Iron Condors are a popular options trading strategy used by both professional and retail traders. Today we will cover the basic components of Iron Condors and how they work. There are many variations of Iron Condor strategies; we will discuss the traditional Iron Condor in this article.

How an Iron Condor is constructed …

- An Iron Condor is constructed by selling a call credit spread (also called Bear Call spread) and a put credit spread (also called Bull Put spread), on the same underlying instrument, in the same expiration cycle.

- All four options are usually out-of-the money.

- For a traditional Iron Condor, both the call credit spread and put credit spread are equal widths. For example, if the strike prices of the call option are 10 points wide, then the put options will also be 10 points wide. There are many variations a trader can choose with an Iron Condor; some may enter an “unbalanced” Iron Condor, where the spread width is different between the call and put spreads, or the number of call spreads is different from the number of put spreads in the position.

- It is a trader's choice how far out of the money the short strikes should be, depending on market opinion. The wider the distance between the two short strikes, the lower the credit.

- An Iron Condor can be used when trading any of the broad indexes such as SPX, RUT, or NDX, as well as any individual stocks, ETFs, etc.

- The margin, or risk, on a traditional Iron Condor is usually the width of the wing on one side of the Iron Condor (for example, 10 point wings would be $1,000), less the credit received when the trade is entered. Please check with your broker to determine how they margin an Iron Condor.

- The Iron Condor is generally best used as a market neutral trade, without any strong bullish or bearish bias.

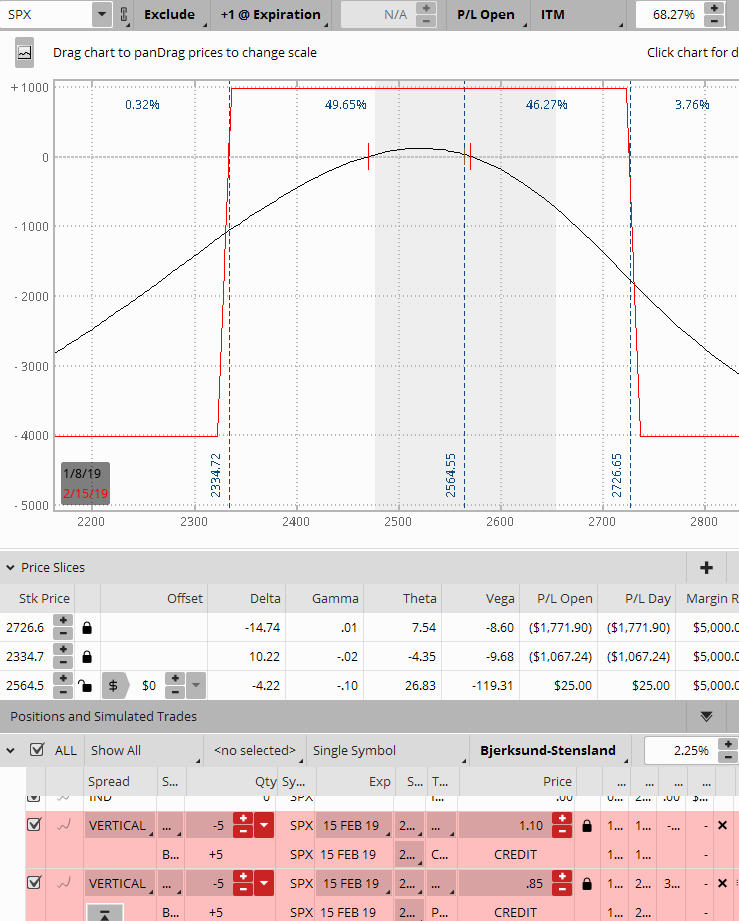

The graph below is a sample 5-lot Iron Condor set up on SPX for the February 2019 monthly cycle, 37 days to expiration, with SPX trading at 2567. This example is selecting short options which have a delta of .11, which means that they have a 89% chance of expiring worthless.

Figure A. SPX Iron Condor

What are the components of Figure A above?

