Long-term Equity Anticipation Securities options, otherwise known as LEAPS, have the same general characteristics as standard options. LEAPS are commonly known to have an expiration date longer than one year. Standard options have an expiration date less than one year.

LEAPS and shorter term long option contracts require a trader to pay a premium for the option. Some factors which affect the price of the premium are the time until expiration and the relationship of the strike price to the price of the underlying.

LEAPS options can be appealing to investors looking to trade longer-term options.

Basically, LEAPS options are set up the same as traditional options (calls and puts). LEAPS have a longer time to maturity.

Leaps can allow traders to endure more price swings in the underlying because of the longer number of days to expiration.

Here’s some Benefits of LEAPS for Traders …

- LEAPS offer alternatives to buying stock

LEAPS can be an alternative to purchasing stock. Buying a LEAPS call option, for example, may allow traders to benefit from the stock price increasing. At the same time, often less capital is at risk. Purchasing LEAPS can require less capital than purchasing stock.

LEAPS options, just like shorter-term standard options, allow a trader to exercise their option ahead of the expiration date. If the stock price increases above the exercise price of the LEAPS, the buyer may choose to exercise the option and purchase shares of the stock at a price below the current market price. Or, the trader may choose to sell the LEAPS option for a profit.

- LEAPS Can Offer Longer-Term Portfolio Diversification

Some traders choose LEAPS to diversify their portfolio using time. A purchaser of a LEAP call has the right, but not the obligation, to purchase shares of stock at a specified expiration date, and a specified price.

Historically, the stock market has moved up over time. This could prompt a trader to purchase a call LEAPS option based on the past historical upward movement in price of a particular underlying. This may enable a trader who is bullish to profit if the underlying rises in price.

- LEAPS can be used as Portfolio Hedges

What can a trader do if he/she is concerned about the price of a particular stock they own dropping and hence losing value?

Here is one possible tactic, the trader can purchase a LEAPS put. By purchasing LEAPS puts the option(s) can act as a portfolio hedge on stock holdings.

If the stock does move down in price, the trader can then sell the put which was purchased to offset some or all of the loss on the stock. Purchasing the LEAPS put option gives the buyer the right to sell the underlying stock at the strike price of the LEAPS up to the option's expiration date.

Traders can also use Index LEAPS options as a portfolio hedge.

For example, if an investor's portfolio contains primarily stocks in the NASDAQ, a trader may want to purchase LEAPS put options on NDX to help protect against a downward move. Another popular index LEAP is SPX.

- LEAPS can be used in a Covered Call strategy

Covered calls are used by many traders to potentially create income. An example of a covered call position starts with a trader holding a long position in an asset. For each one hundred shares of stock the trader owns, a call option can be sold. One option contract is equal to 100 shares of stock.

The option is sold on the same asset to potentially create an income stream from the premium received by selling the option. The premium received by selling the option could potentially reduce the cost basis of the long asset.

LEAPS can be less costly than buying stock…

Stocks can be used as the long asset. Stocks can be costly. Instead of purchasing stock, a trader could purchase a long call option with a year or more until expiration.

LEAPS may be used as an alternative to purchasing stock when using a covered call strategy. This can lower the capital investment required to implement a covered call.

Some traders will choose an option which has a high delta. The higher the delta, the more the option will tend to act like the underlying asset. Some traders will use a delta of 80 when they purchase the long call. The higher the delta of an option, the more the premium for the option tends to be.

Let's use the underlying CAT as an example to show how a LEAPS option can be less costly than buying 100 shares of stock.

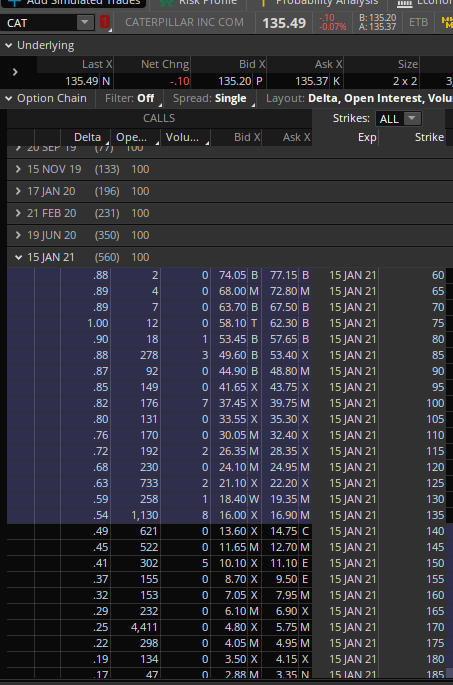

Figure A. CAT Option Chain

Figure A shows the option chain for CAT, which is currently trading around $135.49. In order to sell a covered call against the stock, you would have to purchase 100 shares of stock totaling about $13,549.00. As a stock alternative, a trader could consider purchasing one in-the-money LEAPS call option with an 80 delta for the 15 Jan 2021 105 strike. The approximate cost of this LEAPS option is $3500.00. The 15 Jan 21 LEAPS option has 560 days until it expires.

As you can see, the capital requirement to purchase the LEAPS option saves about 10,000.00 as compared to purchasing 100 shares of stock.

The downside of LEAPS options vs stock ownership …

While LEAPS options have their place in many traders' portfolios, there can also be some disadvantages of owning stock versus LEAPS options.

Options, however far in the future the expiration may be, do have a limited life as opposed to ownership of stock. Because an option has a certain period of time before it expires, its’ time component will cause the option to decay as time move moves forward.

A trader can buy and hold common stock as long as he or she chooses. Some stocks also pay dividends. Options do not pay dividends.

If the investor does not close out or exercise the LEAPS option by the expiration, the instrument will cease to exist. Common stock will remain in the trader's ownership unless the company goes out of business.

What influences the value of an option at expiration?

Let’s use the stock CAT for discussion purposes. CAT is trading at $135.00.

A trader buys a CAT call option with a strike price of 135. One option contract represents 100 shares of stock.

The 135 strike price determines the value of the asset at expiration.

The trader can exercise the 135 strike call option if the market price of CAT is higher than the 135 call option strike price at expiration. The trader could then buy 100 shares of CAT for 135.00 per share by exercising the CAT 135.00 strike call option.

If the market price of CAT is below the 135 at expiration the trader’s option will expire and have no value. The premium the trader paid to purchase the 135 CAT call option will be lost.

Summing it up …

- Long-term equity anticipation securities (LEAPS) can be an excellent choice for options traders who feel a particular underlying is in a longer-term trend.

- LEAPS can be purchased on individual stocks, or on the broader market of indices.

- LEAPS are often used as a hedging strategy, and can be effective for protection retirement portfolios.

- LEAPS could be less costly than purchasing stock.

It is a trader's choice as to what is best suited to his/her trading style, along with their trading goals. Whether it be common stock, traditional options, or LEAPS options – or a combination thereof; there is no perfect combination for every trader. Whatever choice is made, it is important to have a full understanding of the risks involved before investing live capital. Back test and/or paper trade before trading live. This will give you confidence in your strategy. Having confidence in your strategy will allow you to sleep better at night.

If you are looking for a trading community that has a wide variety of programs including one-on-one mentoring, educational classes, and interactive trading groups, look no more – join today. You will not be disappointed in the programs offered.

If you have experiences trading LEAPS you would like to share, feel free to comment below.

Joanna,

Do you teach option strategies? Do you teach the use of Greeks?

Looking for a reliable education mentor.

Thank you.

Hi Jim,

We do. We have two outstanding mentors: Dave Thomas and Tim Pierson. Both have many years of options trading and teaching experience.

https://aeromir.com/mentoring