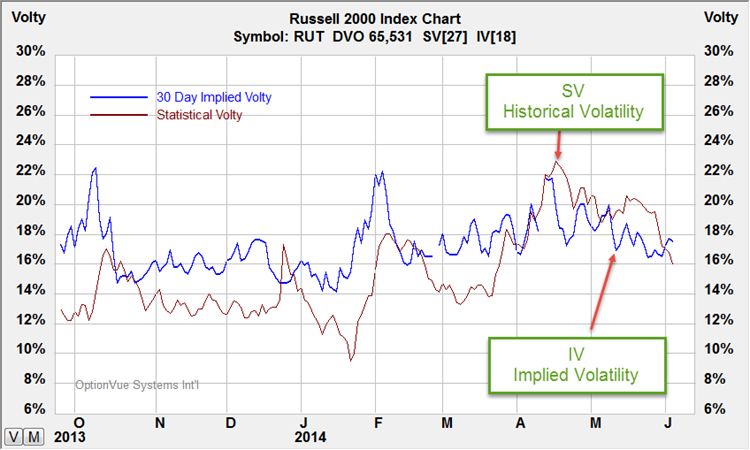

I put an SPX Jun 28 Broken Wing Butterfly (BWB) on yesterday. They seem to be what many of my option trading friends are trading these days. With volatility at historic lows, trading Iron Condors, Weirdors and Jeeps is very difficult because the premium is so low. The Russell 2000 Index (RUT) has been especially challenging. SV (historical volatility) has mostly been higher than IV (Implied Volatility for nearly two months. Look at this chart:

The RUT is moving more than the options are implying it will move. This means the premium you receive doesn't compensate you for the risk you're taking. If you are trading strategies with thin margins like Iron Condors, this spells trouble. It makes sense to change to strategies that have more premium to play with like Butterflies and narrow Iron Condors (also known as Low Probability Iron Condors).

Entering the Trade

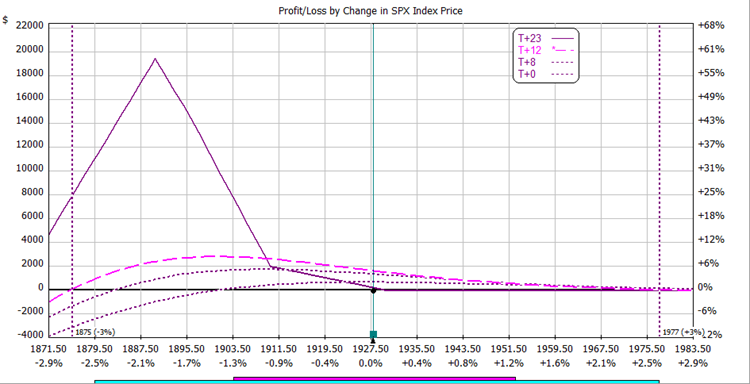

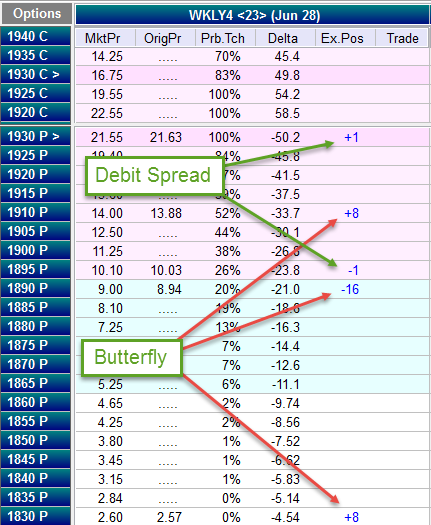

I sold puts around a -25 Delta 25-days to expiration (DTE). My longs were setup to receive a small credit to fund a put debit spread to reduce the negative position delta. You can place the put debit spread more out-of-the-money (OTM) if you prefer. I wanted a pretty flat T+0 line. Here's the butterfly plus the put debit spread:

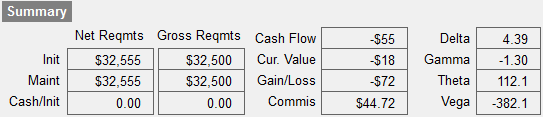

I'm not exactly sure what the margin is because Interactive Brokers doesn't separate trades in a Portfolio Margin account for margin purposes. The RUT trade was using about $4500 of margin before I add this SPX trade. The account margin is now $30,000 so this trade about $25,500 of margin required, which is fairly close to the Reg T margin of $32,555.

Trade management

The plan is to take this off in about 12 days.

On the upside, I'll roll up the put debit spread short strike and eventually take the put debit spread off it SPX keeps moving up. Adding another bullish vertical spread is also possible.

On the downside, add another bearish put vertical if needed. If SPX goes too far, taking the trade off is prudent. The expiration break even of 1865 has a 6% probability of touching and is in the region I would close the trade. You would have another put debit spread helping you so your losses would be less than the initial risk chart shows.

The Upside has no profit, is that ok?

We aren't necessarily trying to get to the expiration line. We are looking at the highest dashed line 12-days from now (T+12). If we sell off a little bit and move into our big potential profit zone, you might have a chance at a big payday, but the closer you get to expiration, the more gamma affects your trade. Profits can vanish with small moves of the underlying. It's best not to gamble and take profits when you have them. As my friend Joe Ross says, you want to “get paid to trade!”

Profit targets are 2% or less if SPX moves up aggressively, 2-5% if it stays near the current price and 5% or more if it sells off a little bit. The only scenario with a loss should be a big move to the downside.

RUT Weirdor update

The Weirdor I put on about three weeks ago is doing fine. I took the calls off and it is just a put Credit Spread now. The trading should make +2.47% profit (Reg T) if I hold it until June expiration. If I closed it now, I would collect about 60% of the potential profit. The short puts are over 4 standard deviations away from trouble. My plan is to just let them bake off.

Conclusion

The Broken Wing Butterfly is a very flexible trade. Consider giving them a try if you're not trading them already. I'll be updating the trade in the forums here. I hope to see you in the forums!

I posted an update to the trade in the forums: http://forums.capitaldiscussions.com/threads/spx-jun-broken-wing-butterfly-trade.20/#post-63

SPX was up quite a bit yesterday so I closed the put debit spread hedge.

I posted an update to my SPX Broken Wing Butterfly in the forums at

http://forums.capitaldiscussions.com/threads/spx-jun-broken-wing-butterfly-trade.20/#post-69

The trade is currently +$717 (+2.3%) in less than a week.