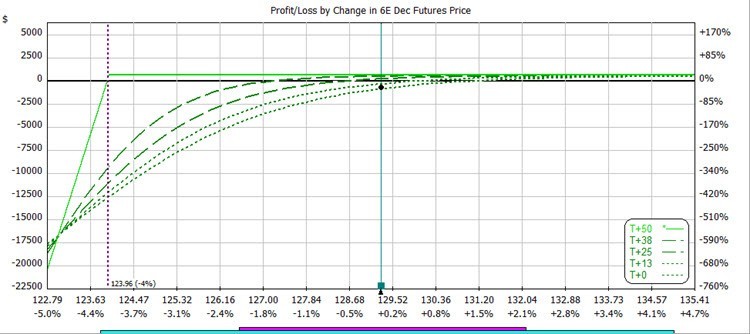

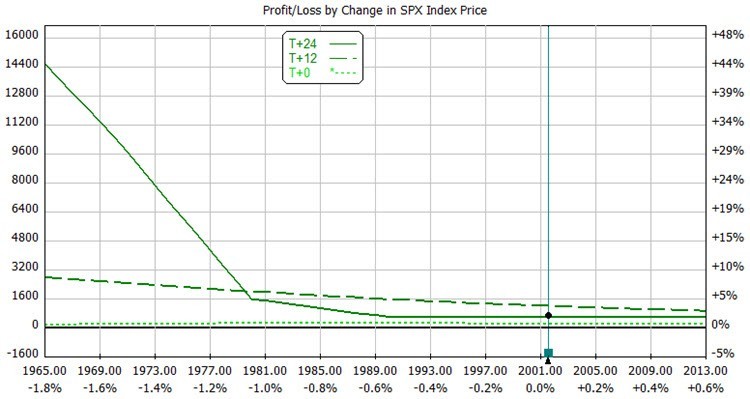

EURUSD sold off another 90 pips so our futures options position with the 6E contract lost some ground; however, the delta is still about -8 so no problem for now. New BWB trade in SPX OCT 17 expiration. The OCT 10 and DEC expiration trades are fine. Enjoy the video!...

Tom’s Trading Update for September 18, 2014

The market recovered after the FOMC meeting announcement. 6E futures options are down but have recovered about $1000 of losses and are poised for a winner. I just have to wait it out and hope nothing makes the EURUSD go further South. The SPX trades are doing great....

REPLAY: Round Table with Greg Harmon

Greg Harmon, from Dragon Fly Capital, spoke about “Using Technical Analysis to Design Winning Options Trades.” Greg showed different setups and how he uses technical analysis to confirm his opinion of a stock in a trend and to create his price targets....

Tom’s Trading Update for September 17, 2014

FOMC meeting announcement today. The U.S. equity markets hardly reacted but the U.S. dollar got stronger, so the EURUSD sold off about 90 pips. The 6E futures options trade is still down, but we are still at a very low delta so the trade is still in good shape! I...