Calls:

- Sell 5 SPX 2725 Calls

- Buy 5 SPX 2735 Calls

Note the Call Spreads you are selling at a lower strike, and buying at a higher strike.

Credit for Call spreads: $1.10

Puts:

- Sell 5 SPX May 18 2335 Puts

- Buy 5 SPX May 18 2325 Puts

Note the Put Spreads you are selling at a higher strike, and buying at a lower strike.

Credit for Put spreads: $.85

The total credit for the Iron Condor in Figure A is $1.95 per lot, or $975 (5 lots @ $1.95 credit) for the entire position. This represents the maximum profit for the trade.

Most traders enter all four legs of an Iron Condor with one order. However, more advanced traders may find it useful to “leg in” the position. Traders who choose to leg in to an Iron Condor may do so by utilizing their technical analysis skills by placing the call credit spread at a failure of resistance, and placing the put credit spread on a successful test of support. Please keep in mind that placing one side of the Iron Condor will usually result in the same gross margin (width of the wings), less the credit received. With most brokers, there is not any additional margin when the other side is entered, as long as it is of equal wing width. Please check with your broker to determine their margin requirements on the position.

How much profit can I make on this position?

When you enter an Iron Condor, it is your goal that the underlying instrument remains in a relatively stable trading range for the duration of the trade. Theta is your friend with an Iron Condor. As time passes, the position will benefit from time decay, which accelerates as expiration approaches. There are some traders who choose to take the position right up to expiration. In the “perfect” Iron Condor, if price remains within the two short strikes and the options expire worthless, you keep all the premium you collected, except commissions. In this case, you would keep the entire $975 premium collected, less commissions.

With every reward in trading there is risk.

Taking an Iron Condor right up to expiration can be very risky. The more conservative trader will manage the position within his/her guidelines as set forth in their trade plan, and close the trade at a pre-determined target profit, or a pre-set max loss. We'll talk about the loss potential next.

How much can I lose on this SPX position?

Using Figure A as an example, this 5-lot Iron Condor using 10 point wide spreads has a gross margin requirement of $5,000. The premium collected ($1.95/lot) is $975, so the total risk/loss potential is $4,025 plus commissions. A maximum loss could happen if the price of the underlying went beyond the expiration breakeven points on either side as shown in Figure A (SPX above 2726 or below 2335), and a trader did not exit the position. You can see by the slope of the T + 0 line (black line) on the risk graph how the loss increases as price moves beyond the expiration breakeven points.

While it is important to understand the maximum profit and loss potential of the Iron Condor, there are numerous ways a trader can manage the position according to their trading style, capital levels, and risk management.

How does implied volatility affect Iron Condors?

Many traders choose to enter an Iron Condor when IV is high on the underlying they select. Why? Because the Iron Condor is a negative Vega trade, an Iron Condor will benefit if volatility falls, as long as the price of the underlying remains with the range of the short strikes.

However, along with the higher premium one may receive when entering an Iron Condor in a high volatility environment, additional risk is brought to the table. When the underlying has a high IV, there is more probability of a move outside the range of the two short strikes. More conservative traders who trade this strategy may approach their entry from the standpoint of “less is more”. This means that those traders taking the more conservative approach may be willing to accept less premium at the trade entry, and have a wider distance between the short strikes. This conservative approach may increase the trader's overall win/loss ratio.

The same risk applies when entering an Iron Condor when volatility is very low. If volatility is low upon entering, the position's P/L will suffer if there is a spike in volatility. While volatility does decrease as options get close to expiration, rising volatility could put the position in jeopardy of reaching a trader's pre-set max loss.

In summary …

Iron Condors allow a trader to maintain a neutral bias while trading, something that many “non-technical” traders find comfortable. Depending on how the position is structured, they can also have a good probability of success if managed properly. As with any options strategy, it is important to first have a thorough understanding and gain experience by back testing different instruments before investing live capital.

If you have found the use of Iron Condors helpful in your overall trade plan and would like to share, please comment below.

hy this is sarath lal from india . i just read your article . Very good madam